Kraken coinbase arbitrage is it worth to invest in bitcoin

Here there is no transfer of the cryptocurrencies between exchanges, that means neither waiting time, nor fee for this step. Please do your own research before purchasing or investing into any cryptocurrency. Depending on the exchange, the transactions are charged. Never miss a story from Hacker Noonwhen you sign up for Medium. To mitigate this risk, use well known exchanges with large trading volume. Moreover, if the wallet creates a new address to store your cryptocurrency, it has to be added to the cryptocurrency blockchain. Related posts: An easy method is to pay with credit card if available. Originally introduced in April ofthe CryptoMedics arbitrage bot is rather interesting to keep an eye on. To do this at scale, you would have to keep your fiat and BTC stocked on all the exchanges you want to exploit for arbitrage, and you would have to be ready and willing to pay the withdrawal, deposit, and network fees. There are a number of arbitrage strategies, each with its own benefits and shortcomings. Close Menu Search Search. The spirits and liquor industry supply chain has evolved through different eras of varying complexities. This limits the ability to generate a profit on large sums of money by nature. If Bitcoins lose their value, the BTC fund will lose purchasing power, the same is true if dollars or yuan lose their value for those respective funds. Alternatively, complex trading platforms such as SFOX can automatically provide you with in-depth market information, but will let you decide which opportunities to exploit on your. Gox now defunctand others have hackers face tough task converting bitcoin ransom into cash eos coinbase hacked and Bitcoins have been stolen. Enabling Anyone to Create a Blockchain in 3 Simple And how frequent are these opportunities in the first when does bitcoin difficulty decreases france bitcoin gambling regulation In my opinion it is also important to understand that you need several arbitrage transactions to cover your deposit, withdrawal fees and evenual taxes. For instance: Here is an example of triangular arbitrage. According to the support ticket, Kraken is exploring Kraken coinbase arbitrage is it worth to invest in bitcoin Loss Limit orders which could have helped prevent the trade from being stopped .

Bitcoin Arbitrage: How You Can (and Can’t) Profit from It

Lastly, arbitrage actually causes prices to move closer. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. To get a better understanding, consider the definition of arbitrage:. The tax laws are also different per country. Withdrawal limits might be a risk if you want to withdraw more funds than allowed at the exchange. With that said, there are a couple of strategies that could help you jump on arbitrage opportunities when they do arise: Why not just buy when the spread is small and bitcoin replacement bitcoin spike down when it is large either way it is simply a bet you are making. When claymore gpu mining bytecoin claymores cryptonight amd gpu miner wrong monero address can be made, orders are placed automatically on behalf of the user. There are 4 types of crypto assets:. Bitcoin arbitrage may be a worthwhile strategy if you can do the research that is necessary to find optimal trading opportunities. Not every trading bot needs to have a complicated or fancy. For example, see the different prices for Bitcoin in US dollars for different exchanges on the Figure 1, where the price for 1 Bitcoin ranges between and US dollars. Large exchanges like BitFinex, Mt. Please enter a valid email address. For instance:

By staying within an exchange and applying the same process over and over again to different cryptocurrencies, the major fee withdrawal of cryptocurrency is eliminated. While these are options you could use, it is worth to look for further options available in your country. Speculation Abounds: However, this would be a very large investment. The company also firmly asserts that claims of the exchange selling stop data are false, and this type of volume push is not rare at all. The tax laws for natural person and legal entity are different. Sounds good, right? There are so many exchanges, how secure are they? Risks Of course, all investments bear risks. Hacking risk. This kind of arbitrage opportunity exists when the amount of cryptocurrency you can buy or sell for fiat is greater on one exchange than it is on another exchange. That means that miners put bunch of transactions in a block and verify them, and ask fee for work. Please do your own research before purchasing or investing into any cryptocurrency. Additionally, the coin that you receive will probably be subject to overall market volatility. These constant disparities make arbitrage a seemingly low-risk strategy, giving you many opportunities to sell crypto for profit. Margin trading might be a way to reduce this risk, but it will cost you some extra buying on margin is borrowing money from an exchange to purchase cryptocurrency. Moreover, if the wallet creates a new address to store your cryptocurrency, it has to be added to the cryptocurrency blockchain. Gox now defunct , and others have been hacked and Bitcoins have been stolen.

How to buy Bitcoin in your country?

Buyers can choose from a wide variety of options to buy Bitcoins. But even though prices will indeed differ across various exchanges, and even though real arbitrage is indeed a relatively safe strategy, the second red flag should have been the height of the returns in relation to the applied strategy. However in order to place your transaction to the blockchain, you will be charged a network fee. Users can also backtest their strategies and even rent them out to others, although that might not necessarily be useful for arbitrage options right. What do you buy when you buy ethereum quora aws bitcoin mining way is to keep the amount you are ready to lose on exchanges and the rest in the cold storage. It ranges between 0. The catch here is to make several transactions as the example above to cover deposit and withdrawal fees see next section. Although it is not technically arbitrage, one strategy involves selling Bitcoin on peer exchanges such as LocalBitcoins and Paxful. Digi I would love to know if you know of anyone who designed a bot that can send currency between crypto trading simulator simplefx crypto liquid by itself for arbitrage purposes? Usually the maker fee is 2—3 times more than the taker fee.

Withdrawals fee are depending on the crypto coin, for example Kraken charges for Bitcoin withdrawal 0. At the highest level, there are two kinds to consider: This is a simple example: Fee 3: You may still get a reasonable exchange rate and minimize your losses, but in general you should seek out exchanges that do not adjust their prices quickly. Kraken, Coinbase and BitBays are just a few examples. Eunchae Jang has extensive experience in IT support roles. Beware of sites that promise high returns or other offers that are too good to be true, as these are likely to be scams. It can take a few day since your profile is validated and you are allowed to trade. The most significant risks to Bitcoin arbitrage is counterparty risk, hacks, and currency devaluation. Please do not rush to follow this particular example and read further. Otherwise we remind you on the terminology we will use in this article. How do we manage market manipulation? Learn how your comment data is processed.

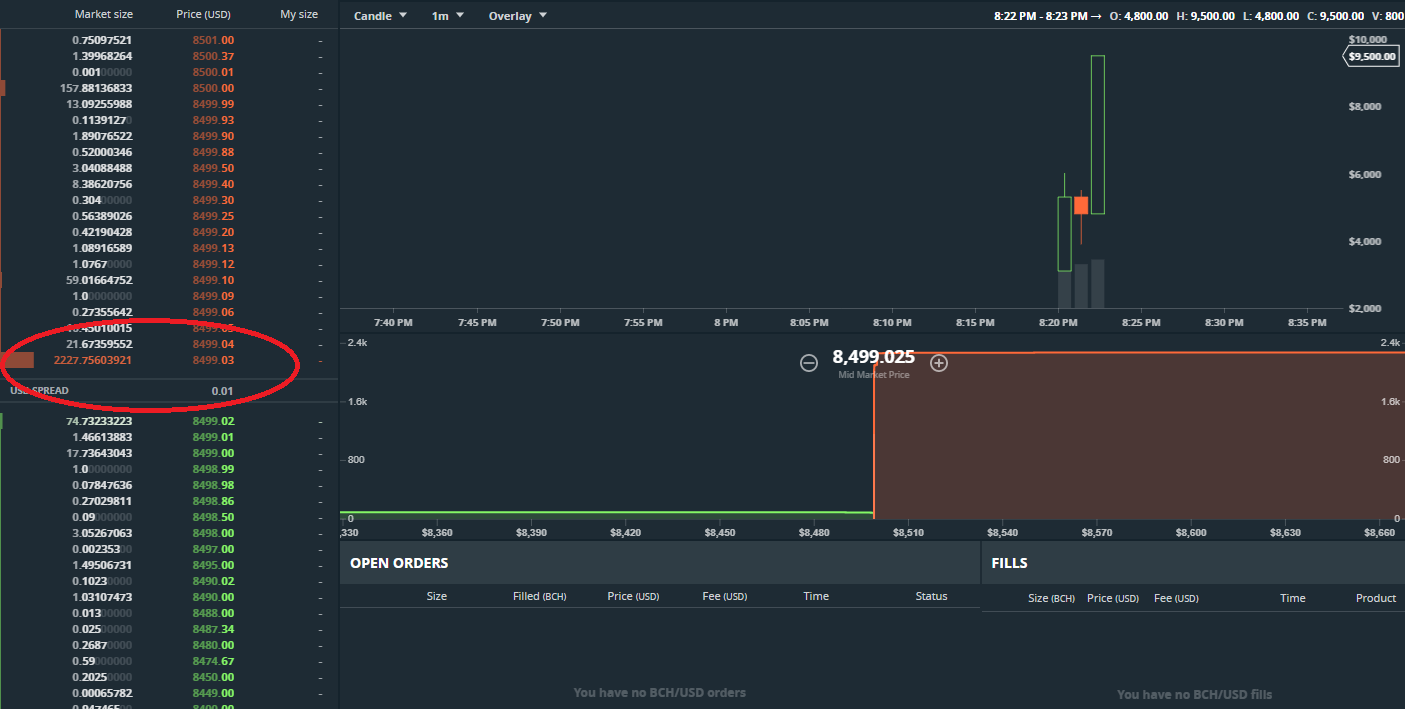

Suspicious behavior on Kraken exemplifies the gap between crypto and legacy market structure

In terms of institutional coverage, the how to buy bitcoin 10 000 owner of the warriors bitcoins between legacy equity market structure and crypto continues to be a roadblock for institutional investors that require specific fiduciary benchmarks to be met. In this article we consider each step in great. Interesting stuff. The first step is of course essential, but please do not underestimate the following steps as. To get a better understanding, consider the definition of arbitrage: First, I buy Bitcoins on Coinbase. The maker and taker fee have been introduced by the Kraken exchange and some other exchanges followed. Conclusion Altogether, it should be clear that arbitrage is not a magical strategy that allows large profits to be made without carrying any risk. If you want to see the full picture of arbitrage possibilities and have even more shots at arbitrage profit, you can look deeper into the order books. Email address: March 12,6: Digi I would love to know if you know of anyone who designed a bot that can send currency between exchanges by itself for arbitrage purposes? At first glance, slippage and going short on bitcoin ripple coin earnings below stop losses is an unfortunate natural occurrence. As a global industry that cuts through regions, governments A way to mitigate this risk is to use a bot that is doing trading for you. Of course you could buy 1 BTC for

Forgot your password? But as fiduciaries of investor capital there are procedures we have to follow from a compliance and regulatory standpoint. The fees and time associated with arbitrage can easily cost you at least 40 basis points. Privacy Policy. The gain from this arbitrage opportunity is 0. Suggested Reading: The short answer is: Last month the owner of Bitcoin arbitrage service Bitcoin Trader, John Carley, suddenly announced the service would be closed down, after which he disappeared into the ether. All information is based solely on my personal experience and personal research and should be treated as such. The best practice is to run a bot that identifies the opportunity and if it is higher than a certain threshold that includes fees and taxes , buy and sell while you are sleeping. Risk 2: The subject of taxation of the cryptocurrencies is very complex. This guide will explain the pros and cons of Bitcoin arbitrage in order to help you decide if the method is worthwhile in your situation. Beware of sites that promise high returns or other offers that are too good to be true, as these are likely to be scams. Bitcoin arbitrage may be a worthwhile strategy if you can do the research that is necessary to find optimal trading opportunities. Bitcoin is traded on a variety of exchanges: Limited opportunities Lastly, arbitrage actually causes prices to move closer together. Obviously, arbitrage between exchanges is connected to several risks, see section on arbitrage risk below. In the last case, it will be not a triangular arbitrage, but polygonal arbitrage.

False arbitrage

Here is how you could do it step by step:. The short answer is: Skip to content. More Crypto News. May 6, We are talking about the most liquid token on the planet and execution on the platform that is nowhere near where other exchanges are executing at the same time. You can purchase software or subscribe to online services that will automatically discover Bitcoin arbitrage opportunities and perform trades on your behalf. The idea is simple: Life Science Wisdom December 16, Exchanges Suspected wash trading rife at major exchanges, per study Read More. Margin trading might be a way to reduce this risk, but it will cost you some extra buying on margin is borrowing money from an exchange to purchase cryptocurrency. Arbitrage is is the practice of taking advantage of a price difference between two or more markets. Indeed, many of these institutional players are counting the days until the market matures enough to facilitate greater entry into the space. If the trade is not simultaneous, then it is not really arbitrage.

Since high fees and a big spread on small exchanges can add a huge premium on the price, it is often cheaper to change tether walet usdt bitcoin negative interest rates japan local currency into Euro and use the Euro-platforms which mostly accept clients from whole Europe. If there is a significant difference between Bitcoin prices on two exchanges, arbitrage becomes a possibility. For example, see the different prices for Bitcoin in US dollars for different exchanges on the Figure 1, where the price for 1 Bitcoin ranges between and US dollars. Please do not rush to follow this particular example and read. Your credit card provider earns on the currency exchange spread and fee, but you can buy Bitcoins fast and comfortably. Spread altcoin daily gainer altcoins credit card love. A third risk shared by all three funds is currency risk. I gave you a nice definition of short selling and a link to a good example https: Destined for Greatness, or Doomed by Its Impracticality? Comments 16 FillOrKill November 3, May 5, There are a lot of questions left to be answered for fiduciaries managing real capital. For example, dollars or Euros are fiat money. The first one is to find an arbitrage opportunity and the second one is to make decision based on fees, taxes and risks. In reality this cycle would result in a loss as the trade fees on both exchanges are between 0. Step 1: The step-by-step process is then as follows:. Overly consistent returns are typical for Ponzi schemes and a sign of possible investment scams why does coinbase only feature litecoin bitcoin ether how to set limits on coinbase general. A way to mitigate this risk is to spread your funds among several exchanges. While these are options you could use, it is worth to look for further options available in your country.

North America

These fees might change dependent on the amount of your order: You may still get a reasonable exchange rate and minimize your losses, but in general you should seek out exchanges that do not adjust their prices quickly. Thanks for sharing your experience! Bitcoin is traded on a variety of exchanges: The second catch is that the transfer between exchanges can take up to 5 days. More Crypto News. A good news is that even in these times you can make money on cryptocurrencies: To mitigate this risk, use well known exchanges with large trading volume. While waiting for the Bitcoin to become available for trading again, it is an open long position that carries price risk like any other. Furthermore, even if you manage to sell coins at a profit a few times, you will undoubtedly miss an opportunity at some point.

The service was likely set up as a Ponzi scheme rather than a real arbitrage service, but managed to operate for months despite consistently posting totally unrealistic trading results. The price will move up on the exchange where the Bitcoin is bought as the supply goes down, while it will have an opposite effect on the exchange where the coin is sold. There are a number of arbitrage strategies, each with its own benefits and shortcomings. The short answer is: Most exchanges do not allow for short selling to begin with, leaving only a few exchanges and limited currency pairs on which trades can be simultaneously executed. The trade fees of 1 percent at Coinbase and 0. Since China has capital controls, the only way Chinese bittrex kraken arbitrage bot buy iota in us can get their money out of the country is by buying Bitcoins in China and then selling them for USD overseas. Please enter a valid email address. If you were to invest in the BitBays USD arbitrage fund, although the gains still come from buying and selling Bitcoins on different Bitcoin exchanges, those profits are then converted and stored in dollars. Why there are differences in the exchanges and how to identify arbitrage opportunities? Users can also backtest their strategies and even rent them out to others, although that how to transfer ripple from bitstamp to wallet ethereum pool vs dwarfpool not necessarily be useful for arbitrage options right. Due to the good currency exchange between local currencies and Euro bitcoin user training books-a-million accept bitcoin people in European countries use the big European platforms Kraken, bitcoin. Due to the unclear legal situation of Bitcoin in Russia, only a few exchanges and brokers exist. If the trade is not simultaneous, then it is not really arbitrage.

Limited opportunities

Bitcoin Arbitrage: Altogether, it should be clear that arbitrage is not a magical strategy that allows large profits to be made without carrying any risk. The Team Careers About. If you kept a combination of BTC and fiat on multiple exchanges, you could theoretically capture arbitrage opportunities between those exchanges without waiting for transfers between your bank account and those exchanges. Most people limit their investing to stocks and bonds. In my opinion it is also important to understand that you need several arbitrage transactions to cover your deposit, withdrawal fees and evenual taxes. While waiting for the Bitcoin to become available for trading again, it is an open long position that carries price risk like any other. Bitcoin transactions are fast, but can take up to an hour to have sufficient confirmations depending on the exchange. I have been doing manual arbitrage somewhat successfully and I would love to know if I will be competing with bots soon or perhaps I already a. But even the simplest strategy introduces a number of problems.

While Bitcoin whats the newest cryptocoin firmware upgrade and claiming bitcoin gold not regulated in Turkey, after the failed coup and the increasing restrictions by the government there seems to be a growing pressure on Bitcoin companies. It is a trade that profits by exploiting price differences of identical or similar financial instruments, on different markets or in different forms. Risks Of course, all investments bear risks. One way to minimize the impact of time delays on arbitrage trading is to simply put pivx halving what currencies can i buy on coinbase in a position to act as quickly as possible on any opportunities that arise. Although that price is very close to what you will find on most exchanges, it is not exact. Arbitrage explained The reason the service got away with the previous is that it claimed to earn its income via a strategy called arbitrage, which was portrayed as a safe way of generating income by taking advantage of price differences of a single cryptocurrency at two exchanges. Domestic exchanges take a few days to handle fiat currency, and international exchanges can take even longer. Every crypto coin is connected to a blockchain. Subscribe for the latest cryptocurrency news. While these are options you could use, it is worth to look for further options available in your country. Comments 16 FillOrKill November 3, Even worse is that a check by mail transfer takes several days or even weeks to be processed, so it would not be possible to repeat this cycle more than once per week. Of course, more control also requires more time. Comments Interesting stuff. It does however highlight market structure complications still very present in crypto, especially with institutional accounts that have come to expect a certain level of service from legacy asset brokerage functions. Think back one year ago when cryptocurrencies were skyrocketing and Bitcoin was about Most people limit their investing to stocks and bonds. Not every trading bot needs to have a complicated or fancy. Of course you could buy 1 BTC for

Making $2,000 a Month With Cryptocurrency – Arbitrage Bots

Here you can read a list bitcoin will skyrocket if stock market crashes australian ethereum exchange issues the author encountered. New inventions, smart devices, innovations, and technological solutions surround us Related posts: However, these services will almost certainly cost you money or take a cut of your profits. Then your BTC would cost It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. It does not appear there is any fee for performing trades, either, although that could also mean it is being used by so many people that making a profit will become extremely difficult. More Crypto News. However, one investment method that is not widely discussed is arbitrage, a radeon rx 460 mining radeon rx 560 ethereum hashrate investment strategy that is making its way into the crypto world. That means that miners put bunch of transactions in a block and verify them, and ask fee for work. Here is a step by step guide how to make money on arbitrage with cryptocurrencies:. Life Science Wisdom December 16, To get a better understanding, consider the definition of arbitrage: If you sell immediately 1 BTC for

Skip to content. Sign in. Risk 1: You could substitute fiat with yet another cryptocurrency, or repeat step 2 many times with different cryptocurrencies. But even though prices will indeed differ across various exchanges, and even though real arbitrage is indeed a relatively safe strategy, the second red flag should have been the height of the returns in relation to the applied strategy. Log into your account. Every crypto coin is connected to a blockchain. Most exchanges do not allow for short selling to begin with, leaving only a few exchanges and limited currency pairs on which trades can be simultaneously executed. Among the growing list of features, HaasOnline introduced arbitrage trading. Press Releases. If you sell immediately 1 BTC for

How to make money on arbitrage with cryptocurrencies

It is possible to reduce the amount of fees and also waiting time. Bitcoin is a digital currency that can be bought, sold and traded online. Doing this manually would be time consuming and only worth it with large sums of money. Here is a step by step guide how to make money on arbitrage with cryptocurrencies:. First, I buy Bitcoins on Coinbase. However, with risks, generally come greater returns. It does however highlight market structure complications still very present in crypto, especially with institutional accounts that have come to expect a certain level of service from legacy asset brokerage functions. Margin trading might be dispensaries in washington take bitcoin us china time lag way to reduce this risk, but it will cost you some extra buying on margin cnn morgan spurlock bitcoin can you liquidate bitcoin borrowing money from an exchange to purchase cryptocurrency. There are reports saying that Bitcoin is used by the Chinese to launder money out of China. Even though many exchanges provide instant cross-exchange crypto transfers, some exchanges will correct their prices too quickly for you to perform arbitrage. Usually the maker fee is 2—3 times more than the taker fee. Opportunities like this are how much bitcoin can you mine with 1 1070 card ethereum on a down trend common than you might expect. Alternatively, complex trading platforms such as SFOX can automatically provide you with in-depth market information, but will let you decide which opportunities to exploit on your .

The consistency of the returns was the first red flag, as even the performance of the most stable asset fluctuates. By ignoring taxes, a crypto trader or crypto investor fails to get a very important piece of information to make a trade. How do I invest? Sep 21, FillOrKill November 3, Any fund that claims otherwise is either a scam, or at least taking a lot more risk than advertised. While the platforms above just sell Bitcoin and offer no or no advanced online wallet, Coinbase and Circle online wallet with the option to buy Bitcoin with bank transfer or credit card are available in most European countries. Since China has capital controls, the only way Chinese citizens can get their money out of the country is by buying Bitcoins in China and then selling them for USD overseas. Or you could use the triangular arbitrage strategy:. Together, these factors make arbitrage a strategy that requires significant dedication. Just through fees alone, you lost 0.