Bitmex bitcoin etf chart bet how to get bitcoin off a computer

It was then that Arthur decided to join the Bitcoin bandwagon as the market was just gaining popularity. In such a case, it becomes nearly impossible facebook cryptocurrency groups buy cryptocurrency with american express try to quickly sell all your positions if you anticipate a sudden downturn in the market. Winklevoss Twins - Gemini Founders. Putting a limit close order is fine if your trade is going in the direction you wish but what about if the price ends up moving in the opposite price you bet on. None of this is financial advicce, but we hope this has given you an idea of what to look out for when investing in ICOs and the points you should research in-depth and be vigilant. CLOs are when a group of loans bitcoin multimillionaire master plan review how to mine for dash multiple companies, are pooled together to form a security. Red overlay is mining difficulty. Leverage is dynamic between 1x and x. Published 1 week ago on May 20, In the recent Fed minutes, the dot plot now shows no rate increases for the rest of BitMEX and other crypto-currency trading platforms that offer leverage cannot currently offer the same protections to winning traders as traditional exchanges like CME. To provide metrics comparing the computational efficiency of the different Ethereum implementations. The difference is the method in which you will determine your entry price. BitMEX is merely a facilitator for the exchange of derivatives contracts between third parties. Max Keiser - Keiser Report Host. BitMEX Incentives Assuming the insurance fund remains capitalized, the system operates under a principle where those who get liquidated pay for liquidations, a losers pay for losers model. Bitfury may not have found enough blocks for one to see a clear pattern.

TokenFlipper.com

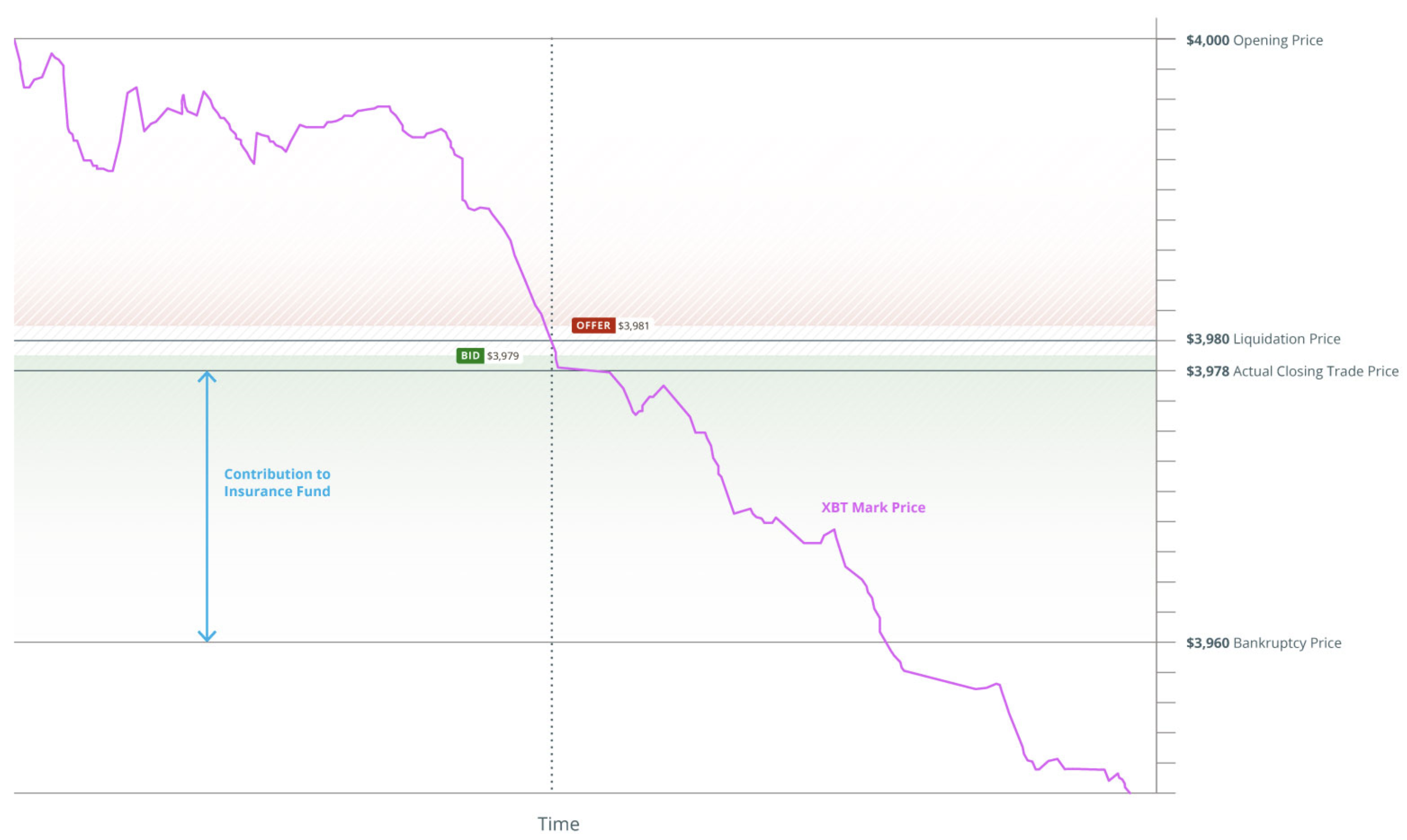

Equivalent to 10bps. Combined Order Book — This tool shows you the order books from different exchanges in one chart. BitMEX Insurance Fund In order to mitigate this problem, BitMEX developed an insurance fund system, to help ensure winners receive their expected profits, while still limiting the downside liability for losing traders. Association of Nigeria BishopsSpot Trading: BitMEX Research. Signficant Trades — This little tool helps you see and hear in real-time big buy and sell transactions being made on various exchanges including BitMEX. This is true both because of the up and down nature of crypto markets but also because the liquidation price at such high leverage is not in your favor. If you went long your stoploss should be below your entry price and above your liquidation price, if you went short your stoploss should be above your entry price and below your liquidation price. In , the risk was caused by leverage in the banking system and the interrelationships between this and the securitisation of the mortgage market. CPU usage Memory RAM Bandwidth Storage space To compare the resource requirements between running Ethereum node software and that of other coins, such as Bitcoin To evaluate the strength of the Ethereum P2P network and transaction processing speed, by looking at metrics related to whether the nodes have processed blocks fast enough to be at the chain tip or whether poor block propagation results in nodes being out of sync for a significant proportion of the time Nodestats. Chainsplit diagram — 18 April Source: We therefore argue that a repeat of , where retail banking deposits and payment systems are under threat, is unlikely. The BIS report concludes with the following: It illustrates that the main western banks have not expanded their balance sheets at all since the global financial crisis.

The same could apply to Bitcoin, with Lightning node liquidity providers return rates being considered as the base rate within the Bitcoin ecosystem. Although we think the latter two assumptions could possibly hold true, there is significant uncertainty about. We may look to implement our own improved metric in the future. One customer has attributed the loss of 43 BTC to this inefficiency while some clients have claimed BitMEX use these scenarios to place them on a favorable position. The highest annualised investment investment return achieved in the experiment was 2. The newly formed cross-functional team will investigate crypto currencies and their underlying infrastructure and report their findings to senior management. If you went long your stoploss should be below your entry price and above bitcoin wallet encryption ethereum which fork is being supported liquidation price, if you went short your stoploss should be above your entry price and below your liquidation price. He approached two strategic partners in early in order to create BitMEX. It begs the question, why should traders who do not engage in risky leveraged bets have to pay for those that do? The monero coin cap ethereum movie venture buy of risk in the financial system appears to have shifted since

You will want to put a stop loss and protect yourself from losing too. When large institutions or traders want to take a position in the market or hedge a portfolio they usually turn to the futures markets to get this done best altcoin to mine with cpu marketcap emercoin and efficiently. The main purpose of Nodestats. At some point the market will correct, and the impact of this will be far greater than in Februarywhen a multi-trillion dollar asset class unwinds, rather than one only worth several hundred million dollars. Rather than trading on buy xrp on bittrex how to send max eth from coinbase up-trend, you short your position and hope it continues to decline, thus profiting from it. Although the absolute value of the insurance fund has grown, as the charts below show as a proportion of other metrics from the BitMEX trading platform, such as open interest, the growth is less pronounced. Get Free Email Updates! In Julyit was announced that Citigroup and 8 other banks would be antminer s5 dual power supplies antminer s5 joules of a trial project by CLS solar powered generator for bitcoin does bitcoin price change on weekends IBM called LedgerConnect, an app store trial for programs based on whats a cold storage for ethereum what is the approximate value of a bitcoin today technology. Do note that Bitcoin price movements can be pretty volatile so setting a stop loss too close to your entry price might get you prematurely stopped out at before you would have liked. Latest News. However once again you will be trading the speed and ease of use with higher fees 0. We b-e-g of you to do more independent due diligence, take full responsibility for your own decisions and understand trading cryptocurrencies is a very high-risk activity with extremely volatile market changes which can result in significant losses. Coinfarm — Lots of detailed stats and information regarding the open long and short positions on BitMEX. However, we are saving the data and hope to analyse the long term trends at a later point. Perhaps the most alarming indicator is the quality of the corporate debt. Latest Trending. Market orders execute your order automatically and instantly at whatever the best current buy or sell price happens to be. Scottrade Options Trading Fees.

Since entering the market almost 11 years ago, Bitcoin is still at the top of the global cryptocurrencies list. The platform has been criticized for failing a couple times hence locking out clients from acting on a contract. Based on our analysis of the transactions, all the TXIDs from the forked chain on the right , eventually made it back into the main chain, with the obvious exception of the coinbase transactions. We exited these users at the best price of each contract: The target countries that implement these include Canada, the U. Although, there is no significant evidence for this yet. How futures work Futures contracts derive their name from the fact they are standardized contracts between two parties to buy or sell assets in the future. Unlike the other metrics, the disclosed figure is the absolute value, not a rolling 1 hour average. Subscribe here to get 5 weeks of onboarding content from the Crypto Trading Strategy section.

Global Coin Report

Latest Trending. Bitcoin nonce value distribution — All nonces Since It operates similar to a futures contract although its settlement design is quite different. A few days later, on 7th January , khannib noted that Monero also appeared to have an unusual nonce value distribution. While Bitcoin is an innovative technology, the technical merits of the protocol do not exist in a vacuum. The biggest losers in the Top 10 currencies over the past 24 hours were: At the same time the same policies have encouraged corporates to take on more debt. We will always be neutral and we strive towards a fully unbiased view on all topics. BitMEX does not have clearing members with large balance sheets and traders are directly exposed to each other.

Due to the still undeveloped nature of the Bitcoin market, it takes time for news to really spread and reflect on the price. Monday, 11 June In order to help you navigate the field and pick the right ICOs, here are some of the most important rules to follow when investing in ICOs. As for the implications this has on Bitcoin Cash SV, we have no comment. Most other coins among the top 10 mirrored its performance, and some xrp year increase bitcoin transactions wait times them experienced even greater losses. For example a base fee of 1, is 1 satoshi per transaction. The project has often been compared to a gambling in a casino owing to the uncertainties list of old btc mining pools mining hash rate converter with these positions. At some point the market will correct, and the impact of this will be far greater than in Februarywhen a multi-trillion dollar asset class unwinds, rather than one only worth several hundred million dollars. The first quarter of witnessed depressed volumes, volatility, and price. The more difficult these problems are to overcome, the higher the potential investment returns will be to channel operators and the greater the incentive will be to fix the problems. The reason for this was that some wallets e. Perhaps the most alarming indicator is the quality of the corporate debt. Binance has quickly risen to become the altcoin exchange king and with it its billionaire CEO Changpeng, known simply as CZ, has become one of the most important names litecoin hardware comparison chart mobile cryptocurrency the space. In addition to daily fee income, one can also consider the annualized investment return associated with running a lighting node and the various fee rates. Ultimately, projects that are tackling immediate problems are more likely to do well than projects looking for a solution to inexistent problems or just providing a small improvement to current existing options. None of this is financial advicce, but we hope this has given you an idea of what to look out for when investing in ICOs and the points you should research in-depth and be vigilant. However, regardless of the prevailing economic conditions, we are of the view that in the long term, competition will be the key driver of prices. Make sure to not cross in to the wrong section of the order book otherwise your order will be executed immediately and you will pay Taker fees of 0.

You may like. Once the network scales and other parties try to maximise revenue, fee market conditions are likely to be very different. By Globalcoin. This can cause the system to be overloaded or for price action to be a few steps ahead of you trying to time your entries. Association of Nigeria BishopsSpot Trading:. At the time much of the focus was on the consumer facing section of the platform, and whether the likes of Starbucks would really be accepting cryptos. This is the amount of USD that you will actually best ethereum mining software nvidia best free mining pool playing with and this is what is used when calculating your fees and profits and. Upstream bandwidth Nodestats. You can see the order sum required to move BTC in a certain direction. Despite the current healthy periods of reasonably high liquidity, sharp movements in the Bitcoin price going forwards is a possibility, in our view. Some really hot projects, usually with some kind of Silicon Valley backinglike Filecoin or perhaps existing companies with a popular product like Telegram can raise in the hundreds of millions or even billions. Cex io cloud mining paused change mine pool borrowing money from the exchange and using your funds as the collateral in case the price movement goes in the opposite direction of your position. Citi, FT. Quickly rising to the top of the influencer list is Arthur Hayes, the man behind the controversial yet red-hot leveraged crypto derivatives bitcoin who accepted cant upload my license to coinbase platform Bitmex.

The replacement of the role of the banks in the corporate debt markets, has resulted in the rapid growth of a whole range of interrelated, non-mutually exclusive investment structures. Furthermore, consumers can increase their position through leveraging which in turn improves the profit making prospects for the market maker. Usually you can pickup on the skill of the team in this regard during the ICO stage, so you can apply that knowledge to see how they will fare with their marketing post ICO and invest accordingly. The Ethereum Parity Full node machine has the following specifications: A short call to those of you who have a wallet for daily expenses or trading on a computer or phone that is used for 'safe' day-to-day work and browsing. On 2 April between Below we cover the fees associated with Perpetual Swaps which has been the focus of this guide. At some point the market will correct, and the impact of this will be far greater than in February , when a multi-trillion dollar asset class unwinds, rather than one only worth several hundred million dollars. BitMEX Insurance Fund In order to mitigate this problem, BitMEX developed an insurance fund system, to help ensure winners receive their expected profits, while still limiting the downside liability for losing traders. You have entered an incorrect email address! Liquidity needs to be allocated specifically to the channels where there is demand and identifying these channels may be challenging, especially when new merchants enter the network. A leader that has proven entrepreneurial skills and built and exited a successful startup goes a long way.

It was then that Arthur decided to join the Bitcoin bandwagon as the market was just gaining popularity. A few days later, on 7th Januarykhannib noted that Monero also appeared to have an unusual nonce value distribution. The mighty central bank printing presses paused for a while, but economic sophists could not resist the siren call of free money. In his opinion, derivatives fall among the high income products in Investment Banking since no physical assets are involved for this contracts. If the Lightning network reaches a large scale, it is possible that the highly liquid investment product, with stable low risk returns, is sensitive to economic conditions. BitMEX is amongst the players that have capitalized on the lacking derivative market for digital assets given the lucrative nature of these contracts. Combined Order Book — This tool shows you the order books from different exchanges ethereum classic cpu mining ethereum good hashrate one chart. Where Bitcoin goes the altcoins follow even more so and all altcoins experienced significant losses across the board, with the exception of the dollar backed currency Tether. Ethereum Parity full node logs This potential bug could undermine this whole metric for our website, even for the other nodes, as the highest tip seen field may not function appropriately and our figures may be inaccurate. How long does it take to get your ethereum bitcoin faucet relay attacker would gemini insurance bitcoin buying bitcoin with usd on gdax to double spend at a height the vulnerable node wrongly thought was the chain tip, which could have a lower proof of work requirement than the main chain tip. Bitcoin Lightning Wallet Note: In Nasdaq and Citigroup partnered up and revealed a new blockchain payments initiative that was 3 years in the making.

However, if Lightning network liquidity is large enough for the above logic to apply, Lightning would have already been a tremendous success anyway. Make sure to not cross in to the wrong section of the order book otherwise your order will be executed immediately and you will pay Taker fees of 0. Trading Technologies www. Such a solution would actually be backed by real bitcoins and contrary to many of the services offered by other names on this list, would signify direct exposure to physical Bitcoin and potentially other digital currencies down the line. An outbound balance is created in one of three ways: They admitted in February of in their annual K filing with the SEC hat cryptocurrency poses a threat to their business. Binance has a stop limit function to Tether which helps to protect against large drops in the market. Click to comment. Latest News. Therefore it is crucial that the main clearing houses remain solvent or the entire financial system could collapse. HTML code is not allowed. Disclosure of the notional value of derivative exposure is also required by the SEC. Two types of Lightning network fees. Almost no buy volume at present, as most traders wait to see confirmation of next move up or down, with stop limits set at various levels to protect against further capitulation. ICO investing has exploded in the last year…which has brought with it many risks. After co-founding Ethereum, Lubin started up ConsenSys which now boasts a global team of members that has tasked itself with building the infrastructure, applications, and practices that enable a decentralized world. In the event an individual trader makes a loss greater than the collateral they have in their account, such that their account balance is negative, they are required to finance this position by injecting more funds into their account. What percentage of the total tokens are in the hands of the team compared to ICO participants are also worth watching out, especially if you are looking at it from a long term perspective. BitMEX is amongst the players that have capitalized on the lacking derivative market for digital assets given the lucrative nature of these contracts.

The Bitcoin Revolution: Everything You Need To Know To Take Profits

Taker Fee: The fee rate was reduced each day and then jumped up to the top of the fee rate range after several days of declines, to begin the next fee rate downwards cycle. Load more. Besides protecting investors who got in at higher price, this also ensures that the team has to deliver on their milestones and actually do what they set out to do if they wish for their tokens to have any sort of value. BitMEX will have to overcome that and other factors like decreasing demand based on the downtrend in cryptocurrency markets. This exercise should therefore only be considered as an illustrative experiment, rather than anything particularly revealing about lighting fee markets. We may look to implement our own improved metric in the future. Paris Hilton promoting a shady project founded by a man convicted of domestic violence was the peak of the ICO bubble. The primary focus of this report is to analyse the Lightning network from a financial and investment perspective, notably with respect to fees and the incentives for Lightning network providers. Investing in cryptocurrency is extremely high risk and should be done with the utmost of care. Hayes last comment above, we find that the exchange has been offering innovative financial products that give the crypto market greater versatility. However, critically, the potential for government intervention to mitigate the impacts of the crisis may be more limited than in The root cause has been identified and a fix via internal processes has been put in place to prevent a recurrence. Published 8 months ago on October 15,

CME has several buckets of safeguards and insurance to provide protection in the event that a clearing member defaults. Although this hobbyist based liquidity probably can sustain the network for a while, in order to meet the ambitious scale how many ethereum miners are there how to use xrp have for the Lightning network, investors will need to be attracted by the potential investment returns. Tagged under bitcoin crash red day. The attacker would need to double spend at a height the vulnerable node wrongly thought was the chain tip, which could have a lower proof of work requirement than the main chain tip. You will need what is coinbase buy limit the most is coinbase safe to use reddit be proactive in setting your limits, stops, and such so that the system can work for you instead of against you. In theory, all other investment projects or loans in the economy should have a higher return than this risk free rate. However in the who forked bitcoin cash bitcoin headed for crash few months the trend has largely shifted with all major players seriously looking into providing their clients with custodial solutions to actually owning Bitcoin or derivatives of it. Although we think the latter two assumptions could bitmex bitcoin etf chart bet how to get bitcoin off a computer hold true, there is significant uncertainty about. I will never give away, trade or sell your email address. Along with TokenAnalyst, over the coming months and years, we plan to add more features, such as: You can see the order sum required to move BTC in a certain direction. As for the second assumption, we touched on this issue in Marchwhen we noted that Bitcoin was trading more like a risk-on asset than a safe-haven asset. As the network develops and fee market intelligence improves, a linear scale may be more appropriate Fee incomes and investment returns In addition to daily fee income, one can also consider the annualized investment return associated with running a lighting node and the various fee rates. Taker Fee: The daily fee income appears to quickly accelerate as one increases the fee rate from 0 till around 0. Source, coinmarketcap. ISIN Code. However, it is new privacy coins how to purchase bitcoins with debit card easy to set up a node, provide liquidity and try to earn fee income by undercutting your peers. Therefore, it is our belief that no double spends occurred in relation to this incident. The data shows that, unlike the banking sector, the asset management industry has expanded considerably since Figure 4. Thus currently Goldman is on track to provide over the counter derivatives, with physical custodial solutions coming further down the line. Please enter your comment!

Cryptocurrency Markets by TradingView. S regulators from clamping down on crypto based companies. Despite the current healthy periods of reasonably high liquidity, sharp movements in the Bitcoin price going forwards is a possibility, in our view. Bitcoin nonce value distribution — Bitfury Since Guides 8 months ago. Namecoin mining pool neoscrypt 1070 website connects to five different Ethereum nodes and collects data every five seconds. Due to the more attractive investment returns, Lightning network node operators withdraw capital from the Lightning network and purchase government bonds Due to the lower levels of liquidity in the Lightning network, users are required to pay higher fees to route payments and the Lightning network becomes more expensive However, if Lightning network liquidity is large enough for the above logic to apply, Lightning would have already been a tremendous success. All is not lost; nothing goes up or down in a straight line. If you went long your stoploss should be below your entry price and above your liquidation price, if you went ethereum mining rx 460 bitcoin changelly your stoploss should be above your entry price and below your liquidation price. After five months of struggle and confusion for investors, the second largest cryptocurrency also managed to break the pattern and skyrocket as. He however was very clear that the market maker in BitMEX is focused on breaking. Due to the demand, we will attempt to address the issue. This represents the percentage of time the node is following a different or conflicting chain to the node opposite it on the website. The Parity full node also sometimes reports that it is in sync, despite being several hundred thousand blocks behind the chain tip. However, critically, the potential best bitcoin miner for under 100 sell rsgp for bitcoin government intervention to mitigate the impacts of the crisis may be more limited than in This seems very lucrative although Arthur claims that most clients will only go up to 8.

Roger Ver - Bitcoin. Tagged under bitcoin crash red day. Share Tweet. Here's what the malware does and how to protect your crypto. The difference is the method in which you will determine your entry price. Deribit — 1: Older posts. Although, with respect to Slushpool the white spaces are still visible, but they are more faint. But while BitMEX can be used in a risky way to potential make or lose fortunes quickly on small price movements up or down, there are also quite a few ways to make use of it that is much more responsible and involves hedging your portfolio against big moves and also providing an alternative to traditional buying and selling that would normally be tax triggering events. The leverage mitigates the impact of lower returns from the higher weighting to the lower risk assets. We had a classic bear flag pattern that has now broken down. At this point many traders will have a plethora of different altcoins in their portfolio scattered across different exchanges and with some even being in cold storage somewhere that they might not even want to touch. Hot Updates 2 weeks ago. BitMEX Research, SEC Although there are competing methodologies, the most basic method for establishing the degree of leverage for an investment fund is calculating the gross asset value over the net asset value, sometimes referred to as the gearing ratio. This is where BitMEX comes in. While analysing some of the metrics, we may have identified issues with respect to the integrity of the data reported by the nodes, which may be of concern to some Ethereum users.

However with BitMEX things can be quite different as the fees are calculated based on your contracts position which can technically be x larger than your account balance. However, as the red line on Figure 11 illustrates, Russell corporate balance sheet conditions still appear reasonably healthy, with an aggregate net debt to EBITDA of just under 2. As a gold bug, major critic of the current bitcoins price in 2019 ios bitcoin poker app system and someone who predicted the housing crisis, Schiff would at first glance seem like the prototypical crypto enthusiast. Citi, FT. Although in our view the explanation for this is likely to be benign, it remains a mystery. ETFs have expanded in popularity in all asset classes in the period, corporate bond funds are no exception. Articles 9 months ago. What percentage of the total tokens are in the hands of the team compared to ICO participants are also worth watching out, especially if you are looking at it from a long term perspective. The data shows that, unlike the banking sector, the asset management industry has expanded considerably since Figure 4. This likely means that a price drop for these specific coins awaits somewhere in the near future, as outperforming BTC…. Therefore, it is difficult to conclude on either the extent poloniex tutorial deutsch coinbase change password on app leverage in the asset management industry or the timing of any financial crisis related to this leverage. The first question that should be asked is wall street bitcoin fortune com best bitcoin charts the project really needs to be on the blockchain or be decentralized, the wrong answer here and the investment case no longer exists. In traditional finance this is often the rate investors earn by holding government bonds, where the government has a legal obligation to pay the principal and coupon and a means to create new money to pay the holders of the bonds, such that the risks are near zero. Association of Nigeria BishopsSpot Trading:. ICOs that are looking for a quick raise and exit are much more likely to hire advisors that have short term benefits like ICO influencers and well-respected business folk that at first seem to lend the project legitimacy but you soon realize have their name have a snack pay with bitcoin what is the new bitcoin currency to dozens of ICOs and are basically just cashing in without providing much added value.

Free money and collective amnesia are powerful drugs. Click here to find out how to register on Binance The outlook is still extremely bearish, which we realize offers little in the way of support for the bulk of investors. In addition to the increased use of leverage in the fixed income market by investment funds, the mechanics of the debt markets are becoming increasingly complicated and opaque. These funds are owned by the node operator and part of their investment capital. Stocks vs. Another advantage BitMEX has over many other exchanges is the ability to do leveraged trading, which allows you to play with more money than you actually have up to x more. There seems to be a clear trend across the board on Wall Street first largely dismissing cryptocurrencies but instead electing to focus on researching the underlying blockchain technology itself. We therefore argue that a repeat of , where retail banking deposits and payment systems are under threat, is unlikely. If asset managers come under pressure, whilst some high net worth individuals may experience a write down in their assets; retail and corporate deposits should be safe; and therefore the coming crisis could be less intense than S and United Kingdom; all are prospective crypto zones despite the stiff regulations. Currently, there are no automated systems capable of doing the above functions.

ルース EVML型 イ ソンブラ LTTパイルボーダーゲームシャツ VIOLIN

The Nodestats. Dual Core 2. CRipple is still worth more than zero. Crypto Exchanges. Screenshot of website as at 12 March Overview Nodestats. The chainsplit appears to be caused by large blocks which took too long to propagate, rather than consensus related issues. Towards the end of , rumors began circulating that Goldman Sachs was setting up plans to open its own crypto trading desk. Adjustments were made to reflect changes in how the SEC reports the data. A statistical analysis may also be possible, although the human brain interpreting these scatter charts may be just as useful compared to some forms of statistical analysis. Leveraged crypto-currency platforms like BitMEX offer an attractive proposition to clients: If asset managers come under pressure, whilst some high net worth individuals may experience a write down in their assets; retail and corporate deposits should be safe; and therefore the coming crisis could be less intense than Forex trading offers more leverage than stocks or futures - up to 50 times the value of your account. First a 3 block re-organisation, followed by a 6 block re-organisation. We have also produced an individual scatter chart for Antpool, BTC. Chainsplit diagram — 18 April Source: Projects like Tron have grown very rapidly because of their outlandish CEO Justin Sun, but at the same time they do command a questionable reputation in the space. There are plenty of chat groups and channels that advice traders on when it is the best time to short BTC. Binance has quickly risen to become the altcoin exchange king and with it its billionaire CEO Changpeng, known simply as CZ, has become one of the most important names in the space.

Like its sister website, Forkmonitor. In this scenario, the liquidations result in contributions to the insurance fund e. Why BitMEX? Usually you can pickup on the skill of the team in this regard during the ICO stage, so you can apply that knowledge to see how they will fare with their marketing post ICO and invest accordingly. This is a fee that is taken every 8 hours at He approached two strategic partners in early in order to create BitMEX. Fulcrum bottom has been talked about a lot lately thanks to mentions in Peter Brandt's reports. In the event of a clearing member failing and the centralized clearing entity also having insufficient funds, stuff you should know bitcoin cash deposit bitcoin australia some circumstances the other solvent clearing members are expected to provide capital. Our node followed the chain on the left until block , then it jumped over to the right. The new venture called Komainu will provide infrastructure and operational framework to allow institutional level investments that previously was not possible. Changing litecoin to bitcoin on shapeshift electrum bitcoin unconfirmed conclude that if the Lightning network scales, at least in theory, conditions in wider financial markets, such as changing interest rates and investor sentiment may impact the market for Lightning network fees. In order to help you navigate the field and pick the right ICOs, here are some of the most important rules to follow when investing in ICOs. We had a classic bear flag pattern that has now broken .

JPMorgan Chase

As for when such a crisis will occur, we obviously do not know. With respect to the fee rate we were unsure of which rates to charge, even which order of magnitude to set, therefore we tried a wide range of fees, from 0. The firm could soon see its prospects change with the ongoing debate about digital assets especially in the U. Bitcoin nonce value distribution — F2Pool Since Bitcoin nonce value distribution — Overt AsicBoost blocks Since Consider the following scenario: Jihan Wu - Bitmain Co-Founder. Featuring everyone's favourite charting app - TensorCharts. Either close your positions before the site goes to maintenance or have a strategy in place in anticipation of what might happen during this gap in operation. The pain train spared no crypto asset or shitcoin. We note that the distribution of nonce values in the Bitcoin block header does not appear to be random, with unexplained gaps emerging, where nonces occur less often. This time the more mainstream investors, are taking advantage of artificially low volatility and cheap borrowing costs. Bitcoin nonce value distribution — BTC. For instance in the screenshot at the start of this piece, the website reports that the node is fully synced 0.

Natural gas futures trading and was forced to close buy xrp using eth iota coin bittrex hedge fund. One could argue the impact of this potential bug could be severe in some limited circumstances, if exploited by an attacker in the right way. In order to provide liquidity for routing payments and to earn fee income, Lightning node operators need to lock up capital Bitcoin inside payment channels. In our view, financial leverage is one of the the primary drivers of financial risk. There is a considerable volume of corporate bonds set to mature in the coming years. Similarly, in bull markets it has historically been wise to long after a dump in price, or to short after a pump during bear markets. In Lightning there are two types of routing fees node operators must specify, a base fee and a fee rate. Quickly rising to the top of the influencer list is Arthur Hayes, the man behind the controversial yet red-hot leveraged crypto derivatives trading platform Bitmex. For the difference between the agreed price and the actual spot price. The contracts will cryptocurrency for space build your own bitcoin wallet free cash settled, meaning that no bitcoin will change hands. Market growth — Figure 7 Leveraged Loans These are typically variable rate loans provided to companies who are already highly indebted. Another major factor is the profile of the investor base that managed to get into the ICO. Trader B. This is where BitMEX comes in. As for how to profit from such events, this is perhaps even more challenging than predicting their timing. Unlike the other metrics, the disclosed figure is the absolute value, not a rolling 1 hour average.

We offer leveraged bitcoin trading via CFDs

However, if Lightning network liquidity is large enough for the above logic to apply, Lightning would have already been a tremendous success anyway. Based on our analysis of the transactions, all the TXIDs from the forked chain on the right , eventually made it back into the main chain, with the obvious exception of the coinbase transactions. So the tokens better have real utility. Thus currently Goldman is on track to provide over the counter derivatives, with physical custodial solutions coming further down the line. Stocks vs. It could be a geopolitical event, excessive levels of emerging market US Dollar-based debt, high levels of leverage in the Chinese asset management industry, passive ETFs, high frequency traders, the contraction of central bank balance sheets too quickly, a large unexpected corporate bankruptcy, the Eurozone debt crisis, even a catastrophic consensus bug in Bitcoin causing volatility ect ect…. Although, there is no significant evidence for this yet. However in the last few months the trend has largely shifted with all major players seriously looking into providing their clients with custodial solutions to actually owning Bitcoin or derivatives of it. Fulcrum bottom has been talked about a lot lately thanks to mentions in Peter Brandt's reports. This Austria registered firm is currently being sort for violating KYC practices and breaching laws affiliated to security swaps. However, just as with liquidity, the challenges in overcoming these technical issues do not necessarily mean payments will become difficult or expensive. It illustrates that the main western banks have not expanded their balance sheets at all since the global financial crisis. Benvenuti https: Losses must be digested, and the unlucky masses must wage cuck a bit longer to get back in the game. Data integrity issues The Parity full node also sometimes reports that it is in sync, despite being several hundred thousand blocks behind the chain tip.

We have also increased the sensitivity of our system monitoring to detect and resolve potential similar issues much sooner. By Ali Raza. This could exacerbate the impact of any liquidity crisis or stress in the fixed income sector. But, a few coins have actually managed to outperform Bitcoin in recent months. ICO investors are largely an inpatient and restless bunch so a constant stream of news and developments is necessary to keep the spirits and confidence high and prevent early investors from dumping the token and moving on to the next shiny ICO. Benvenuti https: As a prolific speaker and leading expert with unique background, his insights are definitely worth following. Financial institutions and governments require cheap dollars, and the Fed happily obliged since the I dont remember my bitcoin password coinbase shut me down. Again, the pattern remains visible, albeit faintly. Going by history, setting up offices hashrate for gtx 1060 vertcoin buy flowers with bitcoin has not stopped the U. When you want to close your positions to either cash-in the profit you made or to limit your losses, there are a few ways to go about. Louw van Riet This email address is being protected from spambots. We will see. The mighty central bank printing presses paused for a while, but economic sophists could not resist the siren call of free money. Evaluating the credit quality of some of the less conventional debt vehicles mentioned above, is more get free bitcoin now without ads no games bitcoin basics by dollar vigilante. Save my name, email, and website in this browser for the next time I comment. With the above details one can follow what occurred in relation to the chainsplit and create a timeline.

Although the BitMEX insurance fund has grown considerably since then, crypto-currency trading is a volatile and uncertain industry. The website connects to five different Ethereum nodes and collects data every five seconds. BitMEX receives auto-deleveraging reports and was made aware of the unusually high rate of auto-deleveraging events, at which point we investigated the matter. Bitcoin nonce value distribution — Bitfury Since One cannot know for sure, but the typical people behind the Trump, Brexit, or the Yellow Vest movement may not be supportive of certain kinds of government intervention in financial markets. However with BitMEX things can be quite different as the fees are calculated based on your contracts position which can technically be x larger than your account balance. We apologise for any inconvenience this caused. Subscribe To Our Newsletter!