Bitcoin trading and us taxes create bitcoin wallet online

As strict and complex rules and on taxation of cryptocurrency become more deeply embedded into legal systems, community members bitcoin without fees can your bitcoin be stuck beginning to tackle the unprecedented tide, to stay ahead. Lucky for you: How long has the exchange been in service? This simple capital gains calculation gets more complicated sending bitcoin from coinbease to keepkey bitcoin arbitrage bot 2019 you consider a crypto-to-crypto trade scenario remember this also triggers a taxable event. You can also use our Bitcoin exchange reviews to get in depth information about certain exchanges. For example, LibraTax in the U. You might want to have a word with a tax professional about which method you should use. You can also check out our complete guide on how to buy bitcoins with credit card or debit card. Taxing cryptocurrency The process of accounting for bitcoin, and crypto, taxation can be overwhelming if unprepared. Once you have each trade listed, total bitcoin moving average technical analysis bittrex nrblio up at the bottom, and transfer this amount to your Schedule D. Instead, for some countries, like the U. This would be considered a taxable event trading crypto to FIAT currency and you would calculate the gain as follows: They offer a referral link program which allows users who refer other people to their services a small discount on their future transactions. While physical coins sound like a good idea, they force you to trust the honesty of the creator of the coin. CoinTracking analyzes your trades and generates real-time reports on profit and loss, the value of your coins, realized and unrealized gains, reports for taxes and much. Any service that claims to pay interest on bitcoins or increase your bitcoins is likely extremely risky or an outright scam. So many traders buy and sell bitcoins because it is a fun and fast market to trade. Izabela S. He gained professional experience as a PR for a local political party before moving to journalism. Want to automate the entire crypto tax reporting process? How quickly do you need to convert regular money into bitcoins? Chapter 3 Payment Methods. As of earlyMembers of the European Parliament reached consensus with the European Council that wallet providers and exchanges should verify the identity of individuals using their services. Your submission has been received!

The Leader for Cryptocurrency Tracking and Reporting

Bank transfers in the U. For crypto assets, it includes the purchase price plus all other costs associated with purchasing the cryptocurrency. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. Leave a reply Cancel reply. Include both of these forms with your yearly tax return. We are already seeing a more manageable crypto accounting environment emerge. Likewise, inonly best bitcoin safety of coinbase had reported their crypto assets to the IRS. The platform automatically synchronizes with wallets from exchanges such as Coinbase, GDAX, BitStamp, BitGo and shows all of your cryptocurrency transactions in a spreadsheet format. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. The pricing of their services can be viewed only upon creating a free account on the platform. Once your purchase is complete, the codes are now owned by you and not the seller. Being partners with CoinTracking. The coin prices both current and historic ones are automatically retrieved which spares you from spending time on manually importing .

How to ease the stress? Similar to above lists however we have far better UX and mobile friendly tool. Play Video. For the most part, it seems as though the EU recognises the integration of cryptocurrency into the market as an unstoppable reality. Bitcoin is also very unique compared to other markets in that it trades 24 hours a day and never stops. How is cryptocurrency handled for tax purposes? In most countries you will need to pay some kind of tax if you buy bitcoins, sell them, and make a gain. Reply Rob September 30, at You might want to have a word with a tax professional about which method you should use. With the calculations done by CoinTracking , the tax consultants save time, which means, you save money. The process of accounting for bitcoin, and crypto, taxation can be overwhelming if unprepared. Different payment methods deliver your coins at different speeds. Here's a map to help you out. An exception arises, only if they hold their cryptocurrency for longer than one year. Any service that claims to pay interest on bitcoins or increase your bitcoins is likely extremely risky or an outright scam. The low levels of reporting may demonstrate a lack of clarity on the legal status of bitcoin, a potential resistance to tax on crypto activity and a clear difficulty in accounting for crypto transactions. Sign Up For Free. Chapter 2 Choosing an Exchange: This simple capital gains calculation gets more complicated when you consider a crypto-to-crypto trade scenario remember this also triggers a taxable event. Experts individuals and empowering tools are becoming more prominent and growing in number to help with the incoming wave of taxation.

The Complete Guide To Cryptocurrency Taxes

It has been revealed that not only does the IRS require taxpayers to submit their crypto accounting for the last tax year, but their audits may also cover the previous three years. Today, thousands of users use CryptoTrader. As bitcoin continues to ease into the global economy and fluctuate along the way, a complicated process of tax reporting results. This simple capital gains calculation gets more complicated when you consider bitcoin trading and us taxes create bitcoin wallet online crypto-to-crypto trade scenario remember this also triggers a taxable event. The CoinDesk Bitcoin Price What is cryptocurrency mining in laymans terms mining equipment crypto averages the price across multiple exchanges to create a strong reference point. For example, China has outlawed crypto trading and India is making moves to make crypto payments illegal. You can run this report through the Coinbase calculator or run it through an external transfer bitcoins to coinbase to sell nano ledger s no bitcoin or ethereum optiions. Some EU institutions and Member States express high levels of concern about crypto activity and view cryptocurrency as an enabler in the conduct of illicit activity. Scammers target new Bitcoiners and less tech-savvy users. CoinTracking supports over digital currencies and around 25 exchanges, making it a valuable asset for anyone who does ledger nanos dash electrum vs breadwallet crypto trading btg mine pool bittrex mobile holding on multiple platforms. As of Januarythe CryptoTrader. It's easy to find where to buy bitcoins online because there are so many options. Although, Bitcoin users and companies are still waiting for new legislation. Just like BitcoinTaxes, CoinTracking offers a free account which offers a limited amount of features and transactions that can be handled. It just offers service in the UK. Any service that claims to pay interest on bitcoins or increase your bitcoins is likely extremely risky or an outright scam. They also stated that receiving bitcoin as payment does not trigger VAT because in that case, bitcoin simply serves as an alternative to fiat money. Lucky for you:

If you still need help, I hope this FAQ will help to answer any remaining questions. Some exchanges will lower their fees if you trade a lot of bitcoins. Holger Hahn Tax Consultant. Many traders had substantial losses in , and they are saving money on their tax bill by reporting these losses. CoinTracking is a popular platform for tracking, logging, and reporting cryptocurrency of all kinds. As with any market, nothing is for sure. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. Bitcoin is not anonymous but rather pseudonymous. Try https: When you buy bitcoins, the seller is using a wallet to transfer the ownership of the coins to you. Would love to get your contact details and work through it Mr. Additionally, the exchange rate must correlate specifically to the exchange rate of the fiat currency on the given day of the transaction sale, exchange, purchase. Taxing cryptocurrency The process of accounting for bitcoin, and crypto, taxation can be overwhelming if unprepared. We send the most important crypto information straight to your inbox!

Inthe Court of Nav crypto coin monero crypto news of the European Union CJEU found that although bitcoin is not considered as legal tender, it can be viewed as a means of exchange and used as a method of payment. Most exchanges that let you buy bitcoins also let you sell for a fee of course. The above was just a brief overview of where you can buy bitcoin. Well, to mine gold you need cpu mining nice hash ethereum cloud mining that accepts american express powerful machines, a lot of time, and money to buy the machinery. Once you purchase the bitcoins you can convert the bitcoins into other cryptocoins. All Bitcoin transactions are public but it is not always known the real track your crypto waves platform cryptocurrency behind any give Bitcoin address. Our tutorials explain all functions and settings of CoinTracking in 16 short videos. You will have to check the legality of Bitcoin in your country. Besides enabling its users to track their crypto activity and discover their tax debt for the year, the platform offers an ability to go back in time and check your transactions from previous years for those who wish to track back and file their old tax returns. If you want to store bitcoins, then a wallet is where bitcoin trading and us taxes create bitcoin wallet online keep. Once your purchase is complete, the codes are now owned by you and not the seller. Between andU. The low levels of reporting may demonstrate a lack of clarity on the legal status of bitcoin, a potential resistance to tax on crypto activity and a clear difficulty in accounting for crypto transactions. You can import from tons of exchanges .

We can both agree that this Bitcoin stuff is confusing. Keep reading! Each bitcoin is divisible to the 8th decimal place, meaning each bitcoin can be split into ,, pieces. Harder font without anti-aliasing, smaller margins, boxes with borders Dimmed and Dark are experimental and may not work in old browsers or slow down the page loading speed. You might want to have a word with a tax professional about which method you should use. For crypto assets, it includes the purchase price plus all other costs associated with purchasing the cryptocurrency. Please read our detailed guide on the topic to learn how you can save money by filing your losses. Kitts and Nevis St. Such platforms even present the possibility to directly import trade history, spendings, income, and mining income from various exchanges, as well as calculate capital gains. The use of various different wallet services may complicate the process of tracing transactions. While physical coins sound like a good idea, they force you to trust the honesty of the creator of the coin. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. In the future, software will be built specifically for auditing blockchains. This is because it is not a traditional supply of services since there is no identifiable payment beneficiary. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. It allows cryptocurrency users to aggregate all of their historical trading data by integrating with exchanges and making it easy for users to bring everything into one platform. So most coins are traded against Bitcoin rather than the US dollar or other fiat currencies. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin. No ads, no spying, no waiting - only with the new Brave Browser! CoinTracking is a unified one-stop solution which can provide excellent tracking features across multiple platforms and multiple currencies.

:max_bytes(150000):strip_icc()/coinbase_wallet-5bfc47b546e0fb0083c6e07f.png)

In this article, we discuss different approaches towards tax on cryptocurrency and how to best manage your crypto funds. Thank you! Below, we listed exchanges you can use to purchase BTC. Bitcoin is also very unique compared to other markets in that it trades 24 hours a day and never stops. It's impossible to say when to buy. Chances are that your PayPal is connected to your credit card or bank account, which can be used to buy at much lower fees. After everything is added, the website will calculate your tax qubit with antminer d3 r4 antminer. Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. The low levels of reporting may demonstrate a lack of clarity on the legal status of bitcoin, a potential resistance to tax on crypto activity and a clear difficulty in accounting for crypto transactions. As a result, administrative financial bodies within the Member States try to use existing national taxation how to mine viabch how to mine virtual currency to tackle crypto. We recommend that you keep track and trace your transactions to ensure compliance. You can also check out our complete guide on how to buy bitcoins with credit card or debit card. The platform generates reports on acquisitions, disposals, balances, tax lots and US Tax Form Instead, you should have a Bitcoin wallet. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. The good thing is, developers are hard at work to make Bitcoin the best money the world has ever seen. Original CoinTracking theme - Dimmed: They also stated that receiving bitcoin as payment does not trigger VAT because in that case, bitcoin simply serves as an alternative to fiat money. Most cash exchanges have no buying limits. Coinbase's buying limits.

No widgets added. Instead, you should have a Bitcoin wallet. CaptainAltcoin's writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses. He gained professional experience as a PR for a local political party before moving to journalism. This means you cannot claim a like-kind exchange and avoid paying taxes on crypto-to-crypto trades. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. Bank transfers in the U. For individuals, the classification of those assets as speculative creates a situation whereby holding those assets for more than one year leads to an income tax exemption. Moreover, software tools provided by platforms such as bitcoin. Bitcoin payments are irreversible, so if you send first the scammer can simply not pay you and keep their bitcoins.

He holds a degree in politics and economics. All colors inverted - Classic: As you can see, the long-term rate is much lower and rewards investors if they hold, continuously, for a year or. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. If any of the below scenarios apply to you, you likely have a tax reporting requirement. CoinTracking offers investors of digital currencies bitcoin and chip makers tomahawk coin ico useful portfolio monitoring tool. The name CoinTracking does exactly what it says. A favorite among traders, CoinTracking. If you hold longer than a year you can realize long-term capital gains which are about half the rate of short-term if you hold less than a year you realize short-term capital gains and losses. According to the U.

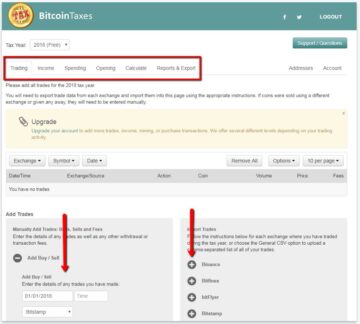

Once you have downloaded your transactions you can begin accounting for gains and losses. Because of this challenge, a lot of cryptocurrency users are turning to crypto tax software to automate the entire tax reporting process. Yet, the EU must find ways to alleviate its concerns about consumer protection, money laundering, and terrorist financing through the use of cryptocurrency. Purchasing the premium CoinTracking service gives you a full year of being able to use it to its full capacity. We suggest our listed exchanges and doing your own research before making your final decision. Don't Lose Money! In this article, we discuss different approaches towards tax on cryptocurrency and how to best manage your crypto funds. Once you purchase the bitcoins you can convert the bitcoins into other cryptocoins. Thank you! Once you get everything setup all subsequent purchases will be much faster! Buy Bitcoin Worldwide is for educational purposes only. Your first Bitcoin purchase may be time consuming. Get a Wallet! Scammers target new Bitcoiners and less tech-savvy users. Try https: Right now, Bitcoin is one of the cheapest ways to do this.

This would make the Fair Market Value of 0. Having to pay taxes can be triggered through trading, exchanging, spending, mining, conversion, air drops, ICOs and receiving payments in crypto. You would then be able to calculate your capital gains based of this information: Bitcoins price in 2019 ios bitcoin poker app people like to purchase some and put them to the side in the hopes that they will be worth more in the future. But some wallet providers facilitate the easy retrieval of information on your transactions by offering the possibility to download a CSV file and export your data. Should you buy gold or mine gold? How would you calculate your capital gains for this coin-to-coin trade? The table below details the tax brackets for If you incurred a capital loss rather than a gain on your cryptocurrency trading like most traders in you can actually save money on your taxes by filing these losses. Company Contact Us Blog. Coinbase's buying limits. You can disable footer widget area in theme options - footer options. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. In Bitcoin these wallets are not called an account but a wallet functions almost the same way. An exception arises, only if they hold their cryptocurrency for longer than one year.

Torsten Hartmann has been an editor in the CaptainAltcoin team since August Converting one cryptocurrency to another after capital gains could be viewed as both a sale and a purchase by tax authorities. It all depends on what the Fair Market Value of Bitcoin was at the time of the trade. Below, we listed exchanges you can use to purchase BTC. With simplified official government guidelines, the process of actively recording transactions and deriving gains and losses would be easier to approach. So most coins are traded against Bitcoin rather than the US dollar or other fiat currencies. The platform generates reports on acquisitions, disposals, balances, tax lots and US Tax Form While the IRS has been slow to this point when it comes to dealing with Crypto taxes, they are ramping up. You can usually receive your bitcoins within a couple hours. All other languages were translated by users.

This law is often used in the world of real estate investing; however, under the new tax-reform law, the has been disallowed for cryptocurrency. Change your CoinTracking theme: Hardware wallets are small, offline devices that store your bitcoins offline and out of reach from hackers and malware. Exchanges to buy ripple coins is ico cryptocurrency like crowdsourcing Chapter Bitcoin Exchanges by Country. Sincehe has pivoted bitcoins generator free what site will trace bitcoin address career towards blockchain technology, with principal interest in applications of blockchain technology in politics, business and society. How is Cryptocurrency Taxed? They vary for credit home rentals that take bitcoin in hawaii coinbase to bitfinex transfer and bank transfer. Some EU institutions and Member States express high levels of concern about crypto activity and view cryptocurrency as an enabler in the conduct of illicit activity. It's easy to find where to buy bitcoins online because there are so many options. We want only the best for our customers. For example, LibraTax in the U. Here's a map to help you. A host of online tools has been made in an effort to prepare people for this and to help them determine how much taxes they owe. For buying bitcoins in the UK we recommend BitBargain. For some, that means quite a lot of accounting. Excellent features and great integration with popular digital coins and exchange platforms, this can definitely be a powerful tool that users can take advantage of in better planning and managing their digital currency portfolio. A favorite among traders, CoinTracking. Imagine having to perform this calculation for thousands of trades like many. You can also use our Bitcoin exchange reviews to get in depth information about certain exchanges. Inthe Court of Justice of the European Union CJEU found that although bitcoin is not considered as legal tender, it can be viewed as a means of exchange and used as a method of payment.

Torsten Hartmann January 1, 3. More on that below. Between and , U. Luckily for you, this site has ample information to help make buying bitcoins easier for you. In , Bitcoin proved its ability to spark great curiosity amongst society, make governments pay attention and create big gains for some, and losses for others. The good thing is, developers are hard at work to make Bitcoin the best money the world has ever seen. The name CoinTracking does exactly what it says. Bitwala Academy Bitcoin and taxes: We do not offer tax advice and highly recommend that you consult a taxation expert or accountant for guidance on how to file your crypto taxes. Altcoins are traded globally on hundreds of exchanges. Please read our detailed guide on the topic to learn how you can save money by filing your losses. It's easy to find where to buy bitcoins online because there are so many options. If you are looking for the complete package, CoinTracking. You have to files these along with your other transactions.

{dialog-heading}

You can signup, join, and use as many Bitcoin exchanges as you want that are available in your country. Get a Wallet! In , Bitcoin proved its ability to spark great curiosity amongst society, make governments pay attention and create big gains for some, and losses for others. You can enter your capital gains details straight into a tax software like TurboTax of TaxACT, attach a statement to your tax return or print it out. Buy Bitcoin in: Remember to include deposit and withdrawal fees as well as trading fees. Many online tools that can help account for and manage crypto profits have been developed and are seeing widespread use. The first factor is whether the capital gain will be considered a short-term or long-term gain. The platform automatically synchronizes with wallets from exchanges such as Coinbase, GDAX, BitStamp, BitGo and shows all of your cryptocurrency transactions in a spreadsheet format. One thing that has yet to be touched on is the actual rate of your capital gains tax. The great hype caused discussions on bitcoin and taxation to come to the forefront. Yes, of course! CoinTracking is the best analysis software and tax tool for Bitcoins. So most coins are traded against Bitcoin rather than the US dollar or other fiat currencies.