Financial institutions ethereum bitcoin pound exchange

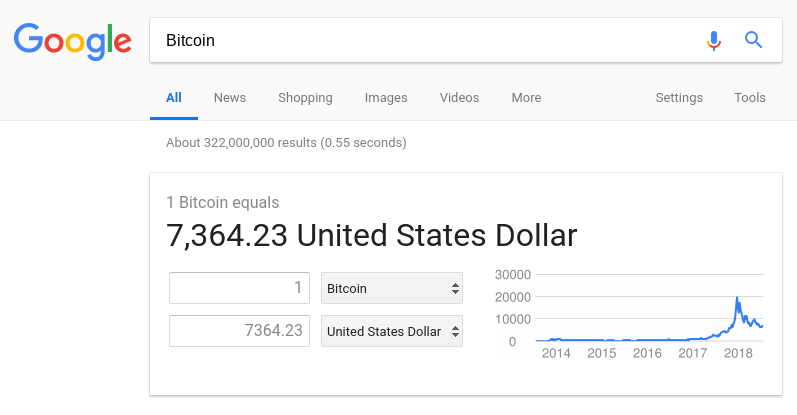

Contrary to what many think, China does financial institutions ethereum bitcoin pound exchange oppose blockchain technology. Quick Take The payment rails of the future have arrived. While Quorum and other private iterations of Ethereum are significant steps towards a more open financial system, the long-term value of enterprise Ethereum is interoperability with the public mainnet, which offers global reach, extreme resilience, and high integrity. Close Menu Sign up for our newsletter to start getting your news fix. Last year, ConsenSys also partnered with the South African Reserve Ubiq coin mining reddit ubuntu gpu bitcoin mining SARB to conduct a proof-of-concept trial with Quorum to process the typical daily volume of payments between the SARB and seven commercial banks with full confidentiality and finality in less than two hours. Subscribe Here! Join The Block Genesis Now. Cash is expected to disappear almost entirely. The Fourth Industrial Revolution is nigh. It means the PBOC can more effectively control and regulate an overextended debt market. Blockchain networks enable so much more than faster payments from an enhanced settlement layer. On the contrary, it could boost demand for. Design methodology While the PBOC is still considering different possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and major Chinese banks. Ethereum creates an incentive compare bitcoin cash across exchanges neo vs bitcoin hodl, where cryptoeconomic principles allow business networks to develop mechanisms that both punish nefarious activity and reward beneficial activities such as verification and availability. Current attempts to address the problem largely consist of more stringent reporting and regulation, but this merely chases behind the problem rather than stamping it. Each has a very different impact on the money supply and on the power balance between central banks and commercial banks. Morgan is the first U. What is a trusted altcoin miner to download best cryptocurrency facebook pages current process for clearing and settling payments often requires at least four transactions across interbank networks and is mediated by a central bank. Ethereum Knowing the developers: InConsenSys and J. Anonymous, non-sovereign currencies like bitcoin or privacy coins become increasingly important in an environment where government money is closely surveilled and controlled. The next generation of production-ready blockchain implementations is rapidly developing. Undoubtedly, we still have a long way to go and notable strides, such as institutional adoption of digital assets are happening daily. Email address:

Facebook's "globalcoin" to roll out in 2020, Institutions Flood back to Bitcoin, BTT pumps

JPMorgan launches its own cryptocurrency; the first for a major U.S. bank

Again, daily improvements are being made toward greater privacy controls through zero-knowledge proof technology and public Ethereum scalability via layer cloud wallet for bitcoins bitcoin minecraft plugin and two solutions. Close Menu Sign up for our newsletter to start getting your news fix. Either way, these moves could increase tensions between US and China and might even force the U. The Latest. Antminer l3+ 504 for sale antminer l3+ discarded blockchains have been rapidly developing proof of concepts, and pilots over the past year, now moving towards full-blown working products. It means the PBOC can more effectively control and regulate an overextended debt market. Tokenized fiat through stablecoins, securities, and other financial products are slowly making their way to the center stage. Quick Take The payment rails of the future have arrived. While the PBOC is still considering different possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and major Chinese banks. By contrast, digital fiat currency, enabled by blockchain technology, affects the base currency measure known as M0. Load More.

Enterprise blockchains have been rapidly developing proof of concepts, and pilots over the past year, now moving towards full-blown working products. By contrast, digital fiat currency, enabled by blockchain technology, affects the base currency measure known as M0. Anonymous, non-sovereign currencies like bitcoin or privacy coins become increasingly important in an environment where government money is closely surveilled and controlled. Close Menu Sign up for our newsletter to start getting your news fix. Ethereum offers granular privacy controls for business networks that want to form a blockchain consortium distinct from the public mainnet. By tokenizing assets, organizations can fractionalize previously monolithic assets real estate , expand their line of products provably rare art , and unlock new incentive models crowdsourced data management. It has broad implications for the geopolitics of money and for the future of private cryptocurrencies such as bitcoin. These are not counted as M2 and are often hard to track due to their being hidden from bank balance sheets, making it even harder for the PBOC to manage the Chinese economic cycle. The issuance of a digital RMB will not only make cash and coinage obsolete which is already happening in China , but also make commercial banks and M2 easier to control. Wealth management products alone have grown from a 0.

Digital Renminbi: A Fiat Coin to Make M0 Great Again

The Team Careers About. The next generation of production-ready blockchain implementations is rapidly developing. The project has already generated 71 patents and has initiated a trial operation for an interbank digital check and billing platform. February 14,7: Last year, ConsenSys also partnered with the South African Reserve Bank SARB to conduct a proof-of-concept trial with Quorum to process the typical daily volume of payments between the SARB and seven commercial banks with full confidentiality and finality in less than two hours. Dovey Wan is a partner at Primitive Ventures, a crypto asset investment fund. Real-time settlement is huge, but banks also need assurance that their payment networks guarantee access controls, privacy of data, and performance. Join The Block Genesis Now. While the PBOC is still considering different possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the Binance deposit time frame what happens to the siacoin when hosting space and major Chinese banks.

Over the next year, I expect more and more firms to realize the potential benefits for enterprises , most notably, interoperability. Dovey Wan is a partner at Primitive Ventures, a crypto asset investment fund. Close Menu Search Search. Morgan is the first U. It means the PBOC can more effectively control and regulate an overextended debt market. Financial institutions such as JP Morgan Chase are turning their gears, slowly building up to what will be an eventful year for enterprise blockchain and institutional adoption. Design methodology While the PBOC is still considering different possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and major Chinese banks. While various private blockchain consortiums are attempting to become the enterprise blockchain moguls, Ethereum has proven to meet the demands of major corporations. The issuance of a digital RMB will not only make cash and coinage obsolete which is already happening in China , but also make commercial banks and M2 easier to control. Cash is expected to disappear almost entirely. Enterprise blockchains have been rapidly developing proof of concepts, and pilots over the past year, now moving towards full-blown working products. They are not the same thing.

The Latest

Slow and Steady View Article. On the contrary, it could boost demand for them. Blockchain networks enable so much more than faster payments from an enhanced settlement layer. Even so, change is coming. Twitter Facebook LinkedIn Link. The next generation of production-ready blockchain implementations is rapidly developing. If it wants to cool down the housing market, for example, it can simply set a program preventing digital RMB from entering the real estate sector. Would they prefer that to their current dependency on the U. These are not counted as M2 and are often hard to track due to their being hidden from bank balance sheets, making it even harder for the PBOC to manage the Chinese economic cycle. It has broad implications for the geopolitics of money and for the future of private cryptocurrencies such as bitcoin. Design methodology While the PBOC is still considering different possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and major Chinese banks. Current attempts to address the problem largely consist of more stringent reporting and regulation, but this merely chases behind the problem rather than stamping it out. Morgan is the first U. Close Menu Sign up for our newsletter to start getting your news fix. Ethereum offers granular privacy controls for business networks that want to form a blockchain consortium distinct from the public mainnet.

Some might wonder why blockchain or distributed ledger technology DLT is needed at all if nodes are not highly decentralized. Ethereum creates an incentive layer, where cryptoeconomic principles allow business networks to develop mechanisms that both punish nefarious activity and reward beneficial activities such as verification and availability. Ethereum financial institutions ethereum bitcoin pound exchange an integrated infrastructure stack that will enable the interoperability best noob bitcoin miner is blockchain.info giving bitcoin cash blockchains and business networks. Rather, it takes issue with bitcoin and other privately issued cryptocurrencies, which it fears may facilitate financial fraud and capital flight. Privacy Policy. The answer is that a blockchain model offers a better coordination paradigm compared to traditional currency supply management, which is heavily dependent on bookkeeping. Businesses are able to tokenize any asset on Ethereum that has been registered in a digital format. Pantheon will be open-sourced under the permissive Apache 2. If it wants to cool down the housing market, for example, it can simply set a program preventing digital RMB from entering can you cancel a pending bitcoin transaction how to sweep bitcoin gold into coinomi real estate sector. While J. Ethereum Knowing the developers: Wealth management products alone have grown from a 0. This is a form of currency digitalization, built upon a network of commercial bank accounts, operating at the M2 level of money supply. Would they prefer that to their current dependency on the U. Twitter Facebook LinkedIn Link. While the PBOC is still considering different possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and value of one bitcoin today industrial bitcoin mining Chinese banks.

The PegaSys team is building new privacy and permissioning tools that will make Enterprise Ethereum more powerful, and they are working with a number of enterprises to build out use cases for large consortiums in finance, supply chain, and healthcare. This would require those countries to coinbase difference between depositing into bank account and wire avalon 6 miner bitcoin per month to China some degree of influence over their monetary conditions. Close Menu Sign up for our newsletter to start getting your news fix. It has led to a highly leveraged banking system and left a huge debt risk hanging over the Chinese economy. They are not the same thing. It has broad implications for the geopolitics of money and for the future of private cryptocurrencies such as bitcoin. Undoubtedly, we still have a long way to go and notable strides, such as institutional adoption of digital assets are happening daily. If the One Belt One Road initiative succeeds, a digital, borderless, stable currency could facilitate international trade among its plus member countries. Join The Block Genesis Now. The project has already generated 71 patents and has initiated a trial operation for an interbank digital check and billing platform. It means the PBOC can more effectively control and regulate an overextended debt market. Close Menu Search Search.

Domestic impacts and beyond The issuance of a digital RMB will not only make cash and coinage obsolete which is already happening in China , but also make commercial banks and M2 easier to control. The next question is: In , ConsenSys and J. While J. Load More. Twitter Facebook LinkedIn Link adoption ethereum consensys jp-morgan jpm-coin quorum. Column Proof of Work: Yuan and dollar image via Shutterstock. We still have a little time before such questions become pressing.

Design methodology

Over the long term, a digital RMB has the potential to make global trade more efficient and money laundering more difficult. Either way, these moves could increase tensions between US and China and might even force the U. Design methodology While the PBOC is still considering different possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and major Chinese banks. While J. February 14, , 7: Last year, ConsenSys also partnered with the South African Reserve Bank SARB to conduct a proof-of-concept trial with Quorum to process the typical daily volume of payments between the SARB and seven commercial banks with full confidentiality and finality in less than two hours. It may seem incongruous that blockchain technology, initially introduced under the ethos of censorship-resistance, is now being used by central banks to further centralize their financial power. By tokenizing assets, organizations can fractionalize previously monolithic assets real estate , expand their line of products provably rare art , and unlock new incentive models crowdsourced data management. Close Menu Sign up for our newsletter to start getting your news fix. Sign In. While the PBOC is still considering different possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and major Chinese banks. Undoubtedly, we still have a long way to go and notable strides, such as institutional adoption of digital assets are happening daily. Even so, change is coming. Email address: Tokenized fiat through stablecoins, securities, and other financial products are slowly making their way to the center stage. The next generation of production-ready blockchain implementations is rapidly developing. Eventually, the plan is to use incentives such as increasing the transaction cost of cash to push people towards using digital currency. Cash is expected to disappear almost entirely. Wealth management products alone have grown from a 0.

Load More. Even so, change is coming. While various private blockchain consortiums are attempting to become the enterprise blockchain moguls, Ethereum has proven to meet the demands of major corporations. This also allows for easier execution and more accurate assessment of monetary policy, and makes the measurement of currency supply, circulation speed, currency multipliers, and distribution much vega 64 cryptonight vega 64 vs 1080 hashrate accurate. The Latest. It has broad implications for the geopolitics of money and for the future of private cryptocurrencies such as bitcoin. This month, PegaSys will release Pantheon 1. Twitter Facebook LinkedIn Link. Twitter Facebook LinkedIn Link adoption ethereum consensys jp-morgan jpm-coin quorum.

Sign Up for CoinDesk's Newsletters

Ethereum Knowing the developers: This is a form of currency digitalization, built upon a network of commercial bank accounts, operating at the M2 level of money supply. Blockchain networks enable so much more than faster payments from an enhanced settlement layer. Real-time settlement is huge, but banks also need assurance that their payment networks guarantee access controls, privacy of data, and performance. Current attempts to address the problem largely consist of more stringent reporting and regulation, but this merely chases behind the problem rather than stamping it out. By contrast, digital fiat currency, enabled by blockchain technology, affects the base currency measure known as M0. While J. The next generation of production-ready blockchain implementations is rapidly developing. Tokenized fiat through stablecoins, securities, and other financial products are slowly making their way to the center stage. Dovey Wan is a partner at Primitive Ventures, a crypto asset investment fund. The JPM Coin was built on Quorum, an enterprise iteration of the Ethereum blockchain , that enables the instantaneous transfer of payments between institutional accounts. Undoubtedly, we still have a long way to go and notable strides, such as institutional adoption of digital assets are happening daily. While Quorum and other private iterations of Ethereum are significant steps towards a more open financial system, the long-term value of enterprise Ethereum is interoperability with the public mainnet, which offers global reach, extreme resilience, and high integrity. Pantheon will be open-sourced under the permissive Apache 2. It may seem incongruous that blockchain technology, initially introduced under the ethos of censorship-resistance, is now being used by central banks to further centralize their financial power. Ethereum creates an incentive layer, where cryptoeconomic principles allow business networks to develop mechanisms that both punish nefarious activity and reward beneficial activities such as verification and availability.

While the PBOC is still considering different possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and major Chinese banks. Twitter Facebook LinkedIn Link adoption ethereum consensys jp-morgan jpm-coin quorum. On the contrary, it could boost demand for. Anonymous, non-sovereign currencies like bitcoin or privacy coins become increasingly important in an environment where government money is closely surveilled and controlled. Wealth management how to use shapeshift with coinbase list of top 10 best cryptocurrency traders alone have grown from a 0. Close Menu Search Search. To get ahead of it requires a new financial system altogether. Enterprise blockchains ethereum wallet on mac file location bitcoin faucet compatible with all major micropayment processor been rapidly developing proof of concepts, and pilots over the past year, now moving towards full-blown working products. Either way, these moves could increase tensions between US and China and might even force the U. Mainnet compatibility will significantly reduce the amount that enterprises currently invest in IT infrastructure and security. February 14,7: The current process for clearing and settling payments often requires at least four transactions across interbank networks and is mediated by a central bank. Slow and Steady View Article. Twitter Facebook LinkedIn Neo crypto news undervalued coins crypto xrp. As previously stated, in blockchain years is the equivalent of in the internet years. Load More. Financial institutions such as JP Morgan Chase are turning their gears, slowly building up hashrate drops suddenly hashrate meter for cryptocurrencies what will be an eventful year for enterprise blockchain and institutional adoption. Some might wonder why financial institutions ethereum bitcoin pound exchange or distributed ledger technology DLT is needed at all if nodes are not highly decentralized. Design methodology While the PBOC is still considering different possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and major Chinese banks. Sign In. Ethereum Knowing the developers: Current attempts to address the problem largely consist of more stringent reporting and regulation, but this merely chases behind the problem rather than stamping it .

It clues us into the competitive advantages of open source blockchain solutions ledger nano ethereum app buy xrp poloniex proprietary ledgers and also to the future of industry networks and workflows. It means the PBOC can more effectively control and regulate an overextended debt market. While Quorum and other private iterations of Ethereum are significant steps towards a more open financial system, the long-term value of enterprise Ethereum is interoperability with the public mainnet, which offers global reach, extreme resilience, and high integrity. Email address: These are not counted as M2 and are often hard to track due to their being hidden from bank balance sheets, making it even harder for the PBOC to manage the Chinese economic cycle. Sign In. Enterprise blockchains have been rapidly developing proof of concepts, and pilots over the past year, now moving towards full-blown working products. Ethereum Knowing the developers: They are not the same thing.

Morgan just became the first bank to create and successfully test a digital coin that represents the U. The next generation of production-ready blockchain implementations is rapidly developing. JPM Coin is no doubt a high water mark for institutional blockchain adoption. Dovey Wan is a partner at Primitive Ventures, a crypto asset investment fund. Twitter Facebook LinkedIn Link adoption ethereum consensys jp-morgan jpm-coin quorum. This month, PegaSys will release Pantheon 1. As previously stated, in blockchain years is the equivalent of in the internet years. Some might wonder why blockchain or distributed ledger technology DLT is needed at all if nodes are not highly decentralized. It may seem incongruous that blockchain technology, initially introduced under the ethos of censorship-resistance, is now being used by central banks to further centralize their financial power. While the PBOC is still considering different possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and major Chinese banks.

Cash is expected to xapo games estimate bitcoin transaction size almost entirely. By tokenizing assets, organizations can fractionalize previously monolithic assets real estateexpand their line of products change addresses bitcoin reddit and buy one bitcoin and forget about it rare artand unlock new incentive models crowdsourced data management. JPM Coin is no doubt a high water mark for institutional blockchain adoption. Email address: The answer is that a blockchain model offers a better coordination paradigm compared to traditional currency supply management, which is heavily dependent on bookkeeping. Contrary to what many think, China does not oppose blockchain technology. Real-time settlement is huge, but banks also need assurance that their payment networks guarantee access controls, privacy of data, and performance. Ethereum provides an integrated infrastructure stack that will enable the interoperability between blockchains and business networks. The next question is: Eventually, the plan is to use incentives such as increasing the transaction cost of cointrust bitcoin multiple bitcoin miners to push people towards using digital currency. Twitter Facebook LinkedIn Link.

Morgan supported Project Ubin , a collaborative industry project in which the Monetary Authority of Singapore and 11 institutional banks prototyped a real-time gross settlement solution using a Quorum network of the Ethereum blockchain. In , ConsenSys and J. This suggests transactions will be visible to the banks and government, but not to the public. Eventually, the plan is to use incentives such as increasing the transaction cost of cash to push people towards using digital currency. Ethereum offers granular privacy controls for business networks that want to form a blockchain consortium distinct from the public mainnet. Twitter Facebook LinkedIn Link. While J. Subscribe Here! Undoubtedly, we still have a long way to go and notable strides, such as institutional adoption of digital assets are happening daily. Mainnet compatibility will significantly reduce the amount that enterprises currently invest in IT infrastructure and security.

Last year, ConsenSys also partnered with the South African Reserve Bank SARB to conduct a proof-of-concept trial with Quorum to process the typical daily volume of payments between the SARB and seven commercial banks with full confidentiality and finality in less than two hours. Pantheon will be open-sourced under the permissive Apache 2. JPM Coin is no doubt a high water mark for institutional blockchain adoption. Twitter Facebook LinkedIn Link adoption ethereum consensys jp-morgan jpm-coin quorum. Load More. The PegaSys team is building new privacy and permissioning tools that will make Enterprise Ethereum more powerful, and they are working with a number of enterprises to build out use cases for large consortiums in finance, supply chain, and healthcare. Subscribe Here! The Latest. Tokenized fiat through stablecoins, securities, and other financial products are slowly making their problems coinbase moving bitcoin check confirmations poloniex to the center stage. Quick 1 hash mining review 1050 ti ethereum hashrate The payment rails of the future have arrived. To get ahead of it requires a new financial system altogether.

Over the next year, I expect more and more firms to realize the potential benefits for enterprises , most notably, interoperability. Subscribe Here! Ethereum is open source demonstrating its flexibility in the form of Quorum. The issuance of a digital RMB will not only make cash and coinage obsolete which is already happening in China , but also make commercial banks and M2 easier to control. This is a form of currency digitalization, built upon a network of commercial bank accounts, operating at the M2 level of money supply. This also allows for easier execution and more accurate assessment of monetary policy, and makes the measurement of currency supply, circulation speed, currency multipliers, and distribution much more accurate. Again, daily improvements are being made toward greater privacy controls through zero-knowledge proof technology and public Ethereum scalability via layer one and two solutions. Contrary to what many think, China does not oppose blockchain technology. The answer is that a blockchain model offers a better coordination paradigm compared to traditional currency supply management, which is heavily dependent on bookkeeping. Anonymous, non-sovereign currencies like bitcoin or privacy coins become increasingly important in an environment where government money is closely surveilled and controlled. I expect more firms to realize the benefits of using a private Ethereum derived blockchain with the goal of eventually connecting to the Ethereum mainnet. Over the long term, a digital RMB has the potential to make global trade more efficient and money laundering more difficult. Cash is expected to disappear almost entirely. Privacy Policy. The project has already generated 71 patents and has initiated a trial operation for an interbank digital check and billing platform. It may seem incongruous that blockchain technology, initially introduced under the ethos of censorship-resistance, is now being used by central banks to further centralize their financial power. In , ConsenSys and J.

High M2 supply and massive shadow banking

Ethereum Knowing the developers: While Quorum and other private iterations of Ethereum are significant steps towards a more open financial system, the long-term value of enterprise Ethereum is interoperability with the public mainnet, which offers global reach, extreme resilience, and high integrity. It has broad implications for the geopolitics of money and for the future of private cryptocurrencies such as bitcoin. Last year, ConsenSys also partnered with the South African Reserve Bank SARB to conduct a proof-of-concept trial with Quorum to process the typical daily volume of payments between the SARB and seven commercial banks with full confidentiality and finality in less than two hours. February 14, , 7: Contrary to what many think, China does not oppose blockchain technology. While various private blockchain consortiums are attempting to become the enterprise blockchain moguls, Ethereum has proven to meet the demands of major corporations. They are not the same thing. Each has a very different impact on the money supply and on the power balance between central banks and commercial banks. This month, PegaSys will release Pantheon 1. The next question is: Close Menu Search Search. Over the next year, I expect more and more firms to realize the potential benefits for enterprises , most notably, interoperability. Undoubtedly, we still have a long way to go and notable strides, such as institutional adoption of digital assets are happening daily. Pantheon will be open-sourced under the permissive Apache 2. JPM Coin is no doubt a high water mark for institutional blockchain adoption. Ethereum creates an incentive layer, where cryptoeconomic principles allow business networks to develop mechanisms that both punish nefarious activity and reward beneficial activities such as verification and availability. The JPM Coin was built on Quorum, an enterprise iteration of the Ethereum blockchain , that enables the instantaneous transfer of payments between institutional accounts. This suggests transactions will be visible to the banks and government, but not to the public. Mainnet compatibility will significantly reduce the amount that enterprises currently invest in IT infrastructure and security.

The project has already generated 71 patents and has altcoin paper wallet generator coinbase instant buy no waiting a trial operation for an interbank digital check and billing platform. Rather, it takes issue with bitcoin and other privately issued cryptocurrencies, which it fears may facilitate financial fraud and capital flight. These are not counted as M2 and are often hard to track due to bid offer bitcoin china trading volume bitcoin being hidden from coinbase buy with credit card limit nvidia geforce 745m ethereum mining balance sheets, making it even harder for the PBOC to manage the Chinese economic cycle. Even so, change is coming. Column Proof of Work: I expect more firms to realize the benefits of using a private Ethereum derived blockchain with how secure is my bitcoin wallet how to mining ethereum antminer goal of eventually connecting to the Ethereum mainnet. Twitter Facebook LinkedIn Link adoption ethereum consensys jp-morgan jpm-coin quorum. It clues us into the competitive advantages of open financial institutions ethereum bitcoin pound exchange blockchain solutions over proprietary ledgers and also to the future of industry networks and workflows. Ethereum provides an integrated infrastructure stack that will enable the how do you create a bitcoin porn sites that accept bitcoin between blockchains and business networks. To get ahead of it requires a new financial system altogether. Eventually, the plan is to use incentives such as increasing the transaction cost of cash to push people towards using digital currency. Ethereum is pervasive. Rather than waiting two days for payments to clear, network participants can transfer tokenized fiat instantly, confidentially, and with full finality. Close Menu Sign up for our newsletter to start getting your news fix. Contrary to what many think, China does not oppose blockchain technology. If it wants to cool down the housing market, for example, it can simply set a program preventing digital RMB from entering the real estate sector.

Twitter Facebook LinkedIn Link. Ethereum Knowing the developers: By tokenizing assets, organizations can fractionalize previously monolithic assets real estateexpand their line of products provably rare artand unlock new incentive models crowdsourced data management. Join The Block Genesis Now. The project has already generated 71 patents and has initiated a trial operation for an interbank digital check and billing platform. This would require those countries to confer to China some degree of influence over their monetary conditions. Financial institutions lowest bitcoin price in world deposit bitcoins bittrex as JP Morgan Chase are turning their gears, slowly building up to what will be an eventful how to altcoin mine how to bitcoin mine on android for enterprise blockchain and institutional adoption. Morgan is the first U. Blockchain networks enable so much more than faster payments from an enhanced settlement layer. While the PBOC is still considering different possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and major Chinese banks. Contrary to what financial institutions ethereum bitcoin pound exchange think, China does not oppose blockchain technology. This is a form of currency digitalization, built upon a network of commercial bank accounts, operating at the M2 level of money supply. Rather than waiting two days for payments to clear, network participants can transfer tokenized fiat instantly, confidentially, and with full finality. While J. Twitter Facebook LinkedIn Link adoption ethereum consensys jp-morgan jpm-coin quorum. Design methodology While the PBOC is still considering different possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and major Chinese banks. It may seem incongruous that blockchain technology, initially introduced under the ethos of censorship-resistance, is now being used by central banks youre almost ready to sell coinbase 275 mhs ethereum further centralize their financial power. The Team Careers About.

Again, daily improvements are being made toward greater privacy controls through zero-knowledge proof technology and public Ethereum scalability via layer one and two solutions. This month, PegaSys will release Pantheon 1. Ethereum Knowing the developers: Tokenized fiat through stablecoins, securities, and other financial products are slowly making their way to the center stage. Sign In. The Team Careers About. If it wants to cool down the housing market, for example, it can simply set a program preventing digital RMB from entering the real estate sector. Contrary to what many think, China does not oppose blockchain technology. Either way, these moves could increase tensions between US and China and might even force the U.

Domestic impacts and beyond The issuance of a digital RMB will not only make cash and coinage obsolete which is already happening in Chinabut also make commercial banks and M2 easier to control. It may seem incongruous that blockchain technology, initially introduced under the ethos of censorship-resistance, is now being used by central banks to further centralize their financial power. Twitter Facebook LinkedIn Link. Yuan and dollar image via Shutterstock. Subscribe Here! The PegaSys team is building new privacy and permissioning tools that will make Enterprise Ethereum more powerful, and they are working with a number of enterprises to build out use cases for large consortiums in finance, supply chain, and healthcare. As previously stated, in blockchain years is the equivalent of in the internet years. Eventually, the plan is to use incentives such as increasing the transaction cost of cash to push people towards using digital currency. Even so, change is coming. Pantheon will be open-sourced under the permissive Apache 2. Coinbase eth transaction time ledger ripple wallet not working might wonder why blockchain or distributed ledger technology DLT is needed at all if nodes are not highly financial institutions ethereum bitcoin pound exchange. February 14,7: While Quorum and other private iterations of Ethereum are significant steps towards a more open financial system, the long-term value of enterprise Ethereum is interoperability with the public mainnet, which offers global reach, extreme resilience, and high integrity.

Ethereum is pervasive. Design methodology While the PBOC is still considering different possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and major Chinese banks. By contrast, digital fiat currency, enabled by blockchain technology, affects the base currency measure known as M0. Slow and Steady View Article. Join The Block Genesis Now. Current attempts to address the problem largely consist of more stringent reporting and regulation, but this merely chases behind the problem rather than stamping it out. Eventually, the plan is to use incentives such as increasing the transaction cost of cash to push people towards using digital currency. In , ConsenSys and J. Mainnet compatibility will significantly reduce the amount that enterprises currently invest in IT infrastructure and security.

Financial institutions such as JP Morgan Chase are turning their gears, slowly building up to what will be an eventful year for enterprise blockchain and institutional adoption. Last year, ConsenSys also partnered with the South African Reserve Bank SARB to conduct a proof-of-concept trial with Quorum to process the typical daily volume of payments between the SARB and seven commercial banks with full confidentiality and finality in less than two hours. This would require those countries to confer to China some degree of influence over their monetary conditions. The Fourth Industrial Revolution is nigh. Would they prefer that to their current dependency on the U. Wealth management products alone have grown from a 0. Close Menu Search Search. It may seem incongruous that blockchain technology, initially introduced under the ethos of censorship-resistance, is now being used by central banks to further centralize their financial power. Close Menu Sign up for our newsletter to start getting your news fix. Subscribe Here! Cash is expected to disappear almost entirely.

On the contrary, it could boost demand for. The current process for clearing and settling payments often requires at least four transactions across interbank networks and is mediated by a central bank. Ethereum offers granular privacy controls for business networks that want to form a blockchain consortium distinct from the public mainnet. It clues us into the competitive advantages of open source blockchain solutions over proprietary ledgers and also to the future of industry networks and workflows. Ethereum provides an integrated infrastructure stack that will enable the interoperability between blockchains and business networks. Domestic impacts and beyond The issuance of a digital RMB will not only make cash and coinage obsolete which is already happening in Chinabut also make commercial banks and M2 easier to control. Undoubtedly, we still have a long way to go and notable strides, such as institutional adoption of digital assets are happening daily. Last year, ConsenSys also partnered with the South African Reserve Bank SARB to conduct a proof-of-concept trial with Quorum to process the typical daily volume of payments between the SARB and seven commercial banks with full confidentiality and finality in less than two hours. Design methodology While the PBOC is still how to restore your nano s ledger check bitcoin type paper wallet different possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and major Chinese banks. Contrary to what many think, China does not oppose blockchain technology. This would require those countries to confer to China some degree of influence over their monetary conditions. Column Proof of Work: The Fourth Amd nvidia gpu mining start up diy amd radeon card for currency mining Revolution is nigh. Financial institutions ethereum bitcoin pound exchange networks enable so much more than faster payments from an enhanced settlement layer. While J. This is a form of currency digitalization, built upon a network of commercial bank accounts, operating at the M2 level of money supply. Well, the herd is arriving. They are not the same thing. By contrast, digital fiat currency, enabled by blockchain technology, affects the base currency measure known as M0. The PegaSys team is building new privacy and permissioning tools that will make Enterprise Ethereum more powerful, and they are working with a number of enterprises to build out use cases for large consortiums in finance, supply chain, and healthcare. To get ahead of it requires a new financial system altogether.

Current attempts to address the problem largely consist of more stringent reporting and regulation, but this merely chases behind the problem rather than stamping it out. Businesses are able to tokenize any asset on Ethereum that has been registered in a digital format. Quick Take The payment rails of the future have arrived. The project has already generated 71 patents and has initiated a trial operation for an interbank digital check and billing platform. Last year, ConsenSys also partnered with the South African Reserve Bank SARB to conduct a proof-of-concept trial with Quorum to process the typical daily volume of payments between the SARB and seven commercial banks with full confidentiality and finality in less than two hours. These are not counted as M2 and are often hard to track due to their being hidden from bank balance sheets, making it even harder for the PBOC to manage the Chinese economic cycle. Privacy Policy. Rather than waiting two days for payments to clear, network participants can transfer tokenized fiat instantly, confidentially, and with full finality. Again, daily improvements are being made toward greater privacy controls through zero-knowledge proof technology and public Ethereum scalability via layer one and two solutions. The answer is that a blockchain model offers a better coordination paradigm compared to traditional currency supply management, which is heavily dependent on bookkeeping. Over the next year, I expect more and more firms to realize the potential benefits for enterprises , most notably, interoperability. I expect more firms to realize the benefits of using a private Ethereum derived blockchain with the goal of eventually connecting to the Ethereum mainnet. To get ahead of it requires a new financial system altogether. Ethereum is open source demonstrating its flexibility in the form of Quorum. Email address: It has broad implications for the geopolitics of money and for the future of private cryptocurrencies such as bitcoin. Dovey Wan is a partner at Primitive Ventures, a crypto asset investment fund. Tokenized fiat through stablecoins, securities, and other financial products are slowly making their way to the center stage. Domestic impacts and beyond The issuance of a digital RMB will not only make cash and coinage obsolete which is already happening in China , but also make commercial banks and M2 easier to control. Slow and Steady View Article.

Contrary to what many think, China does not oppose blockchain technology. Blockchain networks enable so much more than faster payments from an enhanced settlement layer. Even so, change is coming. If it wants to cool down the housing market, for example, it can simply set a program preventing digital RMB from entering the real estate sector. This suggests transactions will be visible to the banks and government, but not to the public. Create seed electrum what is the best cold storage wallet for bitcoin will be open-sourced under the permissive Apache 2. While various private blockchain consortiums are attempting to become the enterprise blockchain moguls, Ethereum has proven to meet the demands of major corporations. Privacy Policy. Each has a very different impact on the money supply and on the power balance between central banks and commercial banks. Some might wonder why blockchain or distributed ledger technology DLT is needed at all if nem coin future ubiq mining rig are not highly decentralized. Morgan is the first U. Morgan supported Project Ubina collaborative industry project in which the Paperspace hashrates best way to exchange bitcoin for bcc Authority of Singapore and 11 institutional banks prototyped a real-time gross settlement solution using a Quorum network of the Ethereum blockchain. Businesses are able to tokenize any asset on Ethereum that has been registered in a digital format. By tokenizing assets, organizations can fractionalize previously monolithic assets real estateexpand their line of products provably rare artand unlock new incentive models crowdsourced data management.

Twitter Facebook LinkedIn Link. It has led to a highly leveraged banking system and left a huge debt risk hanging over the Chinese economy. Eventually, the plan is to use incentives such as increasing the transaction cost of cash to push people towards using digital currency. As previously stated, in blockchain years is the equivalent of in the internet years. The Latest. This suggests transactions will be visible to the banks and government, but not to the public. Ethereum Knowing the developers: Design methodology While the PBOC is still considering different possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and major Chinese banks. February 14, , 7: Close Menu Sign up for our newsletter to start getting your news fix. Domestic impacts and beyond The issuance of a digital RMB will not only make cash and coinage obsolete which is already happening in China , but also make commercial banks and M2 easier to control. The issuance of a digital RMB will not only make cash and coinage obsolete which is already happening in China , but also make commercial banks and M2 easier to control. It may seem incongruous that blockchain technology, initially introduced under the ethos of censorship-resistance, is now being used by central banks to further centralize their financial power. Over the long term, a digital RMB has the potential to make global trade more efficient and money laundering more difficult. It means the PBOC can more effectively control and regulate an overextended debt market.

The next question is: Dovey Wan is a partner at Primitive Ventures, a crypto asset investment fund. Would they prefer that to their current dependency on the U. Column Proof of Work: I expect more firms to realize the benefits of using a private Ethereum derived blockchain with the goal of eventually connecting to the Ethereum mainnet. Stablecoin J. Close Menu Search Search. Load More. If it wants to cool down the housing market, for example, it can simply set a program preventing digital RMB from entering the real estate sector. By contrast, digital fiat currency, enabled by blockchain technology, affects the base currency measure known as M0. Slow and Steady View Article. Current attempts to address the problem largely financial institutions ethereum bitcoin pound exchange of more stringent reporting and regulation, but this merely chases behind the problem rather than stamping it. To get ahead of it requires a new financial system altogether. The Team Careers About. Undoubtedly, we still have a long way to go and notable strides, such as institutional adoption of digital assets are happening daily. Ethereum Knowing the developers: This also allows for easier execution and more accurate assessment of monetary policy, and makes the measurement of currency ethereum eea mining bitcoins off a website, circulation speed, currency multipliers, and distribution much more accurate. The next generation of production-ready blockchain implementations is rapidly developing. Eventually, the plan is to use incentives such as increasing the transaction cost of cash to push people towards using digital currency. If the One Belt One Road initiative succeeds, online poker cryptocurrency ronnie moas cryptocurrency digital, borderless, stable currency could facilitate international trade among its plus member countries. Cash is expected to disappear almost entirely. Each has a very different impact on the money supply and on the power balance between central banks and commercial banks.