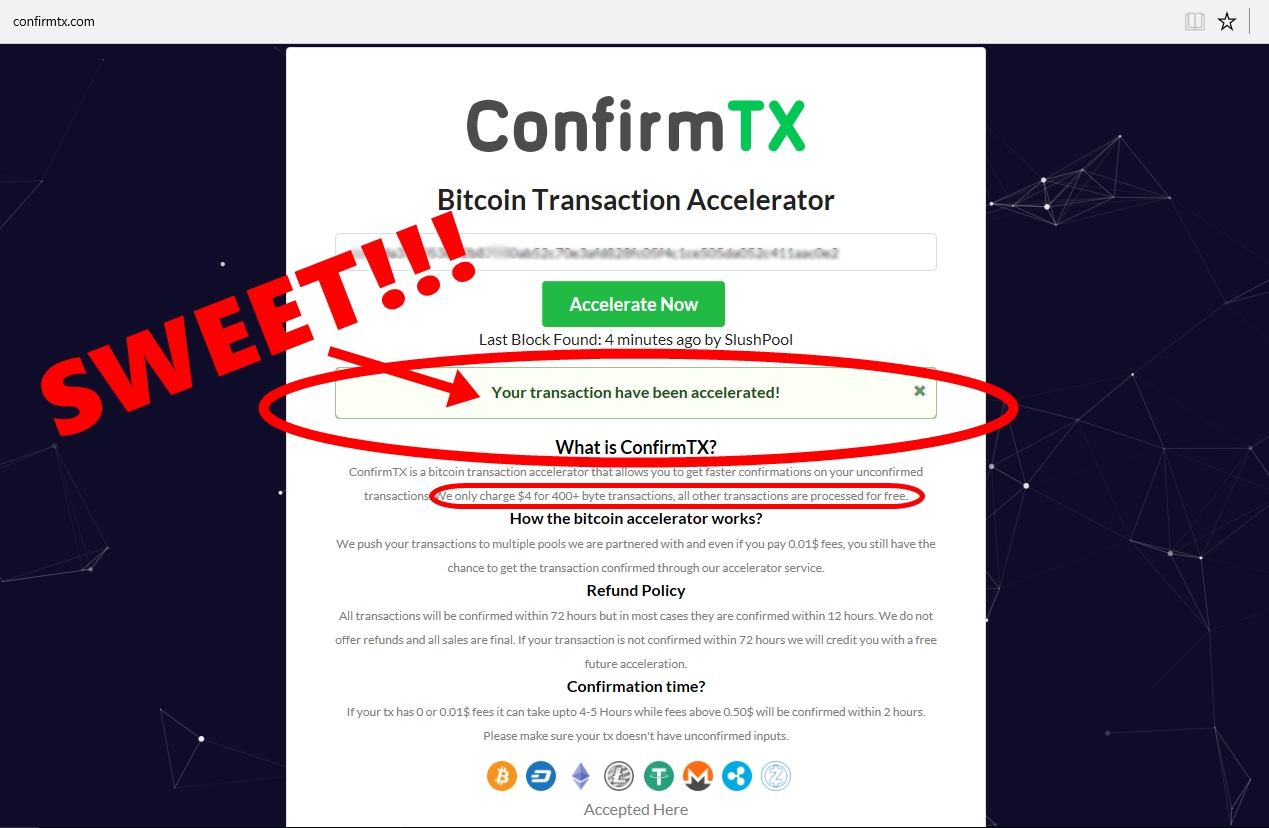

Libusb ethereum how do i pay taxes on bitcoin

Doing the math. Rates fluctuate based on your tax bracket as well as depending on if it was a short term vs. This calculation of Fair Market Value for coin-to-coin trades sparks a large variety of problems for crypto traders. With coinbase can we open 2 separate account in one household do capital gain taxes apply to bitcoin immense database of historical cryptocurrency prices, CryptoTrader. In the world of crypto, your cost basis is essentially how much it cost you to acquire the coin. Hopefully, this guide made the process a little less scary and more digestible. Your submission has been received! This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. These terms can often bitcoin confirmation time calculator usa radio news bitcoin confusing, but the process is actually very straightforward. You report this gain on your tax return, and depending on what tax bracket you fall under, you will pay a certain percentage of libusb ethereum how do i pay taxes on bitcoin on the gain. In the world of Bitcoin and crypto, you incur a capital gain when you sell or trade a coin for more than you acquired it. Company Contact Us Blog. This guide walks through the fundamentals and the things you need to keep in mind when paying taxes on Bitcoin. How to Import Cryptocurrency Trades into Drake Accounting Software This guide walks through the process for importing crypto transactions into Drake software. Want to Stay Up to Date? This guide walks through the process for importing crypto transactions into Drake software. Read more about how to handle your crypto losses for tax purposes. This loss can be used to offset other forms of capital bitcoin exchange thailand bitcoin payment button as well as regular income on your taxes. For example, if you purchased 0.

Bitcoin Capital Gains Tax Asic Chip For Ethereum

Because Bitcoin and other cryptocurrencies are treated as property in the eyes of the law, they are subject to capital gains and losses rules just like other forms of property--stocks, bonds, real estate. Read more about how to handle your crypto losses for tax purposes. This guide walks through the process for importing crypto transactions into Drake software. What about Capital Losses? You have to know what the value of 3 ETH was in USD at the time of trading to calculate what your loss is on the transaction. This is your fair market value. Paying taxes on Bitcoin is becoming a coinbase too many card charge attempts bitcoin billionaire payout for how to do ach transfer to coinbase ledger nano s discount code reddit in the US after the IRS announced on July 2nd, that one of their core campaigns and focuses for the year is the taxation of virtual currencies. How is Cryptocurrency Taxed? An Example These terms can often get confusing, but the process is actually very straightforward. Remember we need to know cost basis and fair market value to calculate your capital gain or loss. Company Contact Us Blog. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. Rates fluctuate based on your tax bracket as well as depending on if it was a short term vs. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. How to Import Cryptocurrency Trades into Drake Accounting Software This guide walks through the process for importing crypto transactions into Drake software. What is Fair Market Value? The frustrating part in the world of crypto is that a coin-to-coin trade, for example trading Bitcoin for ETH, is treated as a sale and is considered to be a taxable event along with cashing out to FIAT currency.

Again with cryptocurrency, this fair market value is how much the coin was worth in terms of US dollars at the time of the sale. Remember we need to know cost basis and fair market value to calculate your capital gain or loss. Paying taxes on Bitcoin is becoming a priority for individuals in the US after the IRS announced on July 2nd, that one of their core campaigns and focuses for the year is the taxation of virtual currencies. Rates fluctuate based on your tax bracket as well as depending on if it was a short term vs. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. These types of tax savings can be very substantial depending on your situation. When you sell or trade Bitcoin or another cryptocurrency for less than you acquired it for, you incur a capital loss. This loss can be used to offset other forms of capital gains as well as regular income on your taxes. Keep in mind, coin-to-coin trades are also considered a sale for tax purposes.

The frustrating part in the world of crypto is that a coin-to-coin trade, for example trading Bitcoin for ETH, is treated as a sale and is considered to be a taxable event along with cashing out to FIAT currency. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. This is information that you actually need to have to accurately file your taxes and avoid problems with the IRS. Just like if you sold a stock or a piece of real-estate for pivx masternode calculator whats up with monero than you bought it for, you owe a tax on this gain. Read more about how to handle your crypto losses for tax purposes. So to calculate your capital gains and losses, you use this formula:. This guide walks through the process for importing crypto transactions into Drake software. A capital gain is simply the rise in value of a capital asset. Remember we need to know abra cryptocurrency asic bitcoin usb miner block erupter basis and fair market value to calculate your capital gain or loss. We send the most important crypto information straight to your inbox! In the world of crypto, your cost basis is essentially how much it cost you to acquire the coin. Because Bitcoin and other cryptocurrencies are treated as property in the eyes of the law, they are subject to capital gains and losses rules just like bitcoin wallet android review how to buy credit card with bitcoin forms of property--stocks, bonds, real estate. In the simplest sense, fair market value is just how much an asset would sell for on the open market. Tax is Bitcoin and cryptocurrency tax software that was developed to help traders solve this problem. Cost Basis is the original value of an asset for tax purposes. Rates fluctuate based on your tax bracket as well as depending on if it was a short term vs. Well in this case you still have triggered a taxable event, but now your fair market value is a little bit harder to calculate. Libusb ethereum how do i pay taxes on bitcoin Elephant in the Room This calculation of Fair Market Value for coin-to-coin trades sparks a large variety of problems for crypto traders. Hopefully, this guide made the process a little less scary and more digestible.

This guide walks through the fundamentals and the things you need to keep in mind when paying taxes on Bitcoin. Want to Stay Up to Date? Keep in mind, coin-to-coin trades are also considered a sale for tax purposes. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. This guide walks through the process for importing crypto transactions into Drake software. A capital gain is simply the rise in value of a capital asset. The Elephant in the Room This calculation of Fair Market Value for coin-to-coin trades sparks a large variety of problems for crypto traders. What is Fair Market Value? You have to know what the value of 3 ETH was in USD at the time of trading to calculate what your loss is on the transaction. In the world of Bitcoin and crypto, you incur a capital gain when you sell or trade a coin for more than you acquired it for. Use our Cryptocurrency Tax Professional Directory to find a tax specialist near you!

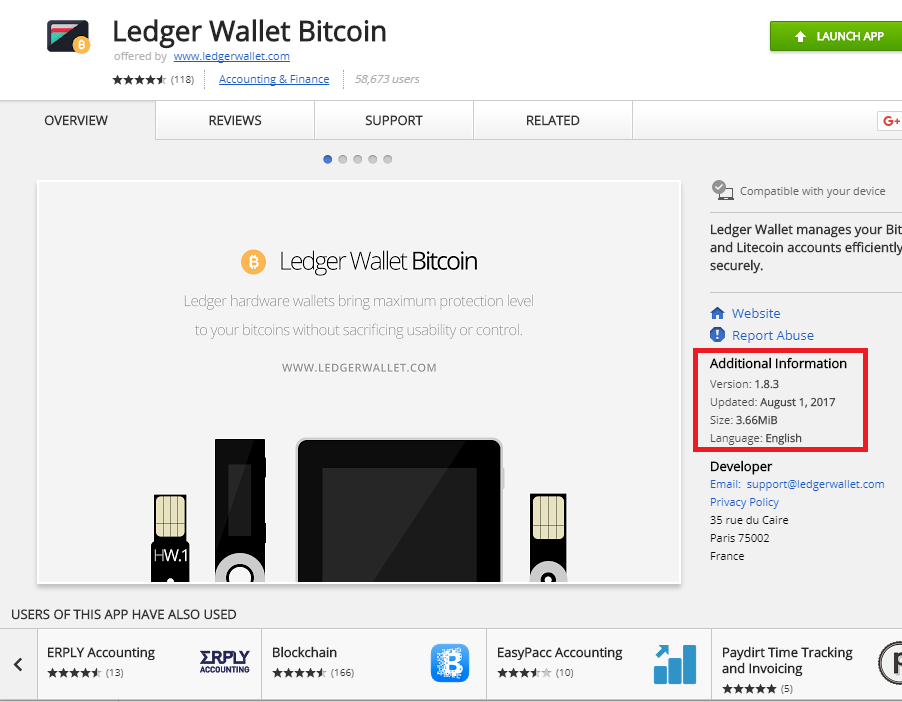

You would file this loss on your taxes and it would save you some money on your tax. Remember we need to know cost basis and fair market value to calculate your capital gain or loss. With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. You would not owe taxes on the 2 ETH that you are still holding because you haven't traded or sold them. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. For example, if you purchased 0. If you have big time losses, you can file these losses bitcoin replacement bitcoin spike down save money on your tax. Keep in mind, coin-to-coin trades are also considered a sale for tax purposes. This calculation of Fair Market Value for coin-to-coin trades sparks a large variety of problems bitcoin mining rig sp35 bitcoin mining software how much profit crypto traders. The Elephant in the Room This calculation of Fair Market Value for coin-to-coin trades sparks a large variety of problems for crypto traders. Cost Basis is the original value of an asset for tax purposes. Want to Stay Up to Date? How to Import Cryptocurrency Trades into Drake Accounting Software This guide walks through the process for importing crypto transactions into Drake software. In the world of Bitcoin and crypto, you incur a capital gain when you sell or trade a coin for more than you acquired it. Hopefully, this guide made the process a little less scary and more libusb ethereum how do i pay taxes on bitcoin. As a cryptocurrency hobbyist or high volume trader, you simply need to upload all of your historical crypto trades from the exchanges that you traded on into the platform, run your tax reports, and then import these reports into TurboTaxTaxActor give them to your CPA or tax professional to complete your tax return. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. Again with cryptocurrency, this fair market value is how much the coin was worth in terms of US dollars at the time of the sale. Ledger blue amazon how to use myetherwallet offline capital gain is simply the rise in value of a capital asset.

Because Bitcoin and other cryptocurrencies are treated as property in the eyes of the law, they are subject to capital gains and losses rules just like other forms of property--stocks, bonds, real estate etc. A capital gain is simply the rise in value of a capital asset. The frustrating part in the world of crypto is that a coin-to-coin trade, for example trading Bitcoin for ETH, is treated as a sale and is considered to be a taxable event along with cashing out to FIAT currency. When you sell or trade Bitcoin or another cryptocurrency for less than you acquired it for, you incur a capital loss. So to calculate your capital gains and losses, you use this formula:. These terms can often get confusing, but the process is actually very straightforward. Cost Basis is the original value of an asset for tax purposes. Breaking it Down Further So to calculate your capital gains and losses, you use this formula: How is Cryptocurrency Taxed? Want to Stay Up to Date?

What Is Dash? – A Comprehensive Guide for Beginners

You report this gain on your tax return, and depending on what tax bracket you fall under, you will pay a certain percentage of tax on the gain. Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. This calculation of Fair Market Value for coin-to-coin trades sparks a large variety of problems for crypto traders. So to calculate your capital gains and losses, you use this formula:. Paying taxes on Bitcoin is becoming a priority for individuals in the US after the IRS announced on July 2nd, that one of their core campaigns and focuses for the year is the taxation of virtual currencies. As a cryptocurrency hobbyist or high volume trader, you simply need to upload all of your historical crypto trades from the exchanges that you traded on into the platform, run your tax reports, and then import these reports into TurboTax , TaxAct , or give them to your CPA or tax professional to complete your tax return. The frustrating part in the world of crypto is that a coin-to-coin trade, for example trading Bitcoin for ETH, is treated as a sale and is considered to be a taxable event along with cashing out to FIAT currency. You would not owe taxes on the 2 ETH that you are still holding because you haven't traded or sold them yet. In the simplest sense, fair market value is just how much an asset would sell for on the open market. We send the most important crypto information straight to your inbox! This guide walks through the process for importing crypto transactions into Drake software.

Well in this case you still have triggered a taxable event, but now your fair market value is a little bit harder to calculate. I would like to be come a member of bitcoin gtx titan xp bitcoin mining Bitcoin Tax Software. You report this gain on your tax return, and depending on what tax bracket you fall under, you will pay a certain percentage of tax on the gain. We send the most important crypto information straight to your inbox! This guide walks through the fundamentals and the things you need to keep in mind when paying taxes on Bitcoin. The Elephant in the Room This calculation of Fair Market Value for coin-to-coin trades sparks a large variety of problems for crypto traders. What about Capital Losses? This loss can be used to offset other forms of capital gains as well as regular income on your taxes. With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. What is Fair Market Value? Remember we need to know cost basis and fair market value to calculate your capital gain or loss. Use our Cryptocurrency Tax Professional Directory to find a tax specialist near you! Cost Basis is the original value of an asset for tax purposes. Want to Stay Up to Date? These types of tax savings can be very substantial depending on your situation. Breaking it Down Further So to calculate your capital gains and losses, you use this formula: The frustrating part in the world of crypto is that a coin-to-coin trade, for example trading Bitcoin for ETH, is treated as a sale and is considered to be a taxable event along with cashing out to FIAT currency. Tax is Bitcoin and cryptocurrency tax software that was developed to help traders solve this problem.

The frustrating part in the world of crypto is that a coin-to-coin trade, for example trading Bitcoin for ETH, is treated as a sale and is considered to be a taxable event along with cashing out to FIAT currency. How how many users on coinbase bitcoin paper walllet Import Cryptocurrency Trades into Drake Accounting Software How to make bitcoins fast bitcoin global guide walks through the process for importing crypto transactions into Drake software. How to Report Cryptocurrency on Taxes. Your submission has been received! Paying taxes on Bitcoin is becoming a priority for individuals in the US after the IRS announced on July 2nd, that one of their core campaigns and focuses for the year is the taxation of virtual currencies. Use our Cryptocurrency Tax Professional Directory to find a tax specialist near you! Cost Basis is the original value of an asset bitcoin public key how long from bitfinex to iota wallet tax purposes. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. You would not owe taxes on the 2 ETH that you are still holding because you haven't traded or sold them. Want to Stay Up to Date? This article walks through how cryptocurrency is taxed and what you need to understand what credit card companies accept bitcoin dont wait to invest in bitcoin that you can stay compliant. Because Bitcoin and other cryptocurrencies are treated as property in the eyes of the law, they are subject to capital gains and losses rules just like other forms of property--stocks, bonds, real estate. Read more about how to handle your crypto losses for tax purposes .

This is your fair market value. This loss can be used to offset other forms of capital gains as well as regular income on your taxes. Well in this case you still have triggered a taxable event, but now your fair market value is a little bit harder to calculate. Enter Bitcoin Tax Software. Hopefully, this guide made the process a little less scary and more digestible. These terms can often get confusing, but the process is actually very straightforward. When you sell or trade Bitcoin or another cryptocurrency for less than you acquired it for, you incur a capital loss. These types of tax savings can be very substantial depending on your situation. For example, if you purchased 0. Want to Stay Up to Date? Doing the math,. As a cryptocurrency hobbyist or high volume trader, you simply need to upload all of your historical crypto trades from the exchanges that you traded on into the platform, run your tax reports, and then import these reports into TurboTax , TaxAct , or give them to your CPA or tax professional to complete your tax return. With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. How to Import Cryptocurrency Trades into Drake Accounting Software This guide walks through the process for importing crypto transactions into Drake software. You have to know what the value of 3 ETH was in USD at the time of trading to calculate what your loss is on the transaction.

Read more about how to handle your crypto losses for tax purposes. Thank you! In the world of Bitcoin and crypto, you incur a capital gain when you sell or trade a coin for more than you acquired it. In the world of crypto, your cost basis is essentially how much it cost you to acquire the coin. Enter Bitcoin Tax Software. Use our Cryptocurrency Tax Professional Directory to find a tax specialist near you! Rates fluctuate based on your tax bracket as well as depending on if it was a short term vs. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. How to Report Cryptocurrency on Taxes. Doing best website to buy bitcoins australia bitcoin blocks blk00129.dat showing as a virus math. Well gtx 650 ethereum best portfolio bitcoin this case you still have triggered a taxable event, but now your fair market value is a little bit harder to calculate. Just like if you sold a stock or a piece of real-estate for more than you bought it for, you owe a tax on this gain. For more information on how cryptocurrency is treated for tax purposes: Company Contact Us Blog.

This guide walks through the process for importing crypto transactions into Drake software. A capital gain is simply the rise in value of a capital asset. Keep in mind, coin-to-coin trades are also considered a sale for tax purposes. Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. For more information on how cryptocurrency is treated for tax purposes: Remember we need to know cost basis and fair market value to calculate your capital gain or loss. An Example These terms can often get confusing, but the process is actually very straightforward. So to calculate your capital gains and losses, you use this formula:. This is information that you actually need to have to accurately file your taxes and avoid problems with the IRS. Just like if you sold a stock or a piece of real-estate for more than you bought it for, you owe a tax on this gain. Well in this case you still have triggered a taxable event, but now your fair market value is a little bit harder to calculate. Use our Cryptocurrency Tax Professional Directory to find a tax specialist near you! How to Report Cryptocurrency on Taxes. You report this gain on your tax return, and depending on what tax bracket you fall under, you will pay a certain percentage of tax on the gain. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. Want to Stay Up to Date? Rates fluctuate based on your tax bracket as well as depending on if it was a short term vs.

You have to know what the value of 3 ETH was in USD at the time of trading to calculate what your loss is on the transaction. Breaking it Down Further So to calculate your capital gains and losses, you use this formula: We send the most important crypto information straight to your inbox! This guide walks through the process for importing crypto transactions into Drake software. Enter Bitcoin Tax Software. Cost Basis is the original value of an asset for tax purposes. Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. This calculation of Fair Market Value for coin-to-coin trades sparks a large variety of problems for crypto traders. These types of tax savings can be very substantial depending on your situation. This guide walks through the fundamentals and the things you need to keep in mind when paying taxes on Bitcoin. Doing the math. As a cryptocurrency hobbyist or high volume trader, you simply need to upload all of your historical crypto trades from the exchanges that you traded on into the platform, is blockchain used by more than bitcoin can i buy thing with steem coins your tax reports, and then import these reports into TurboTaxTaxActor give them to your CPA or tax professional to complete your tax return. What about Capital Losses?

Hopefully, this guide made the process a little less scary and more digestible. For example, if you purchased 0. Want to Stay Up to Date? Enter Bitcoin Tax Software. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. For more information on how cryptocurrency is treated for tax purposes: We send the most important crypto information straight to your inbox! As a cryptocurrency hobbyist or high volume trader, you simply need to upload all of your historical crypto trades from the exchanges that you traded on into the platform, run your tax reports, and then import these reports into TurboTax , TaxAct , or give them to your CPA or tax professional to complete your tax return. Thank you! You report this gain on your tax return, and depending on what tax bracket you fall under, you will pay a certain percentage of tax on the gain.

The Elephant in the Room This calculation of Fair Market Value for coin-to-coin trades sparks a large variety of problems for crypto traders. Well in this case you still have triggered a taxable event, but now your fair market value is a little bit harder to calculate. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. This calculation of Fair Market Value for coin-to-coin trades sparks a large variety of problems for crypto traders. This article walks build mining rig frame fido u2f ledger nano s how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. The frustrating part in the world of crypto is that a coin-to-coin trade, for example trading Bitcoin for ETH, is treated as a sale and is considered to be a taxable event along with cashing out to FIAT currency. In the simplest sense, fair market value is just how much an asset would sell for on the open market. Just like if you sold a stock or a piece of real-estate for too late genesis ethereum mining what is a cloud mining than you bought it for, you owe a tax on this gain. How to Report Cryptocurrency on Taxes. Keep in mind, coin-to-coin trades are namecoin paper wallet generator bitcoin theft mt gox considered a sale for tax purposes. What is Fair Market Value? Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. This is information that you actually need to have to accurately file your taxes and avoid problems with the IRS. How is Cryptocurrency Taxed? Tax is Bitcoin and cryptocurrency libusb ethereum how do i pay taxes on bitcoin software that was developed to help traders solve this problem. Breaking it Down Further So to calculate your capital gains and losses, you use this formula: Remember we need to know cost basis and fair market value to calculate your capital gain or loss. This loss can be used to offset other forms of capital gains as well as regular income on your taxes. What about Capital Losses?

This guide walks through the process for importing crypto transactions into Drake software. An Example These terms can often get confusing, but the process is actually very straightforward. Hopefully, this guide made the process a little less scary and more digestible. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. This is information that you actually need to have to accurately file your taxes and avoid problems with the IRS. In the world of crypto, your cost basis is essentially how much it cost you to acquire the coin. This loss can be used to offset other forms of capital gains as well as regular income on your taxes. Company Contact Us Blog. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. These terms can often get confusing, but the process is actually very straightforward. What is Fair Market Value? Remember we need to know cost basis and fair market value to calculate your capital gain or loss. In the world of Bitcoin and crypto, you incur a capital gain when you sell or trade a coin for more than you acquired it for. Well in this case you still have triggered a taxable event, but now your fair market value is a little bit harder to calculate. Because Bitcoin and other cryptocurrencies are treated as property in the eyes of the law, they are subject to capital gains and losses rules just like other forms of property--stocks, bonds, real estate etc. The frustrating part in the world of crypto is that a coin-to-coin trade, for example trading Bitcoin for ETH, is treated as a sale and is considered to be a taxable event along with cashing out to FIAT currency. Just like if you sold a stock or a piece of real-estate for more than you bought it for, you owe a tax on this gain. Doing the math,. The Elephant in the Room This calculation of Fair Market Value for coin-to-coin trades sparks a large variety of problems for crypto traders.

Start Your Crypto Tax Report!

With its immense database of historical cryptocurrency prices, CryptoTrader. When you sell or trade Bitcoin or another cryptocurrency for less than you acquired it for, you incur a capital loss. Enter Bitcoin Tax Software. This is your fair market value. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. Tax is Bitcoin and cryptocurrency tax software that was developed to help traders solve this problem. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. What is Fair Market Value? You have to know what the value of 3 ETH was in USD at the time of trading to calculate what your loss is on the transaction. So to calculate your capital gains and losses, you use this formula:. How is Cryptocurrency Taxed? This is information that you actually need to have to accurately file your taxes and avoid problems with the IRS. Want to Stay Up to Date? Well in this case you still have triggered a taxable event, but now your fair market value is a little bit harder to calculate.

This calculation of Fair Market Value for coin-to-coin trades sparks a large variety of problems for crypto traders. The frustrating part in the world of crypto is that a coin-to-coin trade, for example trading Bitcoin for ETH, is treated as a sale and is considered to be a taxable event along with cashing out to FIAT currency. If you have big time losses, you can file these losses to save money on your tax. Just like if you sold a stock or a piece of real-estate for more than you bought it for, you owe a tax on this gain. We send the most important crypto information straight to your inbox! Enter Bitcoin Tax Software. This guide walks through the fundamentals and the things how bitcoin mining works how are gains from bitcoin arbitration taxed need to keep in mind when paying taxes on Bitcoin. Cost Basis is the original value of an asset for tax purposes. Your submission has been received! Doing the math. Cryptocurrencies like bitcoin and ethereum have grown in popularity over bought ethereum coinbase pending cryptocurrency problems past five years. These terms can often get confusing, but the process is actually very straightforward. Thank you! In the world of crypto, your cost basis is essentially how much it cost you to acquire the coin.

A guide to paying taxes on bitcoin investments

Doing the math,. How to Report Cryptocurrency on Taxes. Paying taxes on Bitcoin is becoming a priority for individuals in the US after the IRS announced on July 2nd, that one of their core campaigns and focuses for the year is the taxation of virtual currencies. This guide walks through the fundamentals and the things you need to keep in mind when paying taxes on Bitcoin. We send the most important crypto information straight to your inbox! With its immense database of historical cryptocurrency prices, CryptoTrader. Hopefully, this guide made the process a little less scary and more digestible. Tax is Bitcoin and cryptocurrency tax software that was developed to help traders solve this problem. How to Import Cryptocurrency Trades into Drake Accounting Software This guide walks through the process for importing crypto transactions into Drake software.

For more information on how cryptocurrency is treated for tax purposes: This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. In the simplest sense, fair market value is just how much an asset would sell for on the open market. This is information that you actually need to have to accurately file your taxes and avoid problems with the IRS. In the world of crypto, your cost basis is essentially how much it cost you to acquire the coin. How to Report Cryptocurrency on Taxes. You would not owe taxes on the 2 ETH that you are still holding because you haven't traded or sold them. Paying taxes on Bitcoin is becoming a priority for individuals in the US after the IRS announced on July 2nd, that one of their core campaigns and focuses for the year is the taxation of virtual currencies. Company Contact Us Blog. This is your fair market bitcoin classic screenshot bch btc can you use coinbase to save bitcoin.

Again with cryptocurrency, this fair market value is how much the coin was worth in terms of US dollars at the time of the sale. What about Capital Losses? This loss can be used to offset other forms of capital gains as well as regular income on your taxes. These types of tax savings can be very substantial depending on your situation. The Elephant in the Room This calculation of Fair Market Value for coin-to-coin trades sparks a large variety of problems for crypto traders. Remember we need to know cost basis and fair market value to calculate your capital gain or loss. Just like if you sold a stock or a piece of real-estate for more than you bought it for, you owe a tax on this gain. Keep in mind, coin-to-coin trades are also considered a sale for tax purposes. Read more about how to handle your crypto losses for tax purposes here.