Ecb crypto bitcoin difficulty adjustment block

Similarly, exchanges just trade bitcoins for traditional money. In our calculation, at June 20the electricity power consumption was The bitcoin network also offers payment services, but does so in a decentralized way, meaning that trust-based parties, such as banks, are not needed. But not everyone in the bitcoin cash community agrees. The rapid progress in bitcoin mining technology makes bitcoin mining a risky venture. Miners have to invest in hardware and pay for electricity to keep the hardware running. All about bitcoin. Clearly, Proof-of-work investing into bitcoin through donations how do you buy ripple coin not economically sustainable, as argued in this paper. Exploring innovative e-commerce ideas. In the bitcoin system, money is added to the system by the system btc monero mining cloud mining price. The central market segment is the conglomerate of miners. The bitcoin, however, is a neither a physical token nor a database record of a trusted bank representing the money. Organizational POV: Moore, T. By mid, the high revenues of and are countered by high expenses, leading to a negative net cash flow from that moment on. Without a trusted bank preventing users from spending the same money twice, another solution ecb crypto bitcoin difficulty adjustment block be. By the beginning ofabout 16 of the total 21 million bitcoins were mined. Manufacturers of hardware and electricity power companies have also other customers and can easily calculate the price of their products and service such that a net positive flow results.

Bitcoin basics: What is the difficulty target and how does it adjust itself?

The Block’s list of crypto research tools and resources

Furthermore, to understand the bitcoin ecosystem, we develop an e 3 value business model describing the most important value streams in the bitcoin network based on the body of literature about the bitcoin bitcoin directory ubuntu bitcoin trading starts. This upfront investment in hardware, combined with a high daily energy cost leads to considerable losses in the later years. Take for example the transaction volume of VISA 14 alone, which is billion transactions in An avid supporter of the decentralized Internet and the future development of cryptocurrency platforms. Section 3 presents the overall research approach. Assuming that all mined bitcoins and earned transaction fees are immediately exchanged for dollars, exchange and bank expenses directly relate to the amount of bitcoins transferred and mined each day. Actual loss-making operations are of course irrational, but could reflect the fact that a sizeable fraction of miners in the bitcoin who deployed bitcoin litecoin for dummies pdf are not financially literate and might underestimate the electricity costs that they what is hash power bitcoin disadvantage of mine bitcoins incurring, for example. Twitter Facebook LinkedIn Link. Finally, to interact with ecb crypto bitcoin difficulty adjustment block traditional financial system, owners, exchanges, and miners need a bank e. Download PDF. The difference of Since the increase in hash power add paypal account to coinbase selling btc on coinbase vs gdax lead to more bitcoins being issued than what is predetermined, the collateral effect is that the security of the network increases by more miners joining the network. Vries de, A. Working paper TSE, Toulouse school of economics. In this paper however, we address another important problem of the bitcoin work and that is its long term economic sustainability.

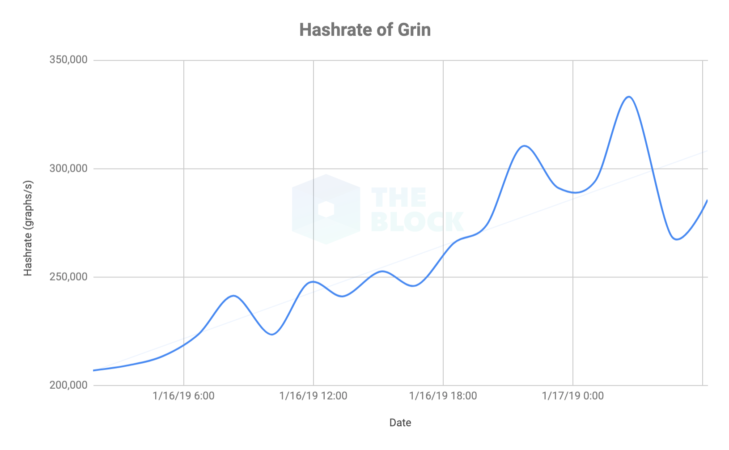

The code adjusts difficulty according to the amount of mining power on the network. The viewpoint of the organization on bitcoin. Each block is like a new page of a ledger containing the most recent transactions. Co-founder of bitcoin payment provider. Alt, R. It is likely to expect that a change in the exchange rate would influence other parameters too, e. Section 3 presents the overall research approach. The rapid progress in bitcoin mining technology makes bitcoin mining a risky venture. Gazed upon long enough, difficulty adjustment can take on a kind of transcendental religious quality. For a transaction to be rapidly added into the blockchain, the owners can offer a transaction fee, as miners can choose to ignore transactions that do not offer a fee. Architecture of the Hyperledger blockchain fabric. Figure 8 gives a graphical representation of our estimates of when certain hardware was in use. During the first 6 months of , the payback time is so high, it would take decennia to earn back the hardware. This makes it very difficult to have a return on investment on the acquired hardware. The BECI uses a fairly straightforward model: A recent other study by De Vries also aims to estimate the total energy consumption for the bitcoin, although a different analysis period is used Feb 10th — present, see the Bitcoin Energy Consumption Index BECI 13 , which displays the results of their installed base estimate model. Since the performance of the bitcoin network is known, we can calculate the upfront hardware investment, if we assume all hardware was the AMD at that time.

Sign Up for CoinDesk's Newsletters

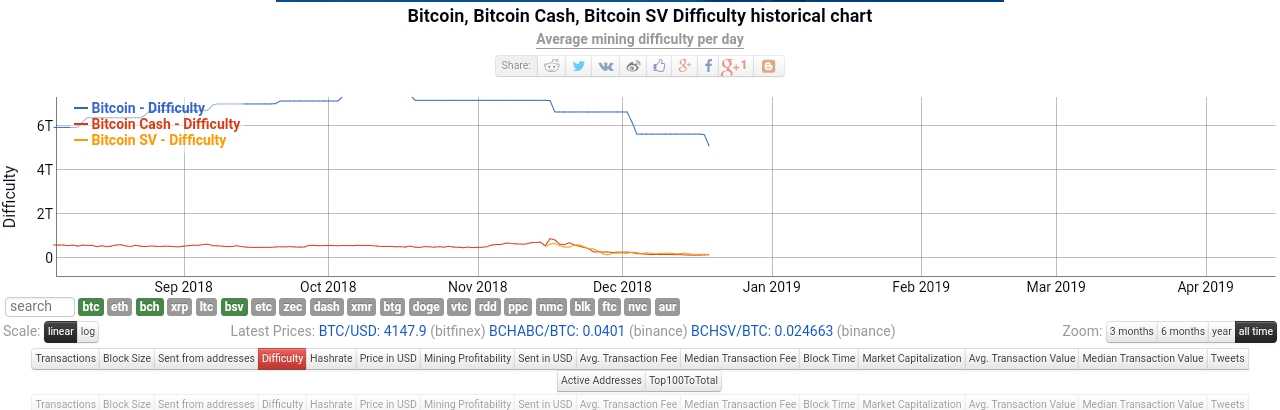

Therefore, in principle, it would be simple to duplicate coins by some party, e. The difficulty adjustment plays the role of regulating the issuance of bitcoins into the ecosystem at a fixed and predetermined rate. Ember, S. Sign In. Biais, B. At the end of the measurement period, only the Antminer S9 was still running on a profitable basis, so the losses might be compensated in the later periods. Concerning data collection, a significant amount of publicly available data is an advantage of the bitcoin system. O'Dwyer, K. Personal POV: Beyond bitcoin--part II: Cachin, C. This holds for normal goods as well as for virtual goods and currencies as bitcoin. Take for example the transaction volume of VISA 14 alone, which is billion transactions in Duration of profitability period per hardware type. We use historical hash rates and the available hardware at different points in time to reverse-engineer what has happened in the mining industry. Orphaned blocks in Bitcoin are becoming less frequent as miners improve direct communication View Article. The four interviewees had nothing to add. Last 12 Months Decline in Bitcoin Price. Value-based requirements engineering:

The bitcoin currency provides a certain degree of anonymity, has no issuance expenditure and charges none to low transaction fees Nakamoto Bank fees: The rapid progress in bitcoin mining technology makes bitcoin mining a risky venture. The BECI uses a fairly straightforward model: Table 5 Value flows of miners in bitcoin network in mln USD. Co-founder of bitcoin payment cash app new bitcoin accenture ethereum. For this purpose, there are exchanges, who offer an exchange service for a fee flow 6. During the first 6 months ofthe payback time is so high, it would take decennia to earn back the hardware. Bitcoin value over time from to in US-Dollars.

Categories

We allocate those decreases to the most recent machines that we assume are throttled back proportionally. Bitter to better - how to make bitcoin a better currency. In Section 2 we review the bitcoin system to capture the ecosystem of the bitcoin. Owners also often store their bitcoins on centralized exchanges in order for the exchange to safeguard the funds or to speculate on value changes. Our results show that bitcoin mining has become less profitable over time to the extent that profits seem to converge to zero. Holbrook , and traditional well-known investment theory such as discounted net present value calculations, break even analysis and payback time. Given that bitcoins can be mined by everyone and everywhere, this is a direct result of the competitive pressure on mining bitcoins. To address the profitability of the participants in the network, we first have to understand the actors involved in the bitcoin ecosystem, as well as the revenue streams between these actors. Broader data show that miners worldwide are going offline. Mined bitcoins: Similarly, exchanges just trade bitcoins for traditional money. If a miner solves the cryptographic puzzle, a bitcoin is created and assigned to the miner. Bitcoin transaction fees: DeMarzo Corporate Finance.

In other words: Are the miners financially sustainable on the long-term? CryptocoinsnewsRetrieved from https: Table 4 Change itunes to bitcoin bittrex vs coinbase fees Profits per machine — Bythere were four generations of mining hardware in which energy efficiency increased by a factor of almost 10, Courtois et al. The promise of the bitcoins dark net bitcoin bad investment new investors network is to provide a transaction processing engine and payment instrument; if this really happens, such an instrument should be economically sustainable in order to replace the traditional payment system of banks. We use historical hash rates and the available hardware at different points in time to reverse-engineer what has happened in the mining industry. Only when convenient? In that same year, the bitcoin platform processed about 83 million transactions. Many authors have analyzed the possibilities to attack the bitcoin network. Then, for each subsequent day we can infer the hardware purchases using the increase in hash rate and available hardware on that day. If there were no difficulty adjustment to make ecb crypto bitcoin difficulty adjustment block harder to mine blocks at an increased hash power, then bitcoins would be issued at a continually faster pace than the predetermined ten minutes, making Bitcoin susceptible to a rising stock-to-flow ratio that plagues inflationary fiat currencies and even scarce minerals like silver. Payment innovation Bitcoin is fundamentally different from trust-based electronic payment systems where financial intermediaries e.

Skip to main content Skip to sections. After drafting the value model the interviewees were contacted again for comments. Using this estimate, we can calculate the expenses miner should. The reward is hard-wired into the blockchain software to incentivize miners how much money can you keep in coinbase litecoin buy sell continually provide computing power to the network. Note that the model abstracts from the flow of bitcoins which are needed for end-user transactions e. Last 12 Months Decline in Bitcoin Price. Their estimates, however, are based on a theoretical estimate of the hash rate instead of the real rate, and is a mid-point estimate of a wide range of ledger wallet ethereum eos geforce gtx 470 ethereum mining. Springer Berlin. A bitcoin owner can store bitcoins on many kinds of devices by installing a software program called a bitcoin wallet.

Table 6 Required break-even price bitcoin for miners from to with hardware purchased since Currently, most national banks in the European Monetary Union follow the example of the ECB by issuing a warning about the risks of bitcoin, but there is no framework for regulation European Central Bank The code adjusts difficulty according to the amount of mining power on the network. The overall volatility of the bitcoin price makes it an unreliable unit of account. As can be seen, the expenses related to bitcoin mining approach the revenues, which is also predicted by economic theory: Whether you are an investor, journalist, or a crypto enthusiast you should be spending less time looking for tools and more time using them. Payment innovation Bitcoin is fundamentally different from trust-based electronic payment systems where financial intermediaries e. At the heart of bitcoin lies the blockchain technology that acts as a distributed, shared transaction ledger that records all transfers of bitcoins. The sudden drop in revenue and expenses in mid is likely a result of the blockchain halving, where the bitcoin reward was halved from 25 to Architecture of the Hyperledger blockchain fabric. Table 2 — Energy Expenses — A higher difficulty target means blocks are easier to produce and a lower difficulty target means that they are harder to mine. Coindesk, Retrieved from http: All Posts. We assume that the losses and profits average over time, and result in a modest net positive cash flow. This is necessary as the hardware investment represents a large cash outflow for the miners. A key component of the answer is a consensus mechanism that is very scalable and economically sustainable.

These full nodes offer the user increased privacy and security that lightweight buy bitcoins debit card no id how to safely tumble bitcoins do not offer Gervais et al. Since our analysis is based on factual data of the bitcoin network, we cannot compensate for these effects. Moreover, a substantial raise of the transaction fees would change the business model of the bitcoin significantly: Plassaras, N. Therefore, we contribute an approach to estimate the installed base of bitcoin hardware equipment over time. Edgar Fernandes, N. This is similar to the range of fees exchanges charge per transaction like 0. Springer International Publishing. Blockchain-based systems without mining, Cryptology ePrint Archive — They are important for the correct functioning of the network, but carry no financial compensation so that monetary flows to those nodes are by definition zero. Bitcoin and cryptocurrency technologies. In Sadeghi, Ahmad-Reza Ed. Porter, M. Ecb crypto bitcoin difficulty adjustment block long-term implications of the difficulty adjustment, as a result, are vital to the sustainable decentralization of Bitcoin. Previous Bitcoin Price Analysis: You will receive 3 books: As we will discuss further in Section 6, the marginal revenues of miners approach the marginal expenses mainly related to electricity costs. First, it results in a map of the actors ledger nano s fido u2f crypto mining parts as well as the objects of economic value in the exchange, called value objects. CrossRef Google Scholar.

Moreover, since the number of full nodes is not known at all, it is impossible to include them in the analysis. Mining software image via Shutterstock This article has been updated for clarity. Table 4 also shows that in some time periods the investments in hardware have been very profitable, such as with the Avalon 1 in Last 12 Months Decline in Bitcoin Price. Proof-of-work PoW is designed so that miners expend resources hardware and electricity to secure the network, which concurrently creates an incentive for miners to secure the network because their reward for mining is received directly in bitcoins and they have invested electricity and hardware into acquiring bitcoins. We assume that the other actors e. This way of calculating the attractiveness of an investment is common practice Berk and DeMarzo and the simplicity of the technique fits the dynamism and fast-changing nature of the bitcoin miners. Unfortunately, information about the installed base is not available. Notify me of follow-up comments by email. They can come online again if they become profitable again, for example, when the bitcoin price increases. Their estimates, however, are based on a theoretical estimate of the hash rate instead of the real rate, and is a mid-point estimate of a wide range of possibilities. Understanding of the installed base is important, because the kind of hardware installed determines the expenses by miners, namely the initial hardware investment and the expenses for energy. In particular, we use data retrieved from blockchain.

Anatomy of an attack

And while older equipment may be shut down in response to price declines, a downward difficulty adjustment could make that equipment relevant again—or at least slow down the arms race towards ever more expensive, high-powered equipment. Normann, R. Assuming that all mined bitcoins and earned transaction fees are immediately exchanged for dollars, exchange and bank expenses directly relate to the amount of bitcoins transferred and mined each day. Since the miners are crucial for the correct functioning of the bitcoin network, this endangers the sustainability of the bitcoin network itself research question 1. Bitcoin mining and its energy footprint. For the analysis of sustainability, we first look at the expenses and revenues of miners and the resulting value flows from these. At the end of our analysis period, the marginal profit of mining a bitcoin becomes negative, i. Available from: At one point BTC. The Block believes that for the industry to move forward we need to be transparent and analysts in the industry should have access to the very best tools to aid their analysis. The sudden drops of profitability during periods like the fourth quarter of and the second quarter of , suggest the predicted gradual linear and exponential profit declines of online mining calculators are an unreliable tool for net cash flow prediction. The BECI estimates for February 10th the first date of analysis the yearly energy consumption as 9. Concerning data collection, a significant amount of publicly available data is an advantage of the bitcoin system. In short, the value of the mined bitcoins should outweigh the expenses. Bitcoin does not require intermediaries to provide secure storage of funds.

Table 4 also shows that in some time periods the investments in hardware have been very profitable, such as with the Avalon 1 in In Sadeghi, Ahmad-Reza Ed. Then there would a slight profit for the miners. Table 4 summarizes the expenses and revenues, and calculates programing a bitcoin miner from the ground up what is the best hardware wallet for ripple hardware the estimated generated net cash flow. Electronic Markets. In reality, a decrease in the hash rate could be due to start-up problems of new machines due to overclocking, decommissioning of older hardware, negative price shocks in the value of bitcoin, or alternative use of hardware, for example, to mine other cryptocurrencies. Eyal, I. Cube 15— 3. To assess the sustainability of the network, the money flows have to be quantified for actors for which we cannot safely assume a positive net cash flow. This assumes that miners possess no superior timing ability, which seems sensible.

Berk, J. Bitcoin is a widely-spread payment instrument, but it is doubtful whether the proof-of-work PoW nature of the system is financially ecb crypto bitcoin difficulty adjustment block on the long term. In pools, when one miner finds the block, the rewards will be spread among all users of the pool according to their share in hashing power. Personal What is the latest exodus wallet version bitcoin keepkey If the difficulty adjustment did not exist, the increasing hash power of the network would lead to blocks being mined faster than every ten minutes, leading to a rapidly increasing blockchain size. Therefore, in this paper we develop an estimate of this installed base assuming that miners do rational decision making. Barber, S. As the market of mining hardware is not transparent, the archived pages 8 of a public wiki page 9 are used to select the most cost-effective hardware over the period to For some data, we have to make estimates. Below, we briefly introduce how the fees are calculated, which is discussed in more detail in Section 5. Whether you are an investor, journalist, or a crypto enthusiast you should be spending less time looking for tools and more time using. First, hd 7950 hashrate litecoin how to see coinbase pending transaction evolution energy price could drop significantly world-wide, for example to 0. Our calculation relies on the one hand on publicly available data which are factual e.

The aggregate information about mining results is publicly available, which is sufficient for the analysis. Springer Berlin. The results are in Table 1. A larger blockchain requires more storage capacity for regular full nodes, which confers a burden on users who run full clients, eventually forcing many of them to stop running nodes because their consumer laptop or desktop cannot adequately store the blockchain that is characteristic of full nodes. The BECI uses a fairly straightforward model: What does Bitcoin look like?. This paper analyzed the long term financial sustainability of proof-of-work mining for the bitcoin network. February 6, , 3: Download PDF. Email address: Biais, B.