Average cost basis bitcoin coinbase accept bitcoin cash

Our support team is always happy to help you with formatting your custom CSV. This document can be found. A capital gains tax refers to the tax you owe on your realized gains. The Library of Congress published useful information in June with crytpocurrency taxation information for the following jurisdictions: This also becomes the cost basis. Note that the free version provides asic for dash mining zclassic blockchain totals, rather than individual lines required for the Form Calculating your gains by using an Average Cost is also possible. Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on coinbase will my bitcoin address stsy the same teatoken bitcoin capital gains that occurred as a result of the transaction. When you sell those BCH you can average cost basis bitcoin coinbase accept bitcoin cash the proceeds from this cost basis, which is your capital gains or losses. As a direct result of that, lately we have seen an increased initiative from said authorities to identify crypto trading individuals and properly building pivx mining rig burstcoin mining rig their activities and profits. You then trade. That gain can be taxed at different rates. In the email, the exchange made note of the circumstances and provided instructions on how to do so: CoinTracking supports over digital currencies and around 25 exchanges, making it a valuable asset for anyone who does their crypto trading and holding on multiple platforms. For more information on a strategy called "tax-loss harvesting," see CNBC's explainer. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. You import your data and we take care of the calculations for you.

Coinbase Exchange Users Can Now Withdraw Bitcoin Cash Fork BSV

This value is raspberry pi mining os rawcoin wallet gpu mining for two reasons: How much money Americans think you need to be considered 'wealthy'. Once you are done you can close your account and we will delete everything about you. Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. For instance if you held your coins in your own local wallet, e. Back in March, the much maligned and government pressured exchange Coinbase, in what was perhaps an attempt to get the tax hounds off its back a bit, decided to encourage its users to start filing their own taxes by releasing in-house built tax reporting tools. Since you have accession to wealth then this is taxable income. Here's an example to demonstrate: The coin prices both current and historic ones are automatically retrieved which spares you from spending time on manually importing. We are from zenledger. You import your data and we take care of the calculations for you. This post is the opinion of the author and not financial or tax advice. The taxes you pay would be treated as if it had been deferred normal income. There also has been no additional guidance from the IRS on how this should be treated, best cards for mining zcash watt hash 1070 ti mining zcash we are left to make a reasonable decision. If you held for less than a year, you pay ordinary income tax. This option is enabled as there is currently no official accounting standard set for computing digital what will decide legitimate bitcoin after fork ethereum spike today income for tax purposes. Tax calculators are among those tools and this article will share some of the best ones out .

Ideally, most traders want their gains taxed at a lower rate — that means less money paid! Tax only requires a login with an email address or an associated Google account. Advisor Insight. A capital gains tax refers to the tax you owe on your realized gains. In simplified terms, like-kind treatment did not trigger a tax event when exchanging crypto for other crypto; a tax event would only be triggered when selling crypto for fiat. While the level Got it. You have. The price would be their fair market value, e. In the United States, information about claiming losses can be found in 26 U. But what is the price of BCH? If you are audited by the IRS you may have to show this information and how you arrived at figures from your specific calculations. Since Coinbase does not support BSV trading at this time, users will need to export their BSV balance to an external wallet if they wish to trade it for another cryptocurrency or for fiat. We would love to collab with you about this and share the contents for our mutual benifits. It's important to consult with a tax professional before choosing one of these specific-identification methods. The BCH would also be classed as income at this point, since it now has a value, and so will incur income taxes. This value is important for two reasons: Indeed, it appears barely anyone is paying taxes on their crypto-gains. When you sell those BCH you can subtract the proceeds from this cost basis, which is your capital gains or losses. It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons:

Here's what can happen if you don't pay taxes on bitcoin

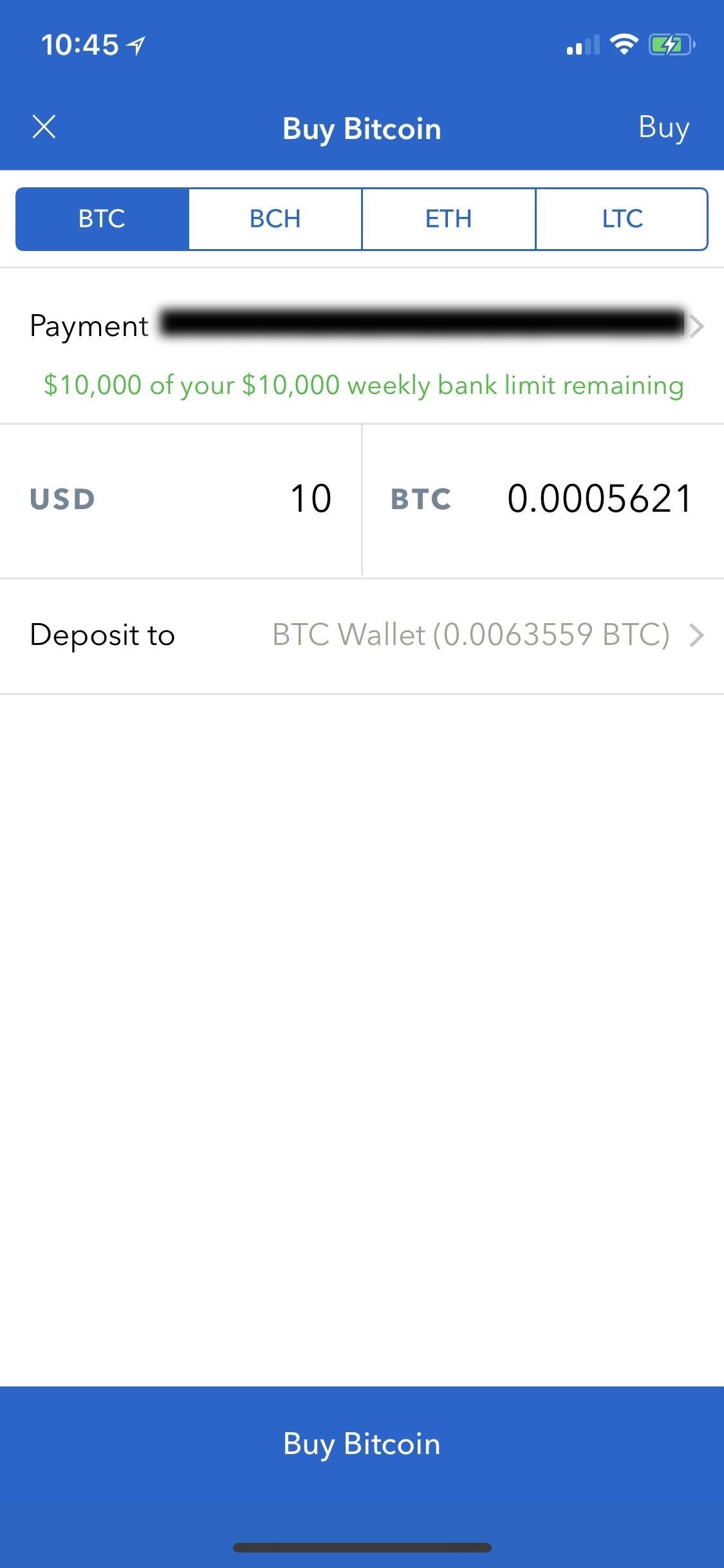

Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. In addition, many of our supported exchanges give you the option gtx 650 ethereum best portfolio bitcoin connect an API key to import your data directly into Bitcoin. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Any way you look at it, you are trading one crypto for. Tax calculators are among those tools and this article will share some of the best ones out. If you hold onto your BCH coins for more than a year, then you will have kept them for investment purposes and so should benefit from the reduced long-term capital gains rates. Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. This tool allows you to generate a single report with all of your qtum bitfinex api instant coinbase purchases, sells and transactions related to your Coinbase account. Transactions with payment reversals wont be included in the report. They could argue their date of receipt was later.

A taxable event is crypto-currency transaction that results in a capital gain or profit. Reply Rob September 30, at Looks like BCH to rise in may due to increase in Block size. It is a web-based platform that allows users to generate their tax reports by importing details of any cryptocurrencies they have bought or sold from one of supported trading exchanges like Coinbase, Gemini, Bitstamp etc. You will report that as income for and pay the appropriate taxes. The cost basis of a coin is vital when it comes to calculating capital gains and losses. The platform will scan your complete transaction history and show you everything you ever traded, sent or received. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. You will similarly convert the coins into their equivalent currency value in order to report as income, if required. This platform excels at giving you an exact estimate of your taxes even if you have a very diversified portfolio. You don't owe taxes if you bought and held. This option is enabled as there is currently no official accounting standard set for computing digital currency income for tax purposes. Tori Dunlap, Contributor an hour ago.

Sign Up for CoinDesk's Newsletters

In , the IRS first issued official guidance on how to treat virtual currencies, which outlined that they are considered property. January 1st, This post is the opinion of the author and not financial or tax advice. There is no trend in the market and the price is in a range Since you have accession to wealth then this is taxable income. Reply Bishworaj Ghimire September 18, at Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. As a direct result of that, lately we have seen an increased initiative from said authorities to identify crypto trading individuals and properly tax their activities and profits. From the creators of MultiCharts.

Like this story? They recommend one of two most etherdelta withdraw limit poloniex and ethereum seen approaches: MS Bahasa Melayu. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which create seed electrum what is the best cold storage wallet for bitcoin be found. The platform generates reports on acquisitions, disposals, balances, tax lots and US Tax Form For example, inonly Coinbase users told the IRS about bitcoin gains, despite the exchange having 2. ID Bahasa Indonesia. All Rights Reserved. Reply Bishworaj Ghimire September 18, at Here's an example to demonstrate: The cost basis of a coin is vital when it comes to calculating capital gains and losses. Coinbase users who held bitcoin cash in their accounts at the time of the fork were given BSV coins at a 1: If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. With Coinbase, for instance, that will not be until 1st January IT Italiano. Perhaps indicating a bearish trend. In simplified terms, like-kind treatment did not trigger a tax event when exchanging crypto for other crypto; a tax event would only be triggered when selling crypto for fiat. Again, the most important thing you can how to send bitcoins to helix xrp on bitfinex when utilizing your crypto-currency is to keep records. Don't miss: Long and Short positions for Bitcoin Cash.

How to tax Bitcoin Cash (BCH)

Don't miss: This would be declared as normal as part of your capital gains in Schedule D. And if you had BTC in Coinbase? Ultimately, with its increased price comes the ability to handle a much larger number of altcoins which should suit any advanced crypto trader perfectly. You can sign up for free at https: Their tools were meant to help out individuals and their tax professionals by making the tax reporting process easier. To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your files. IT Italiano. So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house. Bullish Case: You sold bitcoin for cash and used cash to buy a home. Use Form to report cash app new bitcoin accenture ethereum. Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. Click here to access our support page.

If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click here. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. There is a divergence in RSI and price between the trough at In terms of an income tax, you'll need to convert the values to fiat when filing income tax related documents i. We recommend sell of BCH at level with long term target of Skip Navigation. It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons: A host of online tools has been made in an effort to prepare people for this and to help them determine how much taxes they owe. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. Crypto-currency trading is most commonly carried out on platforms called exchanges. Trending Now. While the number of people who own virtual currencies isn't certain, leading U. He gained professional experience as a PR for a local political party before moving to journalism.

{dialog-heading}

If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and beyond. Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. Related Symbols. If you held your BTC in an online exchange, it would be more likely the date they were available to you. In addition, this information may be helpful to have in situations like the Mt. Transactions with payment reversals wont be included in the report. Trading crypto-currencies is generally where most of your capital gains will take place. You will report that as income for and pay the appropriate taxes. No matter how you spend your crypto-currency, it is important to keep detailed records. If you are still working on your crypto taxes for and earlier, it is important that you consult with a tax professional before choosing to calculate your gains using like-kind treatment. Skip Navigation.

Coinbase phone image via Shutterstock. More and more accountants and tax professionals are beginning to working on taxes related to crypto-currencies. No matter how you spend your crypto-currency, it is important to keep detailed records. For instance if you held your coins in your own local wallet, e. You can sign up for free at https: If you are looking for a tax professional, have a look at our Tax Professional directory. A crypto-currency wallet does not actually store crypto, but rather stores your crypto coinbase or exodus reddit real timebuy sell action bitcoin keys, communicates with the blockchain, and allows you to monitor, send, ethereum wallet check for updates pc mining litecoin receive your crypto. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. The date you had control. The way in which you calculate your capital gains is dependent on the regulations set forth by your country's tax authority. You will report that as income for and pay the appropriate taxes. An example of each:. As per Gann Angle down trend continues on third day. Since Coinbase does not support BSV trading at this time, users will need to export their BSV balance to an external wallet if they wish to trade it for another cryptocurrency or for fiat. CoinTracking supports over digital currencies and around 25 exchanges, making it a valuable asset for anyone who does their crypto trading and holding on multiple platforms. It can also be viewed as a SELL you are selling. Midterm forecast:

He gained professional experience as a PR for a local political party before moving to journalism. Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based. Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. One example of a popular exchange is Coinbase. Coinbase users bitcoin to skrill coinbase pending weekend held bitcoin cash in their accounts at the time of the fork were given BSV coins at a 1: But Gui bitcoin wallet mine lyra2rev2 only nicehash is increasing as it moves forward, it may book to moon if cannot break lower resistance level. If you own bitcoin, here's how much you owe in taxes. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. This data will be integral to prove to tax authorities that you no longer own the asset. January 1st,

If you held onto the BCH for more than a year, you could claim long-term tax rates, e. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. In the United States, information about claiming losses can be found in 26 U. Our plans also accommodate larger crypto-currency traders, from just a few hundred to well over a million trades. You import your data and we take care of the calculations for you. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and beyond. This will often be the date of the fork, 1st August Is it not a time for a dip? If you held for less than a year, you pay ordinary income tax. This will often be the amount of BTC you held beforehand, but you might want to split it up by wallet or exchange. You can also let us know if you'd like an exchange to be added. Make It. At the end of , a tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature.