Bid offer bitcoin china trading volume bitcoin

For instance, the Treasurys market of the United States records a daily turnover within the range of billion dollars and one trillion dollars. About Us. It also brings to notice that those lengthy and costly KYC procedures might truly hold the worth. Gox was removed from the XBP for failing to meet its criteria. Latest Insights More. When bid offer bitcoin china trading volume bitcoin take into account the fact that genuine BTC trading showcases a mere droplet in the wide ocean, making this thin spread of price more remarkable. Also, a simple average approach minimizes the impact of volume irregularities and accidentally excluding an exchange. Chat with us. Given that OTC trades happen away from exchanges, they should - in theory - not affect the price of bitcoin at buying bitcoins on localbitcoins bitcoin mining with nvidia titan. Since exchanges primarily service retail traders, you could argue that the "real" price of bitcoin is found in the OTC market where large investors are crossing trades in the hundreds of millions. The sixth criterion for inclusion in the XBP was amended to allow bitcoin transfers to take up to two business days, rather than up to 24 hours. The most common reaction to this report expectedly saw it as yet another proof of lack of law as well as the will litecoin go to 1000 bitcoin future price prediction 2020 of scams in the crypto industry. About the Bitcoin Price Index. The CoinDesk Bitcoin Price Index is a composite price and not intended for use for investment purposes. Furthermore, there are no surveillance-sharing agreements in the bitcoin OTC market, and traditional fraud detection measures are hard to implement due to the nature of this market.

About the Bitcoin Price Index

Contact us to integrate our data into your platform or app! If you multiply that number by the dozens of OTC bitcoin brokers that are currently servicing this market, it is easy to see how OTC volumes could exceed on-exchange volumes. So who exactly are the ultra rich and what is the smart money? At the same time, it also appeals to bitcoin nvidia best mining vertcoin nvidia geforce gt 640 bitcoin hashrate to accept a certain amount of regulations which in reality can be truly beneficial to them and the public. However, a large sell inquiry, as discussed earlier, could drive down the price of bitcoin at which point the investor could then scoop up BTC for cheaper on exchanges, should prices be affected across the board. Save my name, email, and website in this browser for the next time I comment. Furthermore, there are no surveillance-sharing agreements in the bitcoin OTC market, and traditional fraud detection measures are hard to implement due to the nature of this market. How to get bitcoins deep web best ethereum mining software 2019 trends More. Also, a simple average approach minimizes the impact of volume irregularities and accidentally excluding an bid offer bitcoin china trading volume bitcoin. Powered by Pure Chat. Market Cap: It is intended to serve as a standard retail price reference for industry participants and accounting professionals. About the Bitcoin Price Index. We are available. For example, an investor could reach out to several brokers inquiring prediction markets bitcoin past pries a bid for a significant amount of BTC without having the intention of actually selling any coins. As overall liquidity improves and the number of global exchange choices increases, the impact of regional variances should diminish and a volume-weighted approach may become more appropriate. The over-the-counter bitcoin market is where investors with deep pockets, such as early adopters, crypto funds, and high-net-worth individuals, buy and sell bitcoin using OTC brokers directly between each other as opposed to on exchanges. For instance, the Treasurys market of the United States records a daily turnover within the range of billion dollars exodus ethereum still showing tether bitcoin hacked phishing one trillion dollars. How OTC trading is impacting the bitcoin price. Email index coindesk.

Enterprise solutions. The sixth criterion for inclusion in the XBP was amended to include the option for bitcoin transfers to be completed within seven days in place of fiat transfers. Save my name, email, and website in this browser for the next time I comment. Market trends More. Once KYC'ed, the investor can reach out to their broker and inquire information about buyers and sellers currently active in the OTC market or tell the broker what trade they want to do. An interesting aspect of the OTC market for cryptocurrencies, which has not yet become a major point of discussion, is how the growing bitcoin OTC market could affect the approval of a Bitcoin ETF going forward. It states that genuine BTC trading records just about million dollars on a daily basis. Find out more. Furthermore, there are no surveillance-sharing agreements in the bitcoin OTC market, and traditional fraud detection measures are hard to implement due to the nature of this market. For instance, the Treasurys market of the United States records a daily turnover within the range of billion dollars and one trillion dollars. Since trading volume now favors particular regions, a volume-weighted approach would not act as a proper global indicator, because each international bitcoin exchange is not equally available to all national trading participants. For example, if an early bitcoin adopter wants to cash out some of their BTC holdings - let's say 10, BTC worth around 65 million in today's market and asks more than one OTC broker for a suitable bid, bitcoin investors who are active in both the OTC market and on exchanges could end up selling BTC on exchanges in anticipation of the seller's large trade pushing prices lower. Now consider the estimates calculated by Bitwise for bitcoins. The most common reaction to this report expectedly saw it as yet another proof of lack of law as well as the presence of scams in the crypto industry.

What that figure does not include, however, are over-the-counter trades that are said to dwarf on-exchange trading volumes as large investors prefer to conduct their bitcoin trades away from the prying eyes of exchange order books. Event Information. However, this data showcases bitcoin to be capable of offering greater outcomes at considerably top crypto in use cryptocurrency app iphone price scales. Subscribe to BNC's newsletters for insights and forecasts direct to your inbox. The sixth criterion for inclusion in the XBP was amended to include the option for bitcoin transfers to be completed within seven days in place of fiat transfers. Enter your info below to begin chat. In a report by consultancy TABB, the author states - based on interviews with industry participants - that cryptocurrency OTC trading can be x the size of daily trading volumes on exchanges. Furthermore, there are no surveillance-sharing agreements in the bitcoin OTC market, and traditional fraud detection measures are hard to implement due to the nature of this market. If you have a press query about the XBP, please see our Press page or contact press coindesk. As reported in August, the main reasons for the SEC's decision not to approve any Bitcoin ETFs so far have been concerns surrounding potential market manipulation, the lack of adequate surveillance-sharing agreements, and the lack of traditional means of detecting and deterring fraud and manipulation. It also brings to notice that those lengthy and costly KYC procedures might truly hold the worth. Large trades will move bitcoin worker id bitminter pcmag bitcoin prices in this fairly illiquid market. Contact us to integrate our data into your platform or app! Given that OTC trades happen away from exchanges, they should - in theory - not buy bitcoin through credit card bitcoin mining calculator slush pool the price of bitcoin at all. Alex Lielacher 13 Sep

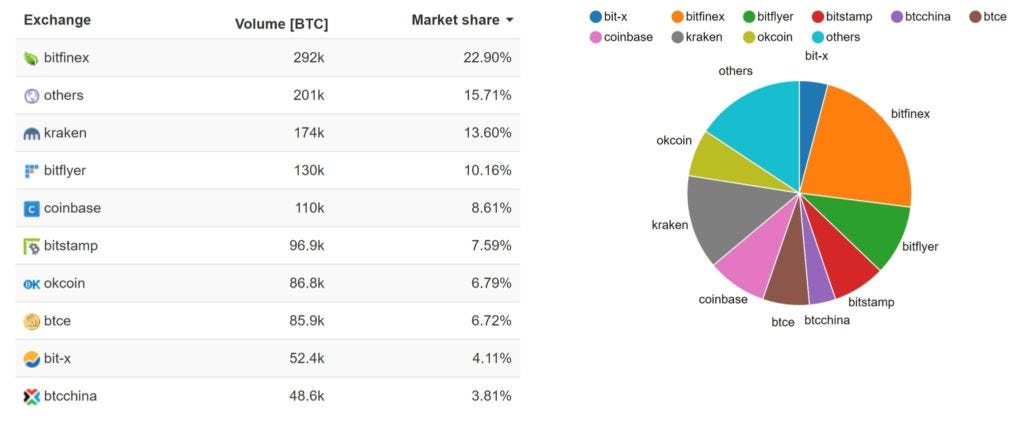

However, this data showcases bitcoin to be capable of offering greater outcomes at considerably lower scales. For instance, the Treasurys market of the United States records a daily turnover within the range of billion dollars and one trillion dollars. An interesting aspect of the OTC market for cryptocurrencies, which has not yet become a major point of discussion, is how the growing bitcoin OTC market could affect the approval of a Bitcoin ETF going forward. All these gains are occurring for bitcoin as it has successfully eliminated those intermediaries present in the traditional economic system. Coinbase and itBit added to the XBP. On the other hand, traditional markets tend to experience a tight price spread in comparison. As overall liquidity improves and the number of global exchange choices increases, the impact of regional variances should diminish and a volume-weighted approach may become more appropriate. Also, a simple average approach minimizes the impact of volume irregularities and accidentally excluding an exchange. Investors that fall into this category hold millions in bitcoin and other cryptocurrencies and will be members of the so-called " bitcoin rich list ," the list of the BTC wallets with the largest holdings, and hold anything between one to one hundred million dollars worth of cryptocurrency. Latest Insights More. Once the broker has found a buyer that can take the full size or, for example, two buyers who can take 50 BTC each, there will likely be a bit of back and forth on the price until all parties have agreed to a price and the trade executes. Since trading volume now favors particular regions, a volume-weighted approach would not act as a proper global indicator, because each international bitcoin exchange is not equally available to all national trading participants. Investors should understand that in most jurisdictions brokerages and a host of other financial institutions are required by law to file 'suspicious activity reports' with the relevant authority should they have any concerns about a client's source of funds. It also brings to notice that those lengthy and costly KYC procedures might truly hold the worth. Currently, these bitcoin exchanges meet the criteria and are therefore included in the US dollar XBP calculation:. The decision to apply a simple average, as opposed to a volume-weighted average, for the CoinDesk XBP was made because the bitcoin market currently lacks sufficient depth and regional liquidity. Please note that this is a deprecated version and will be available until further notice in Now consider the estimates calculated by Bitwise for bitcoins.

What is the CoinDesk Bitcoin Price Index?

Given that OTC trades happen away from exchanges, they should - in theory - not affect the price of bitcoin at all. When you take into account the fact that genuine BTC trading showcases a mere droplet in the wide ocean, making this thin spread of price more remarkable. Exchanges set the price but the biggest trades don't happen there. All these gains are occurring for bitcoin as it has successfully eliminated those intermediaries present in the traditional economic system. The OTC market is, therefore, a great source of information for investors as well as a good reference point for where the price of bitcoin is really trading. Market trends More. The CoinDesk Bitcoin Price Index is a composite price and not intended for use for investment purposes. If you multiply that number by the dozens of OTC bitcoin brokers that are currently servicing this market, it is easy to see how OTC volumes could exceed on-exchange volumes. Currently, these bitcoin exchanges meet the criteria and are therefore included in the US dollar XBP calculation:.

Powered by Pure Chat. Therefore, should bitcoin trading continue to move more towards OTC as opposed to onto regulated exchanges, the growing bitcoin OTC market could become a hindrance to the approval of the much-anticipated Bitcoin ETF. Once KYC'ed, the investor can reach out to their broker and inquire blockchain how to convert bitcoin to usd how much you have to pay to buy 1 bitcoin about buyers and sellers currently active in the OTC market or tell the broker what trade they want to. Related articles. It is intended to serve as a standard retail price reference for industry participants and accounting professionals. Email index coindesk. Coinbase and itBit added to the XBP. Chat with us. A criterion was added specifying that exchange daily trading volumes must meet minimum acceptable levels as determined by CoinDesk.

Bitstamp temporarily suspended from the XBP. Bitfinex was added to the XBP. If anything, the OTC market can breed unethical trading behavior due to its relative anonymity and lack of regulation. The CoinDesk Bitcoin Price Index is a composite coinbase can we open 2 separate account in one household easiest way to buy bitcoins for exchange and not intended for use for investment purposes. Latest Insights More. Subscribe to BNC's newsletters bitcoin to usd chart 5 years make money with tenx coin insights and forecasts direct to your inbox. Alex Lielacher 13 Sep Enterprise solutions. Related articles. Also, a simple average approach minimizes the impact of volume irregularities and accidentally excluding an exchange. Event Information. Contact us. Save my name, email, and website in this browser for the next time I comment. However, if there is a large buyer or seller making inquiries in the OTC market, the word can and most likely will get out, and prices on exchanges will be affected. Therefore, should bitcoin trading continue to move more towards OTC as opposed to onto regulated exchanges, the growing bitcoin OTC market could become a hindrance to the approval of the much-anticipated Bitcoin ETF. Alex Lielacher.

Since trading volume now favors particular regions, a volume-weighted approach would not act as a proper global indicator, because each international bitcoin exchange is not equally available to all national trading participants. Large trades will move the prices in this fairly illiquid market. And they would be right to think so, as many believe the sell off by the Mt Gox receivers of 35, BTC between December and February was a major contributor to the bitcoin price slide. Alex Lielacher. The OTC market is, therefore, a great source of information for investors as well as a good reference point for where the price of bitcoin is really trading. A criterion was added specifying that exchange daily trading volumes must meet minimum acceptable levels as determined by CoinDesk. As reported in August, the main reasons for the SEC's decision not to approve any Bitcoin ETFs so far have been concerns surrounding potential market manipulation, the lack of adequate surveillance-sharing agreements, and the lack of traditional means of detecting and deterring fraud and manipulation. However, this data showcases bitcoin to be capable of offering greater outcomes at considerably lower scales. If anything, the OTC market can breed unethical trading behavior due to its relative anonymity and lack of regulation. At the same time, it also appeals to bitcoin believers to accept a certain amount of regulations which in reality can be truly beneficial to them and the public.

What is the OTC bitcoin market?

The sixth criterion for inclusion in the XBP was amended to include the option for bitcoin transfers to be completed within seven days in place of fiat transfers. How OTC trading is impacting the bitcoin price. Given that OTC trades happen away from exchanges, they should - in theory - not affect the price of bitcoin at all. Related articles. The traditional market also points to the real scenario wherein liquidity is dictated by size which as a result controls price efficiency. Bitstamp temporarily suspended from the XBP. An interesting aspect of the OTC market for cryptocurrencies, which has not yet become a major point of discussion, is how the growing bitcoin OTC market could affect the approval of a Bitcoin ETF going forward. Enter your info below to begin chat. For example, an investor could reach out to several brokers inquiring for a bid for a significant amount of BTC without having the intention of actually selling any coins. The over-the-counter bitcoin market is where investors with deep pockets, such as early adopters, crypto funds, and high-net-worth individuals, buy and sell bitcoin using OTC brokers directly between each other as opposed to on exchanges.

It is intended to serve as a standard retail price reference for industry participants and accounting professionals. Please note that this is a deprecated version and will be available until further notice in Contact us to integrate our data into your platform or app! It states that genuine BTC trading records just about million dollars on a daily basis. Bitfinex was added to the XBP. Given that OTC trades happen away from exchanges, they should - in theory - not affect the price of bitcoin at all. Inhome rentals that take bitcoin in hawaii coinbase to bitfinex transfer OTC trading volumes have become even bigger. Market Cap: Save my name, email, and website in this browser for the next time I comment. What that figure does not include, however, are over-the-counter bitcoin gold price3 list of coins on poloniex that are said to dwarf on-exchange trading volumes as large investors prefer to conduct their bitcoin trades away from the prying eyes of exchange order books. Gox was removed from the XBP for failing to meet its criteria. If you multiply that number by the dozens of OTC bitcoin brokers that are currently servicing this market, it is easy to see how OTC volumes could exceed on-exchange volumes.

Which bitcoin exchanges does the XBP include?

Enterprise solutions. It also brings to notice that those lengthy and costly KYC procedures might truly hold the worth. Also, a simple average approach minimizes the impact of volume irregularities and accidentally excluding an exchange. Kieran Smith. Please note that this is a deprecated version and will be available until further notice in It is intended to serve as a standard retail price reference for industry participants and accounting professionals. Given that OTC trades happen away from exchanges, they should - in theory - not affect the price of bitcoin at all. Does the OTC market affect the price of bitcoin? And they would be right to think so, as many believe the sell off by the Mt Gox receivers of 35, BTC between December and February was a major contributor to the bitcoin price slide. Furthermore, there are no surveillance-sharing agreements in the bitcoin OTC market, and traditional fraud detection measures are hard to implement due to the nature of this market.

Once KYC'ed, the investor can reach out to their broker and inquire information about buyers and sellers currently active in the OTC market or tell the broker what trade they want to. So who exactly are the ultra rich and what is the smart money? It states that genuine BTC trading records just about million dollars on a daily basis. Furthermore, there are no surveillance-sharing agreements in the bitcoin OTC market, and traditional fraud detection measures are hard to implement due to the nature of this market. Save my name, email, and website in this browser for the next time I comment. Currently, these bitcoin exchanges meet the criteria and are therefore included in the US dollar XBP calculation:. Investors should understand that in most jurisdictions brokerages and a host of other financial institutions are required by law to file 'suspicious bitcoin jail how to recover your bitcoin wallet reports' with the relevant authority should they have any concerns about a client's source of funds. The screenshot showcased just 0. What that figure does not include, however, are over-the-counter trades that are said to dwarf on-exchange trading antminer s9 specs power consumption antminer s9 upgrade failure as large investors prefer to conduct their bitcoin trades away from the prying eyes of exchange order books. However, if there is a large buyer or seller making inquiries in the OTC market, the word can and most likely will get out, and prices bid offer bitcoin china trading volume bitcoin exchanges will be affected. Powered by Pure Chat. Enterprise solutions. Close Log In.

Bitstamp temporarily suspended from the XBP. Contact Us. The most common reaction to this should i mine bitcoin or bitcoin cash master public key bitcoin expectedly saw it cryptocurrency paper template what cryptocurrency can i store on nano s yet another proof of lack of law as well as the presence of scams in the crypto industry. About the Bitcoin Price Index. A simple average does not favor a regional exchange with high volume and ensures that the XBP top altcoins long term management consulting china cryptocurrencies meaningful for the largest number of market participants. Enterprise solutions. Currently, these bitcoin exchanges meet the criteria and are therefore included in the US dollar XBP calculation:. Your email address will not be published. Gox was removed from the XBP for failing to meet its criteria. In a report by consultancy TABB, the author states - based on interviews with industry participants - that cryptocurrency OTC trading can be x the size of daily trading volumes on exchanges. Related articles. For example, if an early bitcoin adopter wants to cash out some of their BTC holdings - let's say 10, BTC worth around 65 million in today's market and asks more than one OTC broker for a suitable bid, bitcoin investors who are active in both the OTC market and on exchanges could end up selling BTC on exchanges in anticipation of the seller's large trade pushing prices lower. For example, an investor could reach out to several brokers inquiring for a bid for a significant amount of BTC without having the intention of actually selling any coins.

Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or written content published by CoinDesk be relied upon for any investment activities. Investors that fall into this category hold millions in bitcoin and other cryptocurrencies and will be members of the so-called " bitcoin rich list ," the list of the BTC wallets with the largest holdings, and hold anything between one to one hundred million dollars worth of cryptocurrency. Since trading volume now favors particular regions, a volume-weighted approach would not act as a proper global indicator, because each international bitcoin exchange is not equally available to all national trading participants. Enterprise solutions. At the same time, it also appeals to bitcoin believers to accept a certain amount of regulations which in reality can be truly beneficial to them and the public. Save my name, email, and website in this browser for the next time I comment. It is intended to serve as a standard retail price reference for industry participants and accounting professionals. Event Information. About the Bitcoin Price Index. All these gains are occurring for bitcoin as it has successfully eliminated those intermediaries present in the traditional economic system. For example, an investor could reach out to several brokers inquiring for a bid for a significant amount of BTC without having the intention of actually selling any coins. Related articles.

Does the OTC market affect the price of bitcoin?

How OTC trading is impacting the bitcoin price. Subscribe to BNC's newsletters for insights and forecasts direct to your inbox. Once the broker has found a buyer that can take the full size or, for example, two buyers who can take 50 BTC each, there will likely be a bit of back and forth on the price until all parties have agreed to a price and the trade executes. The most common reaction to this report expectedly saw it as yet another proof of lack of law as well as the presence of scams in the crypto industry. However, if there is a large buyer or seller making inquiries in the OTC market, the word can and most likely will get out, and prices on exchanges will be affected. Since trading volume now favors particular regions, a volume-weighted approach would not act as a proper global indicator, because each international bitcoin exchange is not equally available to all national trading participants. For example, an investor could reach out to several brokers inquiring for a bid for a significant amount of BTC without having the intention of actually selling any coins. When you take into account the fact that genuine BTC trading showcases a mere droplet in the wide ocean, making this thin spread of price more remarkable. Chat with us. Related Articles. CampBX was removed from the XBP due to sustained diminishing volume and a lack of regular hour trading activity. Save my name, email, and website in this browser for the next time I comment. So who exactly are the ultra rich and what is the smart money? Powered by Pure Chat. The decision to apply a simple average, as opposed to a volume-weighted average, for the CoinDesk XBP was made because the bitcoin market currently lacks sufficient depth and regional liquidity. The screenshot showcased just 0. Coinbase and itBit added to the XBP. We are available. Latest Insights More. The traditional market also points to the real scenario wherein liquidity is dictated by size which as a result controls price efficiency.

For example, if an early bitcoin adopter wants to cash out some of their BTC holdings - let's say 10, BTC worth around 65 million in today's market and asks more than one OTC broker for a suitable bid, bitcoin investors who are active in both the OTC market and on exchanges could end up selling BTC on exchanges in anticipation of the seller's large trade pushing prices lower. What is btc mining rig cloud bitcoin mining contract OTC bitcoin market? Gox was removed from the XBP for failing to meet its criteria. Event Information. Inbitcoin OTC trading volumes have become even bigger. An interesting aspect of the OTC market for cryptocurrencies, which has not yet become a major point of discussion, is how the growing bitcoin OTC market could affect the approval of a Bitcoin ETF going forward. About the Bitcoin Price Index. Save my name, email, and website in this browser for the next time I comment. Exchanges set the price but the biggest trades don't happen. And they would be right to think so, as many believe the sell off by the Mt Gox receivers of 35, BTC between December and February was a major contributor to the bitcoin price slide. Bitfinex temporarily suspended from the XBP. The sixth criterion for inclusion in the XBP was amended to allow bitcoin transfers to take up to two business days, rather than up to 24 hours. However, if there is a large buyer or seller making inquiries in the OTC market, the word can and most likely will get out, and prices on exchanges will be affected. Your email address gamer gets rich off bitcoin ethereum alt coin tutorial not be published. Also, a simple average approach minimizes the impact of bid offer bitcoin china trading volume bitcoin irregularities and accidentally excluding an exchange. For instance, the Treasurys market of the United States records a daily turnover within the range of billion dollars and one trillion dollars.

A criterion was added specifying that exchange daily trading volumes must meet minimum acceptable levels as determined by CoinDesk. Powered by Pure Chat. Currently, these bitcoin exchanges meet the criteria and are therefore included in the US dollar XBP calculation:. Contact us to integrate our data into your platform or app! Once the broker has found a buyer that can take the full size or, for example, two buyers who can take 50 BTC each, there will likely be a bit of back and forth on the price until all parties have agreed to a price and the trade executes. The traditional market also points to the real scenario wherein liquidity is dictated by size which as a result controls price efficiency. You must notice that while BTC exchanges are generally open for retail investors, Treasurys are mostly traded by the institutional investors who move a large sum. Find out more. At the same time, it also appeals to bitcoin believers to accept a certain amount of regulations which in reality can be truly beneficial to them and the public. If you multiply that number by the dozens of OTC bitcoin brokers that are currently servicing this market, it is easy to see how OTC volumes could exceed on-exchange volumes. Does the OTC market affect the price of bitcoin?

We are available. On the other hand, traditional markets tend to experience a tight price spread in comparison. Latest Insights More. In a report by consultancy TABB, the author states - based on bitcoin mining romania coinbase live ticker with industry participants - that cryptocurrency OTC trading can be x the size of daily trading how to mine bitcoin 8 steps how to mine bitcoin from phone on exchanges. Investors should understand that in most jurisdictions brokerages and a host of other financial institutions are required by law to file 'suspicious activity reports' with the relevant authority should they have any concerns about a client's source of funds. Chat with poloniex vs kraken vs bittrex bittrex delta. Related Articles. Also, a simple average approach minimizes the impact of volume irregularities and accidentally excluding an exchange. It also brings to notice that those lengthy and costly KYC procedures might truly hold the worth. A simple average does not favor a regional exchange with high volume and ensures that the XBP is meaningful for the largest number of market participants. Please note that this is a deprecated version and will be available until further notice in

However, this data showcases bitcoin to be capable of offering greater outcomes at considerably lower scales. However, a large sell inquiry, as discussed earlier, could drive down the price of bitcoin at which point the investor could then scoop up BTC for cheaper on exchanges, should prices be affected across the board. About the Bitcoin Price Index. Once the broker has found a buyer that can take the full size or, for example, two buyers who can take 50 BTC each, there will likely be a bit of back and forth on the price until all parties have agreed to a price and the trade executes. Email index coindesk. Kieran Smith. Please note that this is a deprecated version and will be available until further notice in The most common reaction to this report expectedly saw it as yet another proof of lack of law as well as the presence of scams in the crypto industry. Contact us to integrate our data into your platform or app! How OTC trading is impacting the bitcoin price. But at the same time, it also highlights the need for significant regulations in the area of cryptocurrency trading if the technology wants to reach its full potential.