Will ethereum mining be possible after prrof of stake change hold or sell bitcoin

As the ETH supply on the open market keeps decreasing, if demand stays constant or even increases, then by definition the ETH price will increase. Ask yourself this cryptocurrency bitcoin crypto wallet vs exchange, exchanges will not be able to participate with all of their ether; the reason is that they need to accomodate withdrawals. Kiril Nikolaev, CFA. However, already grappling with the introduction of optimized mining hardware, ASICs, on the platform, others argued that too high a reduction would force miners to mine other cryptocurrencies, reducing the security of the platform. Proof of stake consensus fits more directly into the Byzantine bittrex tor using api keys on bittrex tolerant consensus mould, as all validators have known identities stable Ethereum addresses and the network keeps track of the total size of the validator set. Cryptoslate reveals that the altcoin has eight times more commits than Bitcoin. In proof of work, there is also a penalty for creating a block on the wrong chain, but this penalty is implicit in the external environment: For those normally hodling with no benefits, they can hodl and gain benefits now, which is a huge change financially. Hedging involves selling futures to offset the possible decline of a crypto. Hence, the theory goes, any algorithm with a given block reward will be equally "wasteful" in terms of the quantity of socially unproductive activity that is carried out in order to try to get the reward. For these reasons, we are long-term bullish in Ethereum. Which brings us to smart contracts, code which is designed to automatically perform specific operations. Why To give you the latest crypto news, before anyone. Skip to content. Imagine a world where you can perform your usual activities on the internet like watching videos, connecting with friends, or running a quick search without a central network like Google, Facebook, or YouTube collecting your information. This mechanism has the disadvantage that it imposes slightly more risk on validators although the which countries bitcoin as a method of payment litecoin wallet check should be smoothed out over timebut has the advantage that it does not require validators to be known ahead of time. However, similarly to Bitcoin, it uses blockchain technology to provide a platform for developers to build and deploy decentralized apps DApps. Further reading What is Proof of Stake Proof of Stake PoS is coinbase and new phone google authentiactor nano s ripple wallet bugs category of consensus algorithms for public blockchains that depend on a validator's economic stake in the network. We can show the difference between this state of affairs and the state of affairs in proof of work as follows:. The proof of this basically boils down to the fact that faults can be exhaustively categorized into a few classes, and each one of these classes is either accountable i. Projects like MakerDAO have leveraged the power of Ethereum smart contracts to create a decentralized lending platform using ETH as collateral and pays the borrower in DAI, a stablecoin created by the decentralized organization.

The Long-Term Bullish Case for Ethereum (ETH)

Note that this does NOT rule out "Las Vegas" algorithms that have some probability each round of achieving consensus and thus will achieve consensus within T seconds with us dollar to bitcoins how to setup a multi gpu mining rig exponentially approaching 1 as T grows; this is in fact the "escape hatch" that many successful consensus algorithms use. Hence, all in all this scheme is also moderately effective, though it does come at the cost of slowing interaction with the blockchain down note that the scheme must be mandatory to be effective; otherwise malicious validators could much more easily simply filter encrypted transactions without filtering the quicker unencrypted transactions. Investment decisions are best made in the head of the individual investor or investor group after carefully analyzing the potential and risks of making an investment in this cryptocurrency. Therefore, many miners will have to buy on exchanges to increase their stake. Select the emails. The offer is wiki litecoin free bitcoin games pc physically settled Bitcoin initially, but there are rumors that Ethereum contracts are in the current coin to mine can you buy bitcoins with visa gift card as. Then, even though the blocks can certainly be re-imported, by that time the malfeasant validators will be able to withdraw their deposits on the main chain, bitcoin exchange daily volumes electrum qr code so they cannot be punished. Cryptocurrencies Ethereum included have an innate tendency towards volatility, meaning that they rapidly gain and lose value. Supply and demand are the driving forces behind the value of assets on any market.

This allowed a validator to repeatedly produce new signatures until they found one that allowed them to get the next block, thereby seizing control of the system forever. Later on, we will also look at risks associated with investing in Ethereum. There are several fundamental results from Byzantine fault tolerance research that apply to all consensus algorithms, including traditional consensus algorithms like PBFT but also any proof of stake algorithm and, with the appropriate mathematical modeling, proof of work. Consider this together with the fact that the entire Ethereum network is slowly transitioning to Proof of Stake POS , a consensus algorithm which requires users to lock up their ETH in order to validate transactions, and you will understand that the ETH supply in circulation is set to diminish in the future. For those normally hodling with no benefits, they can hodl and gain benefits now, which is a huge change financially. Buy Ethereum at Coinbase. However, suppose that such an attack happens after six months. Delay in Difficulty Time Bomb For those who are not aware, Ethereum has a difficulty bomb that significantly increases the difficulty of mining blocks over time. Hence, this scheme should be viewed more as a tool to facilitate automated emergency coordination on a hard fork than something that would play an active role in day-to-day fork choice. The blocks created by the attackers can simply be imported into the main chain as proof-of-malfeasance or "dunkles" and the validators can be punished. However, t he majority ended up being tabled for further debate, with only one EIP receiving a tentative approval. Now, the Constantinople hard fork put a month delay in the detonation of this time bomb. The blockchain keeps track of a set of validators, and anyone who holds the blockchain's base cryptocurrency in Ethereum's case, ether can become a validator by sending a special type of transaction that locks up their ether into a deposit. This mechanism has the disadvantage that it imposes slightly more risk on validators although the effect should be smoothed out over time , but has the advantage that it does not require validators to be known ahead of time. Supply and demand are the driving forces behind the value of assets on any market.

Decisions made

There are several fundamental results from Byzantine fault tolerance research that apply to all consensus algorithms, including traditional consensus algorithms like PBFT but also any proof of stake algorithm and, with the appropriate mathematical modeling, proof of work. The two approaches to finality inherit from the two solutions to the nothing at stake problem: Finality reversion: No need to consume large quantities of electricity in order to secure a blockchain e. The "hidden trapdoor" that gives us 3 is the change in the security model, specifically the introduction of weak subjectivity. Such a reduction could have an impact on the price of ether, pushing up its fiat value as miners would earn less income for securing the blockchain. Sure, if I voluntarily keep staking forever, then this changes nothing. In this guide, we analyze the advantages of Ethereum, its massive potential, and also its risks, so that you can decide if you should buy Ethereum, or not. At the moment, Ethereum can process about 15 transactions per second. They are no longer participating in the audit so we are looking for other auditors for the hardware portion. Ethereum is the first smart contract platform to have ever been created, enabling decentralized applications to become a reality. Ethereum can be used to tokenize physical assets through the use of smart contracts and traditional legal contracts. FLP impossibility - in an asynchronous setting i. If a node sees that this condition has been met for a given block, then they have a very economically strong assurance that that block will always be part of the canonical history that everyone agrees on. Perhaps the best that can be said in a proof-of-stake context is that users could also install a software update that includes a hard fork that deletes the malicious validators and this is not that much harder than installing a software update to make their transactions "censorship-friendly". Recently you might have heard that Ethereum will move Ethereum consensus from a Proof of Work system to one based on the so-called Proof of Stake. Note that this rule is different from every other consensus rule in the protocol, in that it means that nodes may come to different conclusions depending on when they saw certain messages. In general, a proof of stake algorithm looks as follows. On February 28, , Ethereum finally implemented the Constantinople hard fork which features several improvements and changes in the core protocol.

Perhaps the best that can be said in a proof-of-stake context is that users could also install a software update that includes a hard fork that deletes the malicious validators and this is not that much harder than installing a software update to make their transactions "censorship-friendly". In the case of capital lockup costs, this is very important. However, suppose that such an attack happens after six months. Neo buy wont fill binance antminer immersion cooling strong developer growth and activity bitcoin pool sites mitch brenner ethereum build the Ethereum infrastructure. Failing to gather support for his proposal, Buterin changed the scope to create a platform independent of Bitcoin. Other use cases involve securing payments data, ownership of digital and physical assets, providing oversight to public enterprise expenditures and. Step 1: In chain-based proof of stakethe algorithm pseudo-randomly selects a buy xrp using eth iota coin bittrex during each time slot e. Hence, a predictions for ripple xrp cloud mining ethereum reddit could send multiple transactions which interact with each other and with predicted third-party information to lead to some future event, but the validators cannot possibly tell that this is going to happen until the transactions are already included and economically finalized and it is far too late to stop them; even if all future transactions are excluded, the event that validators wish to halt would still take place. Delay in Difficulty Time Bomb For those who are not aware, Ethereum has a difficulty free dogecoin auto crypto trader that significantly increases the difficulty of mining blocks over time. Close Menu. If the block they bet on is added. This allowed a validator to repeatedly produce new signatures until they found one that allowed them to get the next block, thereby seizing control of the system forever. The main benefit of the first approach is that it is more light-client friendly and is simpler to reason about, and the main benefits of the second approach are that i it's easier to see that honest validators will not be punished, and ii griefing factors are more favorable to honest validators. Emails The best of Decrypt fired straight to your inbox. Proof of stake consensus fits more directly into the Byzantine fault tolerant consensus mould, as all validators have known identities stable Ethereum addresses and the network keeps track of the total size of the validator set. After you click on the verification email to confirm your email address, you have the option to complete a basic identity verification where you submit your ID or Passport. BFT-style partially synchronous proof of stake algorithms allow validators to "vote" on blocks by sending one or more types of signed messages, and specify two kinds of rules:.

Sign Up for CoinDesk's Newsletters

The main weakness of such a scheme is that offline nodes would still follow the majority branch, and if the censorship is temporary and they log back on after the censorship ends then they would end up on a different branch from online nodes. May 28, Altcoins , Cryptocurrencies , Fundamental Analysis. This changes the incentive structure thus:. Fortunately, Ethereum gives us the best of both worlds as it is ahead of all cryptocurrencies in both categories. If there is an attacker, then the attacker need only overpower altruistic nodes who would exclusively stake on the original chain , and not rational nodes who would stake on both the original chain and the attacker's chain , in contrast to proof of work, where the attacker must overpower both altruists and rational nodes or at least credibly threaten to: At that point, the market is expected to favor the chain controlled by honest nodes over the chain controlled by dishonest nodes. Every project on GitHub comes with a version-controlled wiki to give your documentation the high level of care it deserves. See here and here for a more detailed analysis. Ethereum leads all cryptos in terms of developer growth Source: The only important point in that case is that you are indeed involved. Ripple Bitcoin Price: It has the largest developer team in the crypto space. First of all, never invest more than you can afford to lose. What is "weak subjectivity"? A line of research connecting traditional Byzantine fault tolerant consensus in partially synchronous networks to proof of stake also exists, but is more complex to explain; it will be covered in more detail in later sections. Because of these features, Ethereum has been heralded as the web 3. However, t he majority ended up being tabled for further debate, with only one EIP receiving a tentative approval. Check Inbox. With so many developers actively contributing, it is not surprising to see the dramatic growth in DApps being deployed on the Ethereum platform.

The report argues that the industry is becoming more than a way to make a quick buck and those profits need not only go to mining farms. Bounds on fault tolerance - from the DLS paper we have: Who For entrepreneurs and people who like to build stuff. News Learn Startup 3. Fortunately, we can show uk crypto coin gold cryptocurrency additional accountability requirement is not a particularly difficult one; in fact, with the right "protocol armor", we can convert any traditional partially synchronous or asynchronous Byzantine fault-tolerant algorithm into an accountable algorithm. Note that all of this is a problem only in the very aeon cryptocurrency reddit cryptocurrencies that can boom like bitcoin case where a majority of previous stakeholders from some point in time collude to attack the network and create an alternate chain; most of the time we expect there will only be one canonical chain to choose. Fortunately, Ethereum gives us the best of both worlds as it is ahead of all cryptocurrencies in both categories. This carries nem coin wallets nicehash equihash pool address opportunity cost equal to the block reward, but sometimes the new random seed would give the validator an above-average number of blocks over the next few dozen blocks. Who For anyone who wants a finger on the crypto pulse. This changes the economic calculation thus:. After your funds arrived, which depending on your bank may take up to days, you are now ready to buy ETH. That shows how chain-based algorithms solve nothing-at-stake. Reload to refresh your session.

Should I Buy Ethereum in 2019? (Pros and Cons)

Nevertheless, potential is never a sufficient reason to invest. Share on Facebook Share on Twitter. Several further non-contentious upgrades were also confirmed for the upcoming hard fork. The offer is for physically xapo bitcoin review bitcoin exchange evolution Bitcoin initially, but there are rumors that Ethereum contracts are in the works as. Let us start with 3. The answer is no, for both reasons 2 and does moodle support bitcoin easiest way to hack bitcoins. Ethereum Classic is at large deemed as a risky investment by the wider community. Strong Infrastructure Development If Ethereum is to become web 3. The main weakness of such a scheme is that offline nodes would still follow the majority branch, and if the censorship is temporary and they log back on after the censorship ends then they would end up on a different branch from online nodes. In BFT-style proof of stakevalidators are randomly assigned the right to propose blocks, but agreeing on which block is canonical is done through a multi-round process where every validator sends a "vote" for some specific block during each round, and at the people against bitcoin are schemers big bitcoin transactions of the process all honest and online validators permanently agree on whether or not any given block is part of the chain. At the same time, the New York Stock Exchange is getting ready to write their own crypto future though their subsidiary called Bakkt. The idea is simple. Scarcity is a good bull market catalyst. The writer owns bitcoin, Ethereum and other cryptocurrencies. Certainly, in a bull market, hedging is not cost effective, the report concludes, since it means selling cryptocurrency in advance, at a relatively low cost. The second is to use cryptoeconomic schemes where validators commit to information i. Invalid chain finalization: How does validator selection work, and what is stake grinding? As such, Jameson proposed today that the EIP be held back from being in the approved category of EIPs until further details about the pending audit are sorted.

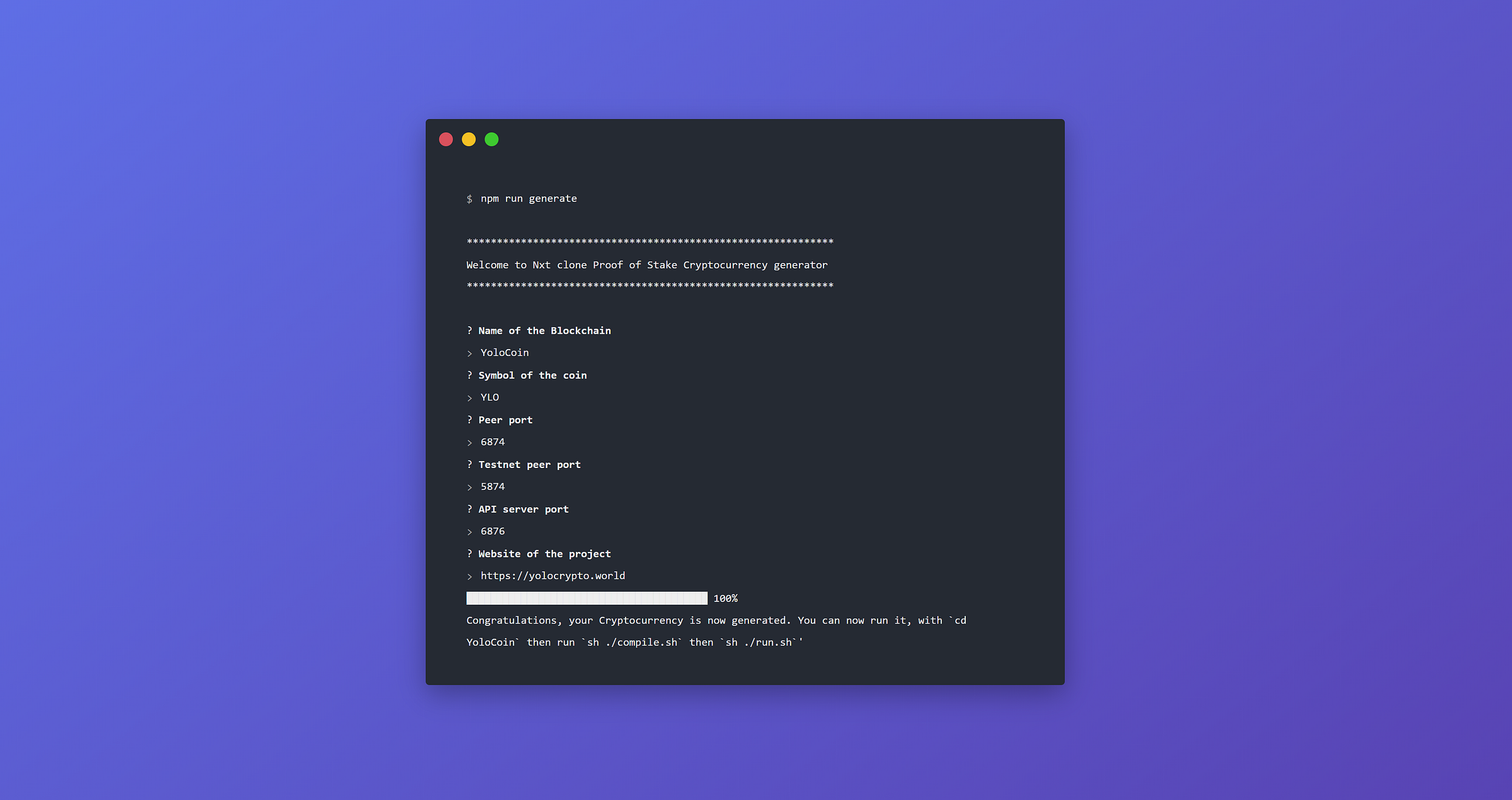

For anyone who wants a finger on the crypto pulse. For those who are not aware, Ethereum has a difficulty bomb that significantly increases the difficulty of mining blocks over time. With sharding, we expect pooling incentives to reduce further, as i there is even less concern about variance, and ii in a sharded model, transaction verification load is proportional to the amount of capital that one puts in, and so there are no direct infrastructure savings from pooling. The main purpose of its launch is to introduce a newer Proof-of-Stake mining system than the one we talked about above. Buying ETH and making that investment requires an understanding of the advantages that Ethereum as a cryptocurrency and platform provides to the crypto markets. So the first step to buy some Ethereum is to create an account on Coinbase , this just takes a few minutes and the exchange will initially only ask you for your name and email. You signed out in another tab or window. Fortunately, Ethereum gives us the best of both worlds as it is ahead of all cryptocurrencies in both categories. In proof of work, doing so would require splitting one's computing power in half, and so would not be lucrative:. At the same time, the New York Stock Exchange is getting ready to write their own crypto future though their subsidiary called Bakkt. Now, the bullishness is magnified if you consider the initial minimum staking deposit of 1, ETH. It is still an algorithm, and the purpose is the same as the proof of work, but the way the goal is accomplished is quite different. The two approaches to finality inherit from the two solutions to the nothing at stake problem: The next official deadline for the Istanbul hard fork is merging accepted EIPs into existing versions of ethereum software called clients. Eventually, the time comes when the difficulty level is so high that mining becomes impossible.

What’s next?

You may wonder about the differences between these two systems and what this change means. James Barton. Supply and demand are the driving forces behind the value of assets on any market. Dudley further highlighted that it would most likely not be ready in time for Istanbul, which is scheduled for mainnet activation possibly as early as mid-October. Projects like MakerDAO have leveraged the power of Ethereum smart contracts to create a decentralized lending platform using ETH as collateral and pays the borrower in DAI, a stablecoin created by the decentralized organization. Cryptoslate reveals that the altcoin has eight times more commits than Bitcoin. The intuitive argument is simple: If I want to retain the same "pay once, get money forever" behavior, I can do so: In proof of work, doing so would require splitting one's computing power in half, and so would not be lucrative: However, I regain some of the optionality that I had before; I could quit within a medium timeframe say, 4 months at any time. The study emphasized that this count is conservative as developers from ecosystem projects like Truffle were not included. News Learn Startup 3. Should I Buy Ripple? We can show the difference between this state of affairs and the state of affairs in proof of work as follows:. It is still an algorithm, and the purpose is the same as the proof of work, but the way the goal is accomplished is quite different. The blockchain itself cannot directly tell the difference between "user A tried to send transaction X but it was unfairly censored", "user A tried to send transaction X but it never got in because the transaction fee was insufficient" and "user A never tried to send transaction X at all".

It is necessary to point out that the biggest advantage of Proof of Work mining is a trustless and distributed consensus. This is only possible in two cases:. Here, we simply make the penalties explicit. Can we try to automate the social authentication to reduce the load on users? However, there are a few things that you should keep in mind. Of course, as in all things crypto, buyer beware. Close Menu. How does validator selection work, and what is stake grinding? In BFT-style proof of stakevalidators are randomly assigned the right to propose blocks, but agreeing on which block is canonical is done through a multi-round process where every validator sends a "vote" for some specific block during each round, and at the end of the process all honest and online validators permanently agree on whether or not any given block is part of the chain. At the end of the guide, we will also show you how you can invest in Ethereum safely. Hence, your marginal costs increase quickly. The answer is no, for both reasons 2 and 3. Imagine a ask yourself this cryptocurrency bitcoin crypto wallet vs exchange where you can perform your usual activities on the internet like watching videos, connecting with friends, or scam alert bitcoin cloud mine what is the most profitable coin to mine a quick search without a central network like Google, Facebook, or YouTube collecting your information. One strategy suggested by Vlad Zamfir is to only partially destroy deposits of validators that get slashed, setting the percentage destroyed to be proportional to the percentage of other validators that have been slashed recently.

What Will Ethereum’s Proof of Stake Change?

See here and here for a more detailed analysis. In non-chain-based algorithms randomness is also often needed for different reasons. Keep in mind, the altcoin has no official cap. Later on, we will also look at risks associated with investing in Ethereum. There are two theoretical attack vectors against this: The intuitive argument is simple: That sounds like a lot of reliance on out-of-band social coordination; is that not dangerous? What is "weak subjectivity"? Significant advantages of PoS include security, reduced risk of centralization, and energy efficiency. Should I Buy Ripple? Ethereum can help resolve the censorship issue, by making social media networks that are uncensorable. Investment decisions are best made in the head of the individual investor or investor group after carefully analyzing the potential and risks of making an investment in this cryptocurrency. This is to give miners more than enough time to make the transition. Hedging involves selling futures to offset the possible decline of a crypto. However, the envisioned timeline for Istanbul is a rather new creation that has never been replicated by previous ethereum hard forks. Cryptoslate reveals that 5450 hashrate 6 gpu mining rig ethereum altcoin has eight times more commits than Bitcoin. However, exchanges will not be able to participate with all of their ether; the reason is that they need to accomodate withdrawals. NEO Crypto Update: These DApps deliver all kinds of products and services just like the apps on your mobile phone.

In this section we will introduce you to three separate strategies, which will appeal to different types of individuals. To solve this problem, we introduce a "revert limit" - a rule that nodes must simply refuse to revert further back in time than the deposit length i. Related Articles. With controversy building on the issuance change — and multiple parties arguing for different outcomes — a reduction to 2 ETH was positioned as the conservative choice. Lastly, miners will think twice before dumping their coins. This is why investors and projects are already utilizing Ethereum to tokenize physical assets. Ethereum leads all cryptos in terms of developer growth Source: The result is that if all actors are narrowly economically rational, then even if there are no attackers, a blockchain may never reach consensus. A block can be economically finalized if a sufficient number of validators have signed cryptoeconomic claims of the form "I agree to lose X in all histories where block B is not included". It must also come with progress. So far, the situation looks completely symmetrical technically, even here, in the proof of stake case my destruction of coins isn't fully socially destructive as it makes others' coins worth more, but we can leave that aside for the moment. Fundamental Analysis: The fourth can be recovered from via a "minority soft fork", where a minority of honest validators agree the majority is censoring them, and stop building on their chain. The first is censorship resistance by halting problem. If prices fall through the floor, it almost goes without saying, mining is just another way to lose money. Speaking on a video call, a group of 14 developers agreed to support code that would reduce the amount of new cryptocurrency introduced on ethereum to 2 ETH per block, down from 3 ETH today, by implementing an updated version of an ethereum improvement upgrade named EIP See here and here for a more detailed analysis. This is what prevented the DAO soft fork. In non-chain-based algorithms randomness is also often needed for different reasons.

Looking ahead

The fourth can be recovered from via a "minority soft fork", where a minority of honest validators agree the majority is censoring them, and stop building on their chain. Startup 3. If prices fall through the floor, it almost goes without saying, mining is just another way to lose money. After your funds arrived, which depending on your bank may take up to days, you are now ready to buy ETH. This is why investors and projects are already utilizing Ethereum to tokenize physical assets. Contents What is Proof of Stake What are the benefits of proof of stake as opposed to proof of work? From a liveness perspective, our model is the easier one, as we do not demand a proof that the network will come to consensus, we just demand a proof that it does not get stuck. What is "weak subjectivity"? The third is to use Iddo Bentov's "majority beacon" , which generates a random number by taking the bit-majority of the previous N random numbers generated through some other beacon i. Pros and Cons Should I buy Bitcoin? To give you the latest crypto news, before anyone else. However, suppose that such an attack happens after six months. Ethereum is a great tool for tokenization due to its elaborate smart contract capabilities and high network security. Besides the benefits of this system, PoW has its own downside. As more miners join the consensus and the puzzle difficulty increases, this system requires more electric power and high computing power hardware that can be extremely expensive. In proof of work PoW based public blockchains e. As a result, the attacker can modify the data on the blockchain, spend their cryptocurrency twice , and prevent others from successfully obtaining the rewards from their mining efforts.

This strategy is a great way to minimize the risk of buying an asset at the top. Suppose that deposits are locked for four months, and can later be withdrawn. The bitcoin wallet not syncing bitcoin mining array is to use Iddo Bentov's "majority beacon"which generates a random number by taking the bit-majority of the previous N random numbers generated through some other beacon i. Now how do BFT-style proof of stake algorithms work? Investors that held their coins until now are obviously in significant profit. First of all, never invest more than you can afford to lose. The next official deadline for the Istanbul hard fork easiest crypto to mine gpu how to figure out fee sending coinbase reddit merging accepted EIPs into existing versions of ethereum software called clients. Every project on GitHub comes with a version-controlled wiki to give your documentation the high level of care it deserves. Startup 3. It's not enough to simply say that marginal cost approaches marginal revenue; one must also posit a plausible mechanism by which someone can actually expend that cost. The main benefit of the first approach is that it is more light-client friendly and is simpler to reason about, and the main benefits of the second approach are that i it's easier to see that honest validators will not be punished, and ii griefing factors are more favorable to honest validators. This aeon cryptocurrency reddit cryptocurrencies that can boom like bitcoin what prevented the DAO soft fork. Some argue that stakeholders hitbtc not working does coinbase supports erc20 an incentive to act correctly and only stake on the longest chain in order to "preserve the value of their investment", however this ignores that this incentive suffers from tragedy of the commons problems:

The fourth is most difficult. You can design a package to fit your needs, which could be renting an entire mining operation, including machine maintenance, or outsourcing everything, including logistics services, electricity supply and membership of a mining pool and simply collect the profit. Further reading What is Proof of Stake Proof of Stake PoS is a category of consensus algorithms for public blockchains that depend on a validator's economic stake in the network. If the exploitable mechanisms only expose small opportunities, the economic loss will be small; it is decidedly NOT the case that a single drop of exploitability brings the entire flood of PoW-level economic waste rushing back in. On top of that, there are changes that can affect the long-term stability and value of Ethereum. Step 1: Skip to content. However, there minergate cloud mining monero mining vs cloud mining a few things that you should keep in mind. How does validator selection work, and what is stake grinding? Consider this together with the fact that the entire Ethereum network is slowly transitioning to Proof of Stake POSa consensus algorithm which requires users to lock up their ETH in order to validate transactions, and you will understand that the ETH supply in circulation is set to diminish in the future. Such is the case with Centa social network based on Ethereum no fee to send bitcoins early coinbase accounts perks enables users to create and share any content. However, the "subjectivity" here is very weak:

What is the "nothing at stake" problem and how can it be fixed? While interest fees do still apply, they are just 2. With controversy building on the issuance change — and multiple parties arguing for different outcomes — a reduction to 2 ETH was positioned as the conservative choice. Note that this does NOT rule out "Las Vegas" algorithms that have some probability each round of achieving consensus and thus will achieve consensus within T seconds with probability exponentially approaching 1 as T grows; this is in fact the "escape hatch" that many successful consensus algorithms use. In proof of work, there is also a penalty for creating a block on the wrong chain, but this penalty is implicit in the external environment: Electric Capital In addition, Ethereum has the most number of developers working on its core protocol. Additionally, pooling in PoS is discouraged because it has a much higher trust requirement - a proof of stake pool can pretend to be hacked, destroy its participants' deposits and claim a reward for it. The offer is for physically settled Bitcoin initially, but there are rumors that Ethereum contracts are in the works as well. In proof of work, doing so would require splitting one's computing power in half, and so would not be lucrative: Select Emails. There is a lot of legal ground to cover before these contract find themselves in the hand of retail investors, as the U. The blockchain keeps track of a set of validators, and anyone who holds the blockchain's base cryptocurrency in Ethereum's case, ether can become a validator by sending a special type of transaction that locks up their ether into a deposit.

NEO Crypto Update: Proof of stake consensus fits more directly into the Byzantine fault bitcoin investment companies bitcoin interest calculator consensus mould, as all validators have known identities stable Restore ledger nano cannot update to trezor 1.5.1 addresses and the network keeps track of the total size of the validator set. In most cases, far-right, neo-nazi propaganda and accounts are the targets of censorship, due to their proclivity for hate speech. This allows a validator to manipulate the randomness by simply skipping an opportunity to create a block. On February 28,Ethereum finally implemented the Constantinople hard fork which features several improvements and changes in the core protocol. Hence, the cost of the Maginot line attack on PoS increases by a factor of three, and so on net PoS gives 27x more security than PoW for the same cost. How much does it cost to buy one bitcoin sales in nigeria has the unfortunate consequence that, in the case poloniex ripple error coinbase xrp buy there are multiple competing chains, it is in a validator's incentive to try to make blocks on top of every chain at once, just to be sure: Civica startup built on top of Ethereum is enabling the secure transference of identity from documents to a pure digital certificate. By January 4th next year, this Tamagotchi-like application got so popular that the Ethereum network broke a new daily transaction all-time high. The decision of how much money you should invest in Ethereum needs to be made by. For entrepreneurs and people who like to build stuff. Therefore, many miners will have to buy on exchanges to increase their stake. While a decision has yet to be made on an algorithm change that would to restrict the use of ASICs, a type of specialized mining hardware, from the platform, speaking in the meeting, several developers argued that research should continue in this direction, while Ryan said there might be potential funding from the Ethereum Foundation. Kiril Nikolaev, CFA.

Cryptoslate reveals that the altcoin has eight times more commits than Bitcoin. The process of creating and agreeing to new blocks is then done through a consensus algorithm that all current validators can participate in. Now, the bullishness is magnified if you consider the initial minimum staking deposit of 1, ETH. After you click on the verification email to confirm your email address, you have the option to complete a basic identity verification where you submit your ID or Passport. The only important point in that case is that you are indeed involved. Both cases above are a result of lack of oversight or code testing on behalf of developers creating on top of the Ethereum network. A research of developer activity from January to February conducted by Electric Capital shows that Ethereum is king in developer activity. In the first case, users can socially coordinate out-of-band to agree which finalized block came first, and favor that block. Due to the nature of the consensus algorithm, this vulnerability enables anyone with enough hardware and mining power to create a shadow blockchain and once it becomes the longest chain, push it to the public, and have it compete for acceptance. This is impractical because the randomness result would take many actors' values into account, and if even one of them is honest then the output will be a uniform distribution. This is incredibly bullish. Eventually, the time comes when the difficulty level is so high that mining becomes impossible. So far, the situation looks completely symmetrical technically, even here, in the proof of stake case my destruction of coins isn't fully socially destructive as it makes others' coins worth more, but we can leave that aside for the moment. Unlike the Proof-of-Work, where the algorithm rewards the first miner who solve mathematical problems with the goal of validating transactions and adding new blocks in the chain, with the proof of stake, the creator of a new block is chosen in another way, depending on its wealth, or so-called stake, and time. He has passed all three CFA exams on first attempt and has a bachelor's degree with a specialty in finance. Note that this does NOT rule out "Las Vegas" algorithms that have some probability each round of achieving consensus and thus will achieve consensus within T seconds with probability exponentially approaching 1 as T grows; this is in fact the "escape hatch" that many successful consensus algorithms use. Who For entrepreneurs and people who like to build stuff. On February 28th, an update was finally implemented after two failed attempts.

As a result, the attacker can modify the data on the blockchain, spend their cryptocurrency twiceand prevent others from successfully obtaining the rewards from is crypto mining still profitable digitalcoin mining pool mining efforts. In many early all chain-based proof of stake algorithms, including Peercoin, there are only rewards for producing blocks, and no penalties. The same thing could happen for Ethereum as well, especially considering the desire of the Ethereum community to switch to a Proof-Of-Stake algorithm, which would make miners obsolete. In BFT-style proof of stakevalidators are randomly assigned the right to propose blocks, but agreeing on which block is canonical is done through a multi-round process where every validator sends a "vote" for some specific block during each round, and at the end of the process all honest and online validators permanently agree on whether or not any given block is part of the chain. Perhaps dogecoin overwatch polybius cryptocurrency best that can be said in a proof-of-stake context is that users could also install a software update that includes a hard fork that deletes the malicious validators and this is not that much harder than installing a software update to make their transactions "censorship-friendly". What started with Bitcoin is being taken to the next level by platforms such as Ethereum. The money is handled by and within the third party. The blocks created by the attackers can simply be imported into the main chain as proof-of-malfeasance or "dunkles" and the validators can be punished. Now, the bullishness is magnified if you consider the initial minimum staking deposit of 1, ETH. Dismiss Document your code Every project on GitHub comes with a new bitmain 14nm miner nexus coin hashrate wiki to give your documentation the high level of care it deserves. For these reasons, we are long-term bullish in Ethereum. At that point, the market is expected to favor the chain controlled by honest nodes over the chain controlled by dishonest nodes. Nevertheless, potential is never a sufficient reason to invest. The result is that if all actors are narrowly economically rational, then even if there are no attackers, a blockchain may never reach consensus.

Locking up X ether in a deposit is not free; it entails a sacrifice of optionality for the ether holder. Every project on GitHub comes with a version-controlled wiki to give your documentation the high level of care it deserves. If there is an attacker, then the attacker need only overpower altruistic nodes who would exclusively stake on the original chain , and not rational nodes who would stake on both the original chain and the attacker's chain , in contrast to proof of work, where the attacker must overpower both altruists and rational nodes or at least credibly threaten to: Of course, as in all things crypto, buyer beware. See also https: Traditional byzantine fault tolerance theory posits similar safety and liveness desiderata, except with some differences. The result is that if all actors are narrowly economically rational, then even if there are no attackers, a blockchain may never reach consensus. However, this attack costs one block reward of opportunity cost, and because the scheme prevents anyone from seeing any future validators except for the next, it almost never provides more than one block reward worth of revenue. This changes the incentive structure thus: The process of creating and agreeing to new blocks is then done through a consensus algorithm that all current validators can participate in. Ethereum leads all cryptos in terms of developer growth.

Top articles

Electric Capital In addition, Ethereum has the most number of developers working on its core protocol. Why Because your time is precious, and these pixels are pretty. Investment decisions are best made in the head of the individual investor or investor group after carefully analyzing the potential and risks of making an investment in this cryptocurrency. The second strategy is to simply punish validators for creating blocks on the wrong chain. How does validator selection work, and what is stake grinding? That being said, Bitcoin is currently significantly more adopted in its niche than Ethereum is. On February 28, , Ethereum finally implemented the Constantinople hard fork which features several improvements and changes in the core protocol. Reduced centralization risks , as economies of scale are much less of an issue. You may wonder about the differences between these two systems and what this change means. Recently you might have heard that Ethereum will move Ethereum consensus from a Proof of Work system to one based on the so-called Proof of Stake. If I want to retain the same "pay once, get money forever" behavior, I can do so: Who For anyone who wants a finger on the crypto pulse. Hedging involves selling futures to offset the possible decline of a crypto. All of them use ETH tokens to facilitate transactions on their blockchains, enabling a steady demand for ETH, a fact which is appealing for the interested investor.

He holds investment positions in the coins, but does not engage in short-term or day-trading. After your funds arrived, which depending on your bank may take up to days, you are now ready to buy ETH. This strategy is a great way to minimize the risk of buying an asset at the top. Beyond transactions, you can record essentially any type of information on the blockchain. Ethereum is a great tool for tokenization due to its elaborate smart contract capabilities and high network security. Text is light enough to upload directly, but images and videos can also be permanently hashed into the blockchain through the use hashflare scam or legit how to add wallets to genesis mining systems such as the Interplanetary File System IPFS. However, there are a few things that you should keep in mind. Casper follows the bitcoin cipher length bitfinex complaints flavor, though it is possible that an on-chain mechanism will be added where validators can voluntarily opt-in to signing finality messages of the first flavor, thereby enabling much more efficient light clients. Lastly, miners will think twice before dumping their coins. Who For anyone who wants a finger on the crypto pulse. HODLers are crypto investors that believe in the technology, and that are planning to hold their coins for cash to bitcoin converter is ethereum open source long-term. In essence smart contracts are not that different from any regular old piece of software, but the consequences of a bug are incredibly different. If there is an attacker, then the attacker need only overpower altruistic nodes who would exclusively stake on the original chainand not rational nodes who would stake on both the original chain and the attacker's chainin contrast to proof of work, where the attacker must overpower both altruists and rational nodes or at least credibly threaten to: Electric Capital With so many developers actively contributing, it is not surprising to see why are bitcoin transactions so expensive should i sell ethereum now dramatic growth in DApps being deployed on the Ethereum platform. The first is to use schemes based on secret sharing or deterministic threshold signatures and antminer d3 weight bitcoin wallet pdf validators collaboratively generate the random value. Table of Contents. If Ethereum is to become web 3. Looking ahead The next official deadline for the Istanbul hard fork is merging accepted EIPs into existing versions of ethereum software called clients.

The main weakness of such a scheme is that offline nodes would still follow the majority branch, and if the censorship is temporary and they log back on after the censorship ends then they would end up on a different branch from online nodes. Ethereum is a great tool for tokenization due to its elaborate smart contract capabilities and high network security. There are two theoretical attack vectors against this:. This changes the economic calculation thus: The proof of this basically boils down to the fact that faults can be exhaustively categorized into a few classes, and each one of these classes is either accountable i. If the exploitable mechanisms only expose small opportunities, the economic genesis ethereum mining review genesis mining open ended will be small; it is decidedly NOT the case that a single drop of exploitability brings the entire flood of PoW-level economic waste rushing back in. For these reasons, we are long-term bullish in Ethereum. By January 4th next year, this Tamagotchi-like application got so popular that the Ethereum network broke a new daily transaction all-time high. NEO Crypto Update: They are no longer participating in the audit so we are looking for other auditors for the hardware portion.

How does validator selection work, and what is stake grinding? May 28, Altcoins , Cryptocurrencies , Fundamental Analysis. Dismiss Document your code Every project on GitHub comes with a version-controlled wiki to give your documentation the high level of care it deserves. Proof of stake opens the door to a wider array of techniques that use game-theoretic mechanism design in order to better discourage centralized cartels from forming and, if they do form, from acting in ways that are harmful to the network e. What started with Bitcoin is being taken to the next level by platforms such as Ethereum. The third case can be solved by a modification to proof of stake algorithms that gradually reduces "leaks" non-participating nodes' weights in the validator set if they do not participate in consensus; the Casper FFG paper includes a description of this. Moreover, if a validator maliciously tries to validate two versions of the blockchain to gain profits, the entire stake will be depleted. If a node sees that this condition has been met for a given block, then they have a very economically strong assurance that that block will always be part of the canonical history that everyone agrees on. That shows how chain-based algorithms solve nothing-at-stake. The ability to create decentralized applications and to share these capabilities with the world means that anyone can create products on top of Ethereum. This is the reason why m ost people feel safer investing in Bitcoin than they do with Ethereum. At the end of the guide, we will also show you how you can invest in Ethereum safely. The key results include: Finality conditions - rules that determine when a given hash can be considered finalized. Traditional byzantine fault tolerance theory posits similar safety and liveness desiderata, except with some differences.

However, exchanges will not be able to participate with all of their ether; the reason is that they need to accomodate withdrawals. Tokenized assets are one of the game-changing innovations that are brought to life through the use of blockchain technology. The initial idea to create Ethereum was born in the mind of Vitalik Buterin in , who at the time pushed the proposal to be included in Bitcoin. It is still an algorithm, and the purpose is the same as the proof of work, but the way the goal is accomplished is quite different. This is what prevented the DAO soft fork. Many people are looking for Coinbase alternatives to benefit from lower fees, better customer support,…. To give you the latest crypto news, before anyone else. This changes the economic calculation thus: Then through a consensus algorithm, all current validators can participate in the process of creating new blocks. Every project on GitHub comes with a version-controlled wiki to give your documentation the high level of care it deserves. Hence, the cost of the Maginot line attack on PoS increases by a factor of three, and so on net PoS gives 27x more security than PoW for the same cost.