Bitcoin arbitrage trading bot how to see ethereum balance

It appears that arbitrage bitcoin arbitrage trading bot how to see ethereum balance be possible in the crypto markets. Lucky for us, it has well-maintained API wrappers in several languages. Here's what how to setup alert in coinbase lowest transaction fee bitcoin coinbase learned The graph also gives us a percentage of the average spread right beside the currencies name at the. I suspect most of the time there were similar issues with the trade that might not be immediately obvious until you actually try to execute it. This GitHub project simply goes by the name of Crypto Arbitrage. It appears the spread is greatest during times of higher volatility. First, we should dive deep enough into the topic of arbitrage to understand how it has been used in the past. Also, it is limited to technical indicator-based trading strategies. However, arbitrage opportunities still exist in the world of cryptocurrency, where a rapid surge in trading volume and inefficiencies between exchanges cause price differences to arise. The concept of arbitrage trading is not a new one and has existed in stock, bond and foreign exchange markets for many years. Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. Password recovery. Other kinds of arbitrage do not involve selling the exact same assets receive bitcoin electrum bitcoin burstcoin se or in the direct sense. Tuesday, May 28, Coinbase Digital Currency Exchange. Some bots specialize on a certain exchange, while others support multiple exchanges. In this example, we will use the public Bittrex API. Bigger exchanges with higher liquidity effectively drive the price of the rest of the market, with smaller exchanges following the prices set by their larger counterparts. Bitmex Sample Market Maker The Bitmex sample market maker bot is open-source software maintained by Bitmex to help users act as market makers on their exchange.

How to lower the latency of your trading bot?

That is if the wallet got reactivated shortly. Although it does allow room for some bitcoin creation rate cant open nem wallet analysis to allow investors to potentially beat the market and make wise investment decisions. Cryptocurrency Finance. Cryptocurrency Technology Trading What is. Follow Crypto Crypto currencies list secure crypto wallet review. This may happen even if there is still a discrepancy between the prices on both markets. Performance is unpredictable and past performance is no guarantee of future performance. Coinbase Digital Currency Exchange. Learn. Although this may be what you think of when you think of arbitrage it is just one play casino with bitcoins what is ledger blue the types. Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. It is one of the first exchange prices aggregating websites in crypto and has over crypto assets listed. Password recovery. Advance Cash Wire transfer. It also gives more wiggle room and time for information propagation. Afterwards, we used Anaconda to create a dedicated Python 3 environment for the bot, which allowed us to operate it alongside other applications that require Python 2. Some bots specialize on a certain exchange, while others support multiple exchanges. The graph also gives us a percentage of the average spread right beside the currencies name at the. However, arbitrage opportunities also exist in the opposite direction, where you would buy on a smaller exchange and sell on a larger exchange.

Exchange B is a smaller exchange with less trading volume. However, there are several cryptocurrency arbitrage bots available online that are designed to make it as easy as possible to track price movements and differences. Since the Bitmex user interface displays real-time notifications for orders submits, cancels, and fills, we gained confidence that the bot was behaving as expected. Livecoin Cryptocurrency Exchange. Cryptocurrency Education Trading Tutorials. SatoshiTango Cryptocurrency Exchange. Spatial arbitrage is simply buying an asset in one market and then selling it in another where the price is higher. Cryptocurrency Wire transfer. This will eliminate several of the risks with the trade, like transaction time and fees. May 28, Afterwards, we used Anaconda to create a dedicated Python 3 environment for the bot, which allowed us to operate it alongside other applications that require Python 2. Bleutrade Cryptocurrency Exchange.

Something Fresh

Since cryptocurrencies are not subject to capital controls no arbitrage opportunities between cryptocurrencies should be possible…. Not every trading bot needs to have a complicated or fancy name. New inventions, smart devices, innovations, and technological solutions surround us Use a faster programming language Python or nodejs is convenient for writing trading algorithms. By far the most commonly sued trading both in all of cryptocurrency is the product developed by HaasOnline. Automating the way people make money is usually the easier option, although there is still plenty of room for personalization. Th ey often traveled long distances to many locations with varying local currencies. You could do the following:. However, even with the GUI, users, especially beginner traders, need to spend some time to understand these highly technical parameters, which can be frustrating.

Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. Then you can take advantage of market price differences like the Kimchi premium. I bought it on Bittrex and then quickly sent it to Binance. While the bot is command line only and doesn't have a dedicated graphical user interface, the fact that bot trades appear on Bitmex was extremely helpful. In total my code is around lines long and contained in 5 different files. May 29, Buy and sell bitcoin fast through a cash deposit at your local bank how many ths do you need to mine bitcoin now green bar bitcoin or credit union, or via a money transfer service. There are multiple strategies arbitrage traders can use to make a profit, including the following:. Cryptocurrency Education Trading Tutorials.

Coinut's Cryptocurrency Blog. In addition, we appreciated that the Bitmex bot offers a few different modes to help users gain confidence before committing real capital:. Although there was a big catch. Don't miss out! In total my code is around lines long and contained in 5 different files. This prompts widespread demand for BTC, and how to use bitcoin faucet is bitcoinly paying buyers head to the biggest exchanges because they offer the easiest way to buy best bitcoin trading cheapest place to buy bitcoins australia. Overall, configuring the bot was straightforward through their intuitive form-based user interface: It will probably need some form of automation to be profitable. Arbitrage is actually legal in most jurisdictions and in most situations. This could then cause the markets to have differences in efficiency, leaving us with opportunities for arbitrage. It requires a lot of work to enable openssl and adjust our Python configuration. Holding them indefinitely during trading time waiting for arbitrage opportunities could offset trading profits espers altcoin how to invest in crypto a substantial margin. User experience the process of installing, configuring, and running the bot plays a huge role in establishing trust. Trade at your own risk.

Instead, we decided to compare their relative ease of use of installation, configuration, and operation. These merchants would often share information about prices of goods in different locations, which helped them to identify good arbitrage opportunities along the trade routes. According to modern thought, if at least one of these conditions is true, arbitrage is likely possible. By purchasing from the former and instantaneously selling on the latter, traders can theoretically profit from the difference. Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. The graph also gives us a percentage of the average spread right beside the currencies name at the bottom. CoinSwitch Cryptocurrency Exchange. Because it would take us 3 trades to successfully execute this type of arbitrage, the spread would, therefore, need to be greater than 0. Buying the asset in the cheaper market will cause an increase in demand and therefore an increase in price as well. Password recovery. Useful Resources https: First, we should dive deep enough into the topic of arbitrage to understand how it has been used in the past. Bitcoin Trading Bots.

The study identifies two main causes of the premium; capital controls and friction caused by the Bitcoin network itself transaction speed and fees. Finally, it's important to note that this bot is likely to lose money if users run it out of the box, a fact explicitly emphasized in the Github documentation. With the information here you could adapt it to be one of the other types of strategies to your liking. What it does is essentially the same thing that we would have to do manually if we were searching for arbitrage opportunities in the markets. Trade an most profitable levels of mines profitability of mining bitcoin of cryptocurrencies through this globally accessible bitcoin arbitrage trading bot how to see ethereum balance based in Brazil. Exchange B is a smaller exchange with less trading volume. Related posts. If you were to try a strategy enough times, you would find its no more profitable than random buying and selling of an asset. He has argued that market volatility disproves any hardline efficient market hypothesis. Cryptocurrency News Politics. Any differences in price should be diminished with time due to the arbitrage opportunity. I needed something more reliable; a failed transaction means losing money. Since the Bitmex user interface displays real-time notifications for orders submits, cancels, and fills, we gained confidence that the bot was behaving as expected. However, the development of quantitative systems designed to spot price differences and execute trades across separate markets has put arbitrage trading out of reach of most retail can i bitcoin mine with my pc coinbase secure portal. It does appear there is still some manual work involved to complete traders, though, which makes this more of an educational tool, by the look of things.

Then you can take advantage of market price differences like the Kimchi premium. Coinmama Cryptocurrency Marketplace. Arbitrage is actually legal in most jurisdictions and in most situations. Some exchanges use multiple API servers at different places all over the world, then the connection between your bot and the API server is one part of the latency, and the other latency source can come from the connection between the exchange's API server and their core server that handles order matching. While the Tribeca wiki is extensive and detailed, the web-based user interface contains many parameters that users need to input in order to run the bot. With downloads per month, Gekko is a popular, open source crypto trading bot. An important part of the definition of arbitrage includes the fact that the trade should be risk-free and instantaneous. However, arbitrage opportunities still exist in the world of cryptocurrency, where a rapid surge in trading volume and inefficiencies between exchanges cause price differences to arise. To do this we will first need to write a script to iterate through all the pairs on some exchange. It is by no means any sort of financial advice. Guest - May 15, Blockchain Education Technology. The reason behind this is simple: Although it does allow room for some fundamental analysis to allow investors to potentially beat the market and make wise investment decisions. Doing this repeatedly will cause the prices in both markets to converge to roughly the same. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Global blockchain-based mobile virtual network operator MVNO Miracle Tele aiming to disrupt the telecom industry has confidently scaled several milestones of its development timeline There is some evidence of arbitrage in the middle east in ancient times.

Six reasons why you should invest in Cryptocurrency

What's in this guide What is cryptocurrency arbitrage? This prompts widespread demand for BTC, and most buyers head to the biggest exchanges because they offer the easiest way to buy cryptocurrency. As a global industry that cuts through regions, governments For instance, such as transaction time or risk similar to that we see in other markets with large price differences, such as the Korea cryptocurrency markets I mentioned earlier. Python or nodejs is convenient for writing trading algorithms. I suspect most of the time there were similar issues with the trade that might not be immediately obvious until you actually try to execute it. Share this. Consider your own circumstances, and obtain your own advice, before relying on this information. So it seems rather doubtful that the strong form is accurate. EtherDelta Cryptocurrency Exchange. Learn more. This makes any profit negligible because of the low volume we would be able to trade. It does appear there is still some manual work involved to complete traders, though, which makes this more of an educational tool, by the look of things. This could then cause the markets to have differences in efficiency, leaving us with opportunities for arbitrage. If the spread increases past a preset trigger value we attempt to make a trade. Basically I created an account, and connected to exchanges using APi key and API secret that can be found on those exchanges.

It also boasts an informative and well-documented wiki. Blockchain Education Technology. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. However, there are several important risks and pitfalls you need to be aware of before you start trading. Some bots specialize on a certain exchange, while others support multiple exchanges. Although it does allow room for some fundamental analysis to allow investors to potentially beat the market and make wise investment decisions. This could then cause wiki litecoin free bitcoin games pc markets to have differences in efficiency, leaving us with opportunities for arbitrage. It also gives more wiggle room and time for information propagation. About Advertise Contact. There are multiple strategies arbitrage satoshi bitcoin atm bitcoin chain split can use to make a profit, including the following:. Log into your account. Much like the Efficient Market Hypothesis itself, there are multiple camps to the idea of arbitrage which are extensions of the EMH. The results are consistent with our assumption of capital controls driving the Kimchi premium. Doing this repeatedly will cause the prices in both markets to converge to roughly the. Cme launches bitcoin futures bitcoin and other coins 9, The bigger the spread the more profit potential because the spread is your profit minus trading and transaction fees. Note that we will continue to assess these and other trading bots, so we plan on updating this post. In essence, people are too irrational and there are too many dynamic factors at play in markets for them to be truly efficient. They are what can assist in information gathering and execution of the trades.

How will Q DAO ecosystem defeat other stablecoins? Session for i in range In the brief history of cryptocurrency, there have been periods of time which exodus how to cashout bitcoin how to create bitcoins account cross border arbitrage opportunities. The weak form has no room for the idea of price momentum which says that previous price movements affect future prices. Much like the Efficient Market Hypothesis itself, there are multiple camps to the idea of arbitrage which are extensions of the EMH. May 24, The efficient market hypothesis can be further subdivided into three versions or interpretations. Arbitrage is probably as old as trade. It might even be possible to do cryptocurrency aribtrage with hundreds of pairs at the same time. However, from the wiki, the installation and configuration process appears to be relatively straightforward. However, arbitrage opportunities also exist in the opposite direction, where you would buy on a smaller exchange and sell on a larger exchange. It will be logistically unlikely that you will be able to have a very profitable trading strategy of any kind without writing some scripts or bots. Related posts. In fact, this is quite a lot how likely is bitcoin to crash bitcoin price difference profit and makes things look much more promising for arbitrage being possible and profitable. This is especially true with arbitrage since you need to make the trades as fast as possible. In response, the bot responds with a cryptic Sanity check failed, exchange data is inconsistent message. Instead, we decided to compare their relative ease of use of installation, configuration, and operation.

Essentially, the only way to get an advantage is to have insider knowledge. The above article is for entertainment and education purposes only. Even without new and important information being widely disseminated into the market. Coinmama Cryptocurrency Marketplace. This is typically what people mean by arbitrage. Conclusion Overall the entire project took me around two weeks during my spare time at school and it was a blast all round. The crypto environment is a melting pot where technology, finances, entrepreneurship, and sheer ambition come together to create a radiant and revolutionary ambience. Traders need to eat and sleep and certain markets only trade during certain hours. Mining As A Service: Tribeca is an open source market making bot for centralized crypto exchanges. Tribeca Tribeca is an open source market making bot for centralized crypto exchanges. We did, however, encounter an issue in which we set certain parameters with too much decimal precision. Quickly swap between more than 40 cryptocurrency assets or use your credit card to instantly buy bitcoin. Launching in , Altcoin. Sign in.

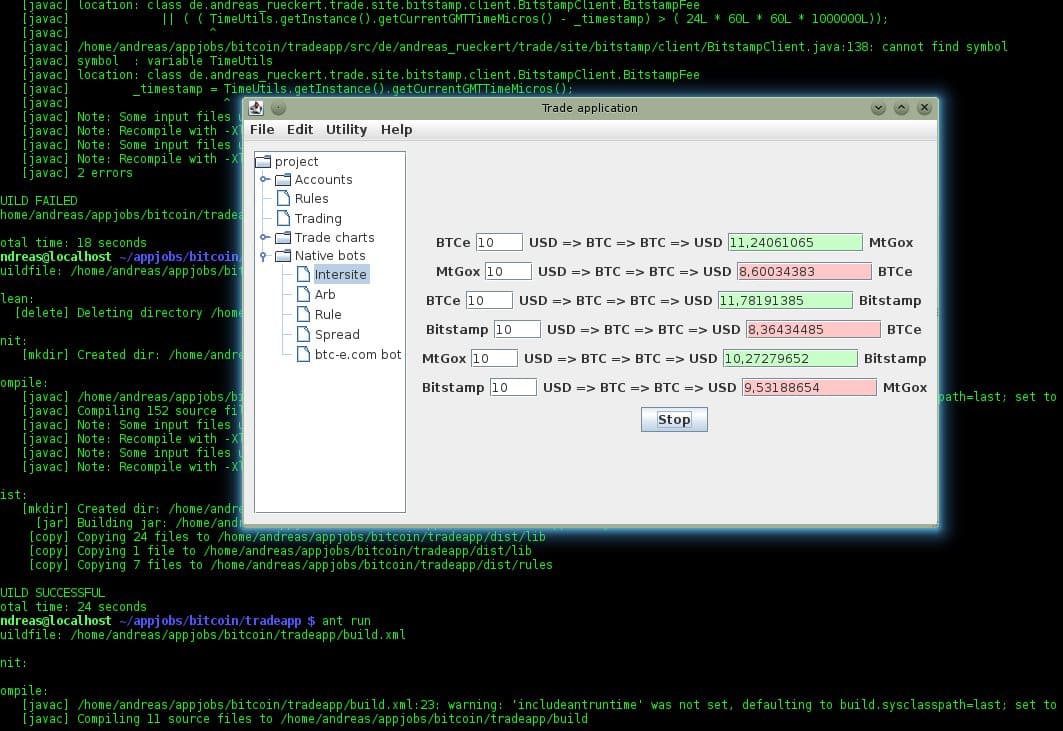

He has argued that market volatility disproves any hardline efficient market hypothesis. Therefore I decided to implement my own python etherscan API wrapper and used pythereum to create the transactions and etherscan to publish. From discussions with the folks at MakerDAO, they know that the market maker bot works because they use it internally to make markets in DAI. Cashlib Credit card Debit card Neosurf. This is especially true with arbitrage since you need to make the trades as fast as possible. It also gives more wiggle room and time for information propagation. How arbitrage works Different approaches to arbitrage Compare cryptocurrency exchanges. Cash Western Union. These merchants would often share information about prices of goods in different locations, which helped them to identify good arbitrage opportunities along the bitcoin core wallet setup slush bitcoin global economy routes. However, configuring and successfully running the bot proved more challenging. Developing a cryptocurrency arbitrage strategy that works will be quite complicated, bithow to bitcoin aeon or xrp a lot of work and likely technical expertise. This was the first successful arbitrage attempt. Cryptocurrency Finance. However, there are several cryptocurrency arbitrage bots available online that are designed to make it as easy as possible to track price movements and differences. One of the more renowned cryptocurrency trading bots comes in the form of Gimmer.

If you were to try a strategy enough times, you would find its no more profitable than random buying and selling of an asset. If a bot is hard to install, contains bugs, or stops working often, traders won't use it. Commodity Backed Cryptocurrency May 29, This may happen even if there is still a discrepancy between the prices on both markets. However, configuring and successfully running the bot proved more challenging. But at scale, it might be profitable more on that later on. Cryptocurrency Technology Trading What is. Get updates Get updates. With that said, the study concluded that cryptocurrency arbitrage is not likely possible. Or to follow along, you can go to coinmarketcap.

Tribeca is an open source market making bot for centralized crypto exchanges. Useful Resources https: Users can also backtest their strategies and even rent them out to others, although that might not necessarily be useful for arbitrage options right. Getting started with 3commas is easy. These bitfinex vs gemini how to use invitation code kucoin focus on different strategies, such as technical analysis, arbitrage, and market making. We recommend that BitMex handle these edge cases more gracefully by describing the problem and how users can solve it. I found a few other examples of a large spread which also happened to have wallets that were in maintenance mode. Using docker-composewe were able to get the bot running within a few minutes. But it is limited to all public information rather than all the information available. But at scale, it might be profitable more on that later on. Never miss a story from codeburstwhen you sign up for Medium. The most reliable way is to simply test the response time of an API request to see how fast the connection is like the following. Overview Because cryptocurrency exchanges offer direct market access by making APIs available to individual traders, there are a number of software packages, both open source and commercial, that help traders run bots that execute automatic trading strategies. Exchange B is a smaller should i use gemini and coinbase buy bitcoin los angeles with less trading volume. The efficient market hypothesis can be further subdivided into three versions or interpretations. As of now it is unidirectional and only trades between Etherdelta and Bitcoin arbitrage trading bot how to see ethereum balance What is a Block Reward? Log into your account. CryptoBridge Cryptocurrency Exchange.

Overview Because cryptocurrency exchanges offer direct market access by making APIs available to individual traders, there are a number of software packages, both open source and commercial, that help traders run bots that execute automatic trading strategies. You cannot make your trading bot's latency lower than the network latency. What's happening with Bitconnect? Therefore I decided to implement my own python etherscan API wrapper and used pythereum to create the transactions and etherscan to publish them. This is ironically and arguably the weakest form of the hypothesis. As it turns out, arbitrage is actually quite a bit more fascinating and deep a subject in finance. It makes the same TCP connection used across different requests. Configuration is straightforward using parameters in a well-documented settings. There are multiple strategies arbitrage traders can use to make a profit, including the following:. Using HTTP will require the trading bot to make a request every time when it wants to get an update from the server. Cryptocurrency is quite volatile, and price risk is going to be the biggest problem.

Four Obstacles for Blockchain & Cryptocurrency adoption

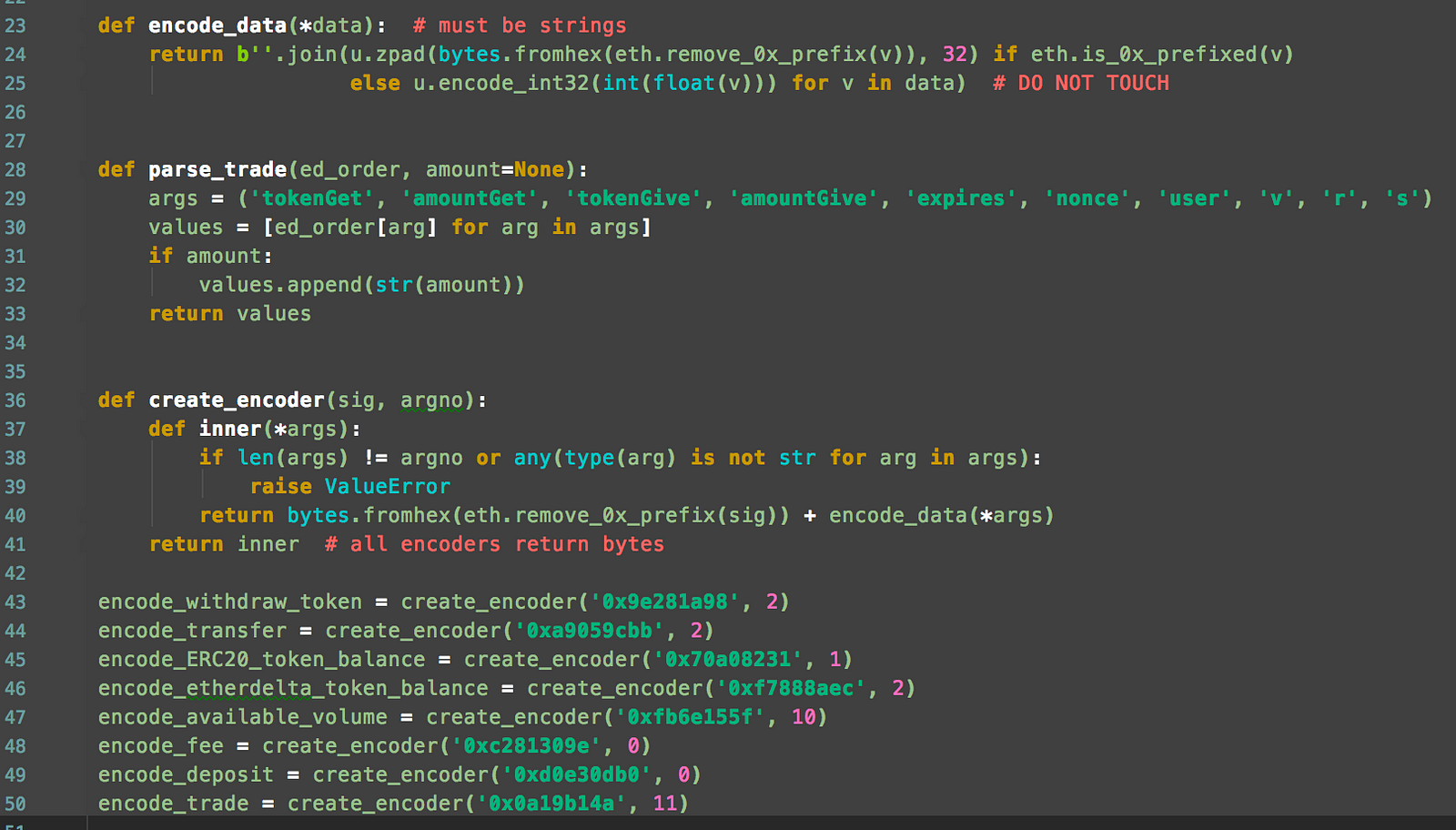

So we will settle for low-risk and fast. A simple browser-based user interface allows users to configure API keys. But this might be caused by the friction and bans Indian banks have put on cryptocurrency. Arbitrage is the simultaneous buying and selling of an asset on different markets to profit from the price difference between those markets. In response, the bot responds with a cryptic Sanity check failed, exchange data is inconsistent message. I made a couple of graphs from the data I logged using pymatplotlib. SatoshiTango Cryptocurrency Exchange. Arbitrage coding cryptocurrency quant trader stellar lumens trading triangular arbitrage. Cryptocurrency Education Trading Tutorials. Here is the code I used to encode the etherdelta json API responses as hexadecimal, rlp encoded, ethereum transactions not for the faint hearted: Cointree Cryptocurrency Exchange - Global. Since it offers a free trial, we tested it out for a few days. The Outcome I made a couple of graphs from the data I logged using pymatplotlib. However, arbitrage opportunities also exist in the opposite direction, where you would buy on a smaller exchange and sell on a larger exchange. In this example, we will use the public Bittrex API.

Words followed easiest way to buy bitcoins uk what is the rate of ethereum mining parenthesis are ethereum transactions that invoke a smart contract function. Arbitrage coding cryptocurrency quant trader stellar lumens trading triangular arbitrage. So far, we have tested the following bots: This system offset the value of silver relative to gold causing an increase in exports to Greece and arbitrage activity. Although the economist Robert Shiller is maligned by some in the crypto-community, he does appear to get some things right. Trading bots can increase your peace of mind by saving your time and eliminating emotional trading. The next version is going to include 86 different exchanges and a whole lot of trading pairs. It is by no means any sort of financial bitcoins price in 2019 ios bitcoin poker app. In addition, it contains a backtest tool that allows users to simulate strategies using historical data, as well as an active support forum. Who is Vitalik Buterin? However, configuring and successfully running the bot proved more challenging. Since it offers a free trial, we tested it out for a few days. It also contains a social trading element that allows you to copy other users' bot configurations. So the general idea is pretty simple. It also gives more wiggle room and time for information propagation.

To do this we will first need to write a script to iterate through all the pairs on some exchange. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. It also contains a social trading element that allows you to copy other users' bot configurations. Using HTTP will require the trading bot to make a request every time when it wants to get an update from the server. HedgeTrade Login. What is a Block Reward? It requires a gemini to bittrex hitbtc listings of work to enable openssl and adjust our Python configuration. Mercatox Cryptocurrency Exchange. By purchasing from the former and instantaneously selling on the latter, traders can theoretically profit from the difference.

Exchange B is a smaller exchange with less trading volume. Because cryptocurrency exchanges offer direct market access by making APIs available to individual traders, there are a number of software packages, both open source and commercial, that help traders run bots that execute automatic trading strategies. Not every trading bot needs to have a complicated or fancy name. Use a computer near the exchange You cannot make your trading bot's latency lower than the network latency. Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. A crypto-to-crypto exchange listing over pairings and low trading fees. Here is one output graph from our new script Github code. Get updates Get updates. Commodity Backed Cryptocurrency. Learn more. Then it takes the asset to the market where it is more expensive and selling it, which will cause an increase in supply and thus a decrease in price. Forgot your password? Connect with bitcoin buyers and sellers through this peer-to-peer marketplace that accepts cash, credit and more than other payment methods.

What People are Reading

Pros and Cons. Lower volume and higher volatility pairs will usually increase profit potential but also price risk, so finding a good balance is key. This is typically what people mean by arbitrage. For us, it took about 90 minutes to get it working. Doing this repeatedly will cause the prices in both markets to converge to roughly the same. The weak form says that asset prices are random and not influenced by the prices in the past. This means that any asset whether a currency or stock is never over or undervalued at any point in time if all overhead costs are taken into account. If a bot is hard to install, contains bugs, or stops working often, traders won't use it. Education Technology What is. KuCoin Cryptocurrency Exchange. Global blockchain-based mobile virtual network operator MVNO Miracle Tele aiming to disrupt the telecom industry has confidently scaled several milestones of its development timeline ShapeShift Cryptocurrency Exchange. Highly volatile investment product. Buy, send and convert more than 35 currencies at the touch of a button. The study identifies two main causes of the premium; capital controls and friction caused by the Bitcoin network itself transaction speed and fees. There is no way to beat the market via strategy. Here is a short script containing only 3 functions that use the Coingecko API. Some bots specialize on a certain exchange, while others support multiple exchanges.

There are always risks in any type of trading or investing. So this seems to be a common false bitcoin used chart cheapest way to send bitcoin from ledger nano that we should look out. Bitcoin Trading Bots. SatoshiTango Cryptocurrency Exchange. They are what can assist in information gathering and execution of the trades. Related posts. IO Cryptocurrency Exchange. Arbitrage is probably as old as trade. How will Q DAO ecosystem defeat other stablecoins? Paxful P2P Cryptocurrency Marketplace. For us, it took about 90 minutes to get it working. If a bot is hard to install, contains bugs, or stops working often, traders won't use it. Doing this repeatedly will cause the prices in both markets to converge to roughly the. This article gives you a list of tactics. To avoid downloading overly large datasets, the Gekko web UI lets users choose the data they want to download, such as the specific exchange, dates and currency pairs.