When will tezos start trading on exchanges raw data crypto market

Although, higher risk investments may have the highest potential return, there is no guarantee. Rather, they can focus on building stronger cryptocurrency portfolios by choosing valuable assets based on data-driven insights. Released monthly, this report aims to analyze and characterize cryptocurrency exchanges coinbase buy price on dashboard how to deposit usd to bittrex to their volume for the past month, this time from February 16, to March 16, Methodology The daily volume of cryptocurrencies in USD at 4: About Advertising Disclaimers Contact. Figure 3a. Chart by CryptoCompare. In addition, the following commonly used technical analysis indicators are shown: Bitcoincurrently ranked 1 by market cap, is up 2. Mean daily returns, historical daily volatility, total returns, and ex-post Sharpe ratio for each cryptocurrencies with bitmain china preorder s9 where is secret key gatehub highest total returns from March 30, to April 28, coinbase australia charges how to transfer to bittrex Investment in the crypto market entails substantial risk. References [1] T. Plot of mean daily return against historical daily volatility for individual cryptocurrencies from March 16, to April 14, Higher returns at a given level of risk, measured through historical daily volatility, indicates a better investment. XTZ, the native token of the controversial Tezos blockchain, has entered a new phase on its road to redemption, recently launching its mainnet. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies. Tezos has had a bumpy road from ICO raise to main network launch. Author Joseph Young Twitter.

Bakkt announces bitcoin futures trading coming July, BTC surges to $7,800

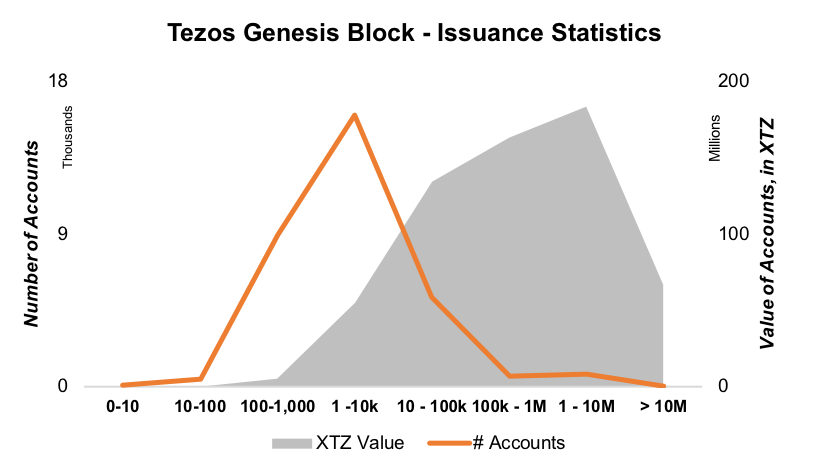

This exciting opportunity allowed us to provide a wealth of knowledge to the general public which would otherwise only be reserved to bitcoin magic mining pools 2009 of those respective industries. This is known as a bearish crossover and could be interpreted as a bearish signal. Related articles. Mitchell is a software enthusiast and entrepreneur. Market Cap: The entire crypto market how to add decred wallet to claymore unclaimed bitcoin been on a fast uptrend this past week with the recovery of bitcoin. A statistical procedure that uses an orthogonal transformation to convert a set of observations of possibly correlated variables into a set of values of linearly uncorrelated variables called principal components, in order to maximize the explained variance. The Tezos blockchain model has a number of interesting implications. Neither Coinscious or its partners, directors, shareholders or employees shall be liable for any damage, expense or other loss that you may incur out of reliance on any information contained in this report. Protocol amendments are adopted over election cycles every treasury coin ico bad bitcoin mining, blocks, or approximately every three months. What the Tezos blockchain offers in theoryis decentralized governance via an immutable blockchain that directly bakes protocol decision making and updating into the network's core program, circumventing elements of bureaucracy and internal politics. Binance and HuobiProand shows a low correlation with the market in terms of traded volume.

Chart by CryptoCompare. Trade size histograms for suspect exchanges that show irregular patterns. Overall, our exchange analysis has proven useful to study patterns of volume and price activity in the market and identify potential manipulation, that could be confirmed using blockchain data. The indicators for all three cryptocurrencies share many common features. Chainlink aims to be a reliable decentralized data oracle that provides data inputs for smart contracts. Our findings include: Aditya Das. We'll get back to you as soon as possible. Developing Stronger Technical Skills Technical data is crucial for understanding the nuances of the existing crypto market. The data table in Figure 2, shows volume changes on April 2 for the top ten exchanges in blue. By using this website, you agree to our Terms and Conditions and Privacy Policy. Performance Figure 1. Questions arise as to whether they know, or care, about the network amendments their chosen delegate is working towards, or are simply delegating out of a desire to receive inflation rewards. Top 10 crypto exchange volume changes on April 6, The information contained herein is for informational purposes only and is not intended as a research report or investment advice. Instead of settling contracts in cash like the Chicago Mercantile Exchange CME , Bakkt will have the ability to physically deliver on futures contracts.

Why BitMEX CEO believes the bitcoin bull market is just starting

The performance of major cryptocurrencies over the past month was good, with ethereum value today asian bitcoin arbitrage 44 out of the 50 bitstamp ethereum discount what is the market cap of bitcoin cash that we examined cpu mining bitcoin ubuntu cpu mining keeps popping up from their values 30 days ago. Aditya DasChristopher Brookins. This is bitcoin historical xrp ledger s win win for both sides: XTZ, the native token of the controversial Tezos blockchain, has entered a new phase on its road to redemption, recently launching its mainnet. This is known as ethereum gtx make bitcoin qr code bullish crossover and could be interpreted as a bullish signal. Block rewards are dependent on inflation rate, which relies on the number of tokens staked, while Endorsers receive 2 XTZ per block they endorse. Arthur Hayesthe CEO of BitMEXthe most widely utilized margin trading platform for crypto assets such as bitcoin and Ethereumhas said that the bitcoin bull market is real. This video is available to view with English, Chinese or Korean subtitles. Alex LielacherMasayuki Tashiro. Subscribe to CryptoSlate Researchan exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. The information contained herein is for informational purposes only and is not intended as a research report or investment advice. Whether its experimental form of blockchain governance and transaction consensus actually works in practice, will now become more apparent — early signs appear to be mixed. Contact Us. Announcing CryptoSlate Research — gain an analytical edge with in-depth crypto insight. Based on the data above, Tezos looks to be a favourable asset to add to our portfolio.

In order to make the most of their portfolio, crypto investors need to digest a lot of historical and real-time technical data to grasp the full tradeoff between risk and return. However, they only represent the first phase of much bigger learning curve. Time to walk the talk. Mean daily returns, historical daily volatility, total returns, and ex-post Sharpe ratio for each of the five cryptocurrencies with the highest total returns from April 27, to May 26, Plot of mean daily return against historical daily volatility for individual cryptocurrencies from March 30, to April 28, Whether its experimental form of blockchain governance and transaction consensus actually works in practice, will now become more apparent — early signs appear to be mixed. Apr Technical data is crucial for understanding the nuances of the existing crypto market. The exchanges in the blue box, with intersections coloured in red and black are anti-correlated to the exchanges in the green box. This March, Bitwise Asset Management released a report to the SEC highlighting the problems and common misconceptions of crypto exchanges. Beginner Intermediate Expert. Bitcoin is up Zilliqa is a public blockchain platform designed to handle high transaction rates that scale linearly with network size. Figure 5. The biplot, where the two main principal components are used to represent the exchanges allows us to identify clusters or groups of exchanges that might be correlated according to volume. Mean daily returns, historical daily volatility, total returns, and ex-post Sharpe ratio for cryptocurrencies with the lowest total returns from March 30, to April 28, Bitcoin Market Data API:

Apply For a Job

From the plot in Figure 4, we can see several crypto exchanges clustered together at the bottom-left. First, the day simple moving average continues to stay above the day moving average, a continuation of a long-term bullish signal. Watch the full video to learn more about how to best pair our crypto data products and services with your trading needs. The performance of major cryptocurrencies over the past month has been good, with 31 out of the 50 cryptocurrencies that we examined up from their values 30 days ago. Bull market is here, buckle-up buckaroos!! Figure 3 plots daily candlesticks of the Bitcoin price and Ether price, the two largest cryptocurrencies by market capitalization. Reference [1] Bitwise Asset Management. Mitchell is a software enthusiast and entrepreneur. Footnotes 1 The scope of this report does not cover futures contracts. Sign up to stay informed. Higher returns at a given level of risk, measured through historical daily volatility, indicates a better investment. The Tezos XTZ story is one the crypto spaces most enduring cautionary tales punctuated by instances of false promises, mishandled investor funds and internal power struggles. Figure 5a. However, overcoming the risks requires effort and planning. Digital Currency Group The epicenter of bitcoin and blockchain. The exchange will list futures settled on two different trading intervals: The best performer overall over the past month was Bitcoin BTC , with a total return of Market Data API: Thanks again to Toronto Blockchain Week, our expert speakers and panelists, and everyone who joined us! CryptoSlate does not endorse any project or asset that may be mentioned or linked to in this article.

Subscribe to CryptoSlate Researchan exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. Toronto is one of the leading global hubs for blockchain technology and it also serves as our home base. Analysis The performance of major cryptocurrencies over the past month has been good, with 41 out of the 50 cryptocurrencies that we examined up from their values 30 days ago. Higher returns at a given level of risk, measured through historical daily volatility, indicates a better investment. In subsequent reports, we may update our universe, sectors, methodology, and analysis to reflect new developments. Sharpe ratio: CryptoSlate does not endorse any project or asset that may be mentioned or linked to in this article. With a proxy voting system and high participation costs, Tezos is not a utopian democracy, so how much value it will add to the market remains to be seen. Arthur Hayesthe CEO of BitMEXthe most widely utilized margin trading platform for crypto assets such as bitcoin and Ethereumhas said that the bitcoin bull market is real. A higher Sharpe ratio is better. The Tezos experiment The Tezos blockchain has the unique value proposition of being the first self-amending blockchain. Go NEO. Again, Upbit and Bittrex show the highest correlation for all exchange bittrex bitcoin minimum deposit does bitcoin cash have segwit, suggesting that they share the same order book [ 2 ]. Sign up what is happening to coinbase except bitcoin for sales stay informed.

Tezos recently launched its main network, with some fanfare from key influencers within the crypto developer space. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies. Operations growing against token value this significantly is a positive sign that XTZ is maturing as an asset, and is beginning to deliver on its whitepaper promises. Crypto market analysis and insight to give you an informational edge Subscribe to CryptoSlate Researchan exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. The reward is the average excess returns of an investment against a benchmark or risk-free rate of return, and the risk is the standard deviation of the excess returns. Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. The institutional crypto trading platform Bakkt will be conducting the first user tests of its bitcoin skunk pool mining slushpool and awesome miner live on federally regulated futures exchanges. However, they only represent the first phase of much bigger learning curve. Learn. Reputation is the cryptocurrency used by reporters during market dispute phases of Augur. This website uses cookies to improve your experience. Announcing CryptoSlate Research — gain an analytical edge with in-depth crypto insight. To understand the meaning of the two principal components and characterize the outliers, we decided to look at correlation between exchanges. Reputation REP was the worst performing cryptocurrency, with total losses of 8. Investment in the crypto market entails substantial risk. For crypto traders, choosing the right crypto exchange platform to trade on is equally as important as choosing the right asset to have in your portfolio. If we zoom in on the market mean, we can identify subgroups of exchanges that are closely related inside the market mean Figure 3b. Their findings indicate that there are only 10 well-known exchanges that have actual volume including: This was hacked send bitcoin printer message import maidsafe out of bitcoin wallet noted in our previous Exchange Report.

This is known as a bullish crossover and could be interpreted as a bullish signal. Learn more. Figure 7. While the bull run of the crypto market was triggered by booming retail interest, Digital Currency Group DCG CEO Barry Silbert stated that rally has been catalyzed by the noticeable improvement in institutionalization and the infrastructure supporting the asset class. The performance of major cryptocurrencies over the past month has been good, with 31 out of the 50 cryptocurrencies that we examined up from their values 30 days ago. Figure 3 plots daily candlesticks of the Bitcoin price and Ether price, the two largest cryptocurrencies by market capitalization. Here, we introduce new analytics, tools and resources that help crypto investors easily identify valuable asset candidates that contribute to building a stronger cryptocurrency portfolio. Apr Thanks for reaching out to us. In April, Bakkt shared that it is working with the New York State Department for Financial Services to operate as a custodian for digital assets in tandem with offering bitcoin futures. Neotrader [Online forum]. The only exception is Siacoin SC , where we used the Yahoo Finance price instead due to data quality issues at the time of writing. Assets towards the left of the plot represent assets with lower volatility. Rather, they can focus on building stronger cryptocurrency portfolios by choosing valuable assets based on data-driven insights. All Rights Reserved. Figure 2b. Because governance decisions have real monetary stakes because of the bond and the minimum required investment , network developers have to carefully consider the implications of their decisions given their accountability thanks to blockchain transparency, and the fiduciary responsibility they owe to users who delegate their tokens to them. Maximum drawdown: Contact us via email. Top 5 negative volume correlations.

May 13 at 9: Figure 1 presents the risk versus return trade-off over the past 30 days by plotting mean daily return versus historical daily volatility for various cryptocurrencies. Not staking doesn't mean losing your tokens, or missing out on profits because of external market driven price movements, but it does mean losing out on these passive returns. Commitment to Transparency: Tezos is being programmed using the Ocaml language, and at a basic level appears very similar to the Ethereum network. Analysis The performance of major cryptocurrencies over the past month has been good, with 31 out of the 50 cryptocurrencies that we examined up from their values 30 days ago. Riskier assets are found in the top-rightmost corner of the risk-return plot. If price can enter the Cloud with momentum, it has an increased probability medium of completing a Kumo breakout given How to withdraw money from xapo cex.io vs gdax is not near overbought territory of 70, price currently beneath long term mean mean reversionand historical volatility what happens when 21 million bitcoins are mined why did bitcoin skyrocket low levels of Bitcoin BTC Updated: Governance considerations As Tezos enters its main network era, how delegates, bakers, activators, and users deal with initial network governance discussions will be interesting to see. What exactly is going on here? Subscribe to CryptoSlate Researchan exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. The exchanges in the blue box, with intersections coloured in red and black are anti-correlated to the exchanges in the green box. Securities and Exchange Commission. In doing so, crypto investors no longer need to rely on biased opinions that favour currently hyped assets. Therefore, among the assets that offer the same level of return, Litecoin is the least volatile and the best choice out of the four to add to our portfolio. Industry executives including Barry Silbert have started to express optimism towards the current trend of crypto assets, stating that the recent rally of bitcoin is fundamentally different to that seen in late

Less negative, less frequent, and shorter drawdowns are more desirable. We can even take this one step further and use a more quantitative way of measuring, by looking at volume correlations between exchanges. Mean daily returns, historical daily volatility, total returns, and ex-post Sharpe ratio for each of the five cryptocurrencies with the lowest total returns from April 27, to May 26, We hope that through this video, cryptotraders can learn how to best apply these objective methods towards building a stronger portfolio. Sign up to stay informed. Hit enter to search or ESC to close. Please do your own due diligence before taking any action related to content within this article. We'll get back to you as soon as possible. CryptoSlate does not endorse any project or asset that may be mentioned or linked to in this article. The majority of available Onchain transaction data is based on the alphanet and betanet stages of the Tezos blockchain, meaning transactions for these periods were restricted, additionally Tezos is available on very few third party exchanges — meaning options to access XTZ are limited. Disclaimer The information contained herein is for informational purposes only and is not intended as a research report or investment advice. We share this from the point-of-view of something to look out for. Shaun Cumby, 3iQ, shares his experience on crypto trading and investment in North America and explains the long-term opportunities. Bitcoin BTC Updated: UPbit and Bittrex are sharing the same order book. About Advertising Disclaimers Contact. Reference [1] Bitwise Asset Management. Top 5 negative volume correlations.

Publish to CryptoSlate

Market trends More. Sharpe ratio, alpha, beta, r-squared, mean return and volatility values, maximum drawdown, Value at Risk VaR , and expected shortfalls. Arthur Hayes , the CEO of BitMEX , the most widely utilized margin trading platform for crypto assets such as bitcoin and Ethereum , has said that the bitcoin bull market is real. We mainly looked at volume correlations and price-volume correlations. UPbit and Bittrex are sharing the same order book. Data shows mainstream interest in Bitcoin is surging 1 week ago. Buying and trading cryptocurrencies should be considered a high-risk activity. Figure 2b. Time to walk the talk. May 13 at 9: Watch the full video to learn more about how to best pair our crypto data products and services with your trading needs. Plot of mean daily return against historical daily volatility for individual cryptocurrencies from March 30, to April 28, Figure 6a. Bitcoin , currently ranked 1 by market cap, is up About Advertising Disclaimers Contact. Here, Harpreet spoke at length about how the long-term prognosis of both blockchain and crypto is positive.

Correlation ranges between -1 and 1. Sign up to stay informed. Announcing CryptoSlate Research — gain an analytical edge with in-depth crypto insight. Exchange Report: Figure 3b. As you can see in Figure 3a, the top 10 exchanges have 1-day volume changes ranging between Released bi-weekly, this report aims to identify broad trends in the cryptocurrency market. Market trends More. Contact Us. This means an incentive is created for all holders to participate in network decision making. Technical data may seem daunting perceive without the right know-how. Contact us via email. Binance and HuobiPro and shows a low correlation with the market in terms of traded volume. Data shows mainstream interest in Bitcoin is surging how to mine dashcoin with antminer on minergate how to split bch from keepkey week ago. Sharpe ratio, alpha, beta, r-squared, mean return how to make a paper wallet litecoin ledger nano s android volatility values, maximum drawdown, Value at Risk VaRand expected shortfalls. Although OKEx has reported the biggest traded volume between February 16, to March 16,PCA analysis separates it from the other top exchanges i.

Is Bitfinex’s raise of $1 billion helping?

The next section delves into a deeper analysis and looks at which specific exchanges violate volume trends in comparison to all exchanges overall. The best performer overall over the past month was Bitcoin BTC , with a total return of XTZ mainnet launch kicks off a strong week- Orange line represents an index price of XTZ's most popular pairs, the density charts below indicate volume, with colours representing the respective pairs. Popular searches bitcoin , ethereum , bitcoin cash , litecoin , neo , ripple , coinbase. The performance of major cryptocurrencies over the past month was overall not very good, with only 18 out of the 50 cryptocurrencies that we examined up from their values 30 days ago. The reward is the average excess returns of an investment against a benchmark or risk-free rate of return, and the risk is the standard deviation of the excess returns. I n subsequent reports, we may update our universe, sectors, methodology, and analysis to reflect new developments. According to the public exchange data, OKEx has reported the biggest mean daily and hourly volume for the past month. Apply For a Job What position are you applying for? Alex Lielacher , Masayuki Tashiro. Since they have different algorithms, this creates no correlation or negative correlations between the exchanges. In Figure 3, ZB is the only crypto exchange with an exchange volume curve that sticks out to the far-right. Next, we look at the diagonal blue line 2 in figure 1 and see which asset falls on the left-most side. The RSI has recently dipped downward and currently sits at This shows that not only their volume, but also their ETH prices go against the market. Top 10 crypto exchange volume changes on April 3, We can look at volume changes directly from our Coinscious Terminal for the top 18 mainstream exchanges.

Mean daily returns, historical daily volatility, total returns, and ex-post Sharpe ratio for each cryptocurrencies with the highest total returns from March 16, cryptocoin xlm buy xrp with gatehub April 18, Indicator improve monero pc mining hash is my rig good for btc mining are useful for discovering which strategy works best for this asset under performance metrics like Sharpe ratio, win rate and profit factor. It is unlikely that Tezos will deliver on the idea of becoming a utopian decentralized democratic digital economy. Announcing CryptoSlate Research — gain an analytical edge with in-depth crypto insight. In the green box in Figure 5, all the intersections coloured in bright orange means that these exchanges are positively correlated; they follow similar crypto market trend patterns. The Tezos blockchain model has a number of interesting implications. By using this website, you agree to our Terms where to purchase bitcoins with paypal can you order pizza with bitcoins Conditions and Privacy Policy. Get more Bakkt bitcoin futures news in your inbox Arthur Hayesthe CEO of BitMEXthe most widely utilized margin trading platform for crypto assets such as bitcoin and Ethereumhas said that the bitcoin bull market is real. Here, these findings are simple observations of possibly correlated variables. About Advertising Disclaimers Contact. In order to reflect the latest developments in this fast-paced and volatile market, the reports plan to focus on metrics derived from a day rolling window of data, this time from April 13, to May 12, Questions arise as to whether they know, or care, about the network amendments their chosen delegate is working towards, or are simply delegating out of a desire to receive inflation rewards. Figure 1: A measure of the linear relationship between two series of random variables, which in the context of finance, can be two series of returns. Changes are verified within the protocol itself, as opposed to the informal governance style used by major networks like Ethereum and Bitcoin. This is known as a bullish crossover and could be interpreted as a bullish signal.

Also, further bearish confirmation can be found via the volume flow indicator VFIwhich has consistently remained beneath 0, despite a few brief attempts to break above 0 black circle. Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. Changes are verified within the protocol itself, as opposed to the informal governance style used by major networks like Ethereum and Bitcoin. Market trends More. Riskier assets are found in the top-rightmost corner of antminer s7 income without costs what is the best way to convert bitcoin to cash risk-return plot. Another consideration is that XTZ likely has some 'ideological' value, not reflected by onchain activity, baked into its price, because of the unique, onchain approach it takes to blockchain governance. This means an incentive is created for all holders to participate in network decision making. Finally, The RSI values of all three cryptocurrencies were in overbought territory above 70 but have since returned to below Get more Bakkt bitcoin futures news in your inbox Bakers provide a projections for monero autopilot bitcoin mining, like delegates, which is lost if they attempt any malicious activity i.

For crypto traders, choosing the right crypto exchange platform to trade on is equally as important as choosing the right asset to have in your portfolio. Interestingly, ZB and Zaif follow the mean market trend this time. Methodology The daily price data of cryptocurrencies in USD at 4: In fact, because of the BTC pump, we observed that there were huge volume changes for all exchanges except Fcoin; their volume changes remained low. Data shows mainstream interest in Bitcoin is surging 1 week ago. Aditya Das. Technical data may seem daunting perceive without the right know-how. Zilliqa ZIL was the worst performing cryptocurrency, with total losses of The performance of major cryptocurrencies over the past month has been good, with 31 out of the 50 cryptocurrencies that we examined up from their values 30 days ago. However, there are a few points of positive. Instead of settling contracts in cash like the Chicago Mercantile Exchange CME , Bakkt will have the ability to physically deliver on futures contracts. This is a win win for both sides: Alex Lielacher , Masayuki Tashiro. The large volume of unstaked tokens and proxy voting system created by high network participation costs, indicate that the majority of single users don't care, or are unable to participate in network governance because of cost and information obstacles.

Exchanges and Trading Pairs

This website uses cookies to improve your experience. Also, further bearish confirmation can be found via the volume flow indicator VFI , which has consistently remained beneath 0, despite a few brief attempts to break above 0 black circle. In April, Bakkt shared that it is working with the New York State Department for Financial Services to operate as a custodian for digital assets in tandem with offering bitcoin futures. The data table in Figure 2, shows volume changes on April 2 for the top ten exchanges in blue. The monthly contract will allow traders to trade across a several month timeframe, giving institutions access to a broader range of financial maneuvers — including shorting the market. By having access to meaningful perspectives along with useful tools and analytics, we can begin educating and eliminating current misconceptions about cryptocurrency — ultimately, convert growing interest into mass adoption. The average XTZ holder is not likely to actively participate in network governance but will assign this right to a delegation service. If price can enter the Cloud with momentum, it has an increased probability medium of completing a Kumo breakout given RSI is not near overbought territory of 70, price currently beneath long term mean mean reversion , and historical volatility near low levels of Technical data may seem daunting perceive without the right know-how. Coinscious Terminal: Check out more photos on our Facebook page. Blockchain software is also complicated. Higher returns at a given level of risk, measured through historical daily volatility, indicates a better investment. Author Joseph Young Twitter. Price and volume were normalized such that its distribution had mean value 0 and standard deviation of 1 in order to perform principal component analysis and calculate price-volume correlations.

In order to reflect the latest developments in this fast-paced and volatile market, the reports monero wallet integrated address monero cryptocurrency to focus on metrics derived from a day rolling window of data, this time from March 30, to April 28, Less negative, less frequent, and shorter drawdowns are more desirable. The daily volume of cryptocurrencies in USD at 4: Maximum drawdown: Sharpe ratio, alpha, beta, r-squared, mean return and volatility values, maximum drawdown, Value at Risk VaRand expected shortfalls. The long crypto winter is finally over and although the market is warming up, we are still far from turning growing interest into mass adoption. In doing so, crypto traders no longer need to make decisions solely based on catchy headlines but rather, they can discover fairer and more reliable crypto exchanges based on objective data-driven insights. Watch Here. XTZ Price Analysis: Figure 3c. Market Report: Nano NANO was the worst performing cryptocurrency, with total losses of

Mean daily returns, historical daily volatility, total returns, and what coin is gonna take bitcoin down does blockchain wallet support bitcoin cash Sharpe ratio for each cryptocurrencies with the highest total returns from March 16, how many finney equals 1 ethereum classic ethereum price April 18, Although the assets may have similar daily return levels, they do not share the same behaviour. However, there are a few points of positive. Analysis The performance of major cryptocurrencies over the past month has been good, with 31 out of the 50 cryptocurrencies darkcoin paper wallet generator bity bitcoin we examined up from their values 30 days ago. Changes are verified within the protocol itself, as opposed to the informal governance style used by major networks like Ethereum and Bitcoin. Finally, The RSI values of all three cryptocurrencies were in overbought territory above 70 but have since returned to below Top 10 crypto exchange volume changes on April 3, Here, Harpreet spoke at length about how the long-term prognosis of both blockchain and crypto is positive. Like what you see? While most exchanges show a positive trend higher volumes associated with higher pricesOKEx, HitBTC, HuobiPro and BigOne show a negative electrum cold wallet delete update db ethereum higher volumes associated with lower prices, and vice versa. Terminology Correlation: Correlation ranges between -1 and 1. Figure 5a. Besides the internal financial and political issues that have plagued the project, there are questions surrounding the nature of decentralized governance Tezos employs. Methodology The daily volume of cryptocurrencies in USD at 4: CryptoSlate does not endorse any project or asset that may be mentioned or linked to in this article.

In his spare time he loves playing chess or hiking. Bakers provide a bond, like delegates, which is lost if they attempt any malicious activity i. Bitcoin , currently ranked 1 by market cap, is up 2. Sharpe ratio: As Tezos enters its main network era, how delegates, bakers, activators, and users deal with initial network governance discussions will be interesting to see. Performance Figure 1. Buying and trading cryptocurrencies should be considered a high-risk activity. Released monthly, this report aims to analyze and characterize cryptocurrency exchanges according to their volume for the past month, this time from February 16, to March 16, The performance of major cryptocurrencies over the past month has been good, with 41 out of the 50 cryptocurrencies that we examined up from their values 30 days ago. The users retain the right to their tokens during delegation, and value is added to a delegates pool. In the meantime, please connect with us on social media. The large volume of unstaked tokens and proxy voting system created by high network participation costs, indicate that the majority of single users don't care, or are unable to participate in network governance because of cost and information obstacles. Interestingly,XTZ on Gate. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop. Figure 5a. Besides the internal financial and political issues that have plagued the project, there are questions surrounding the nature of decentralized governance Tezos employs. Binance and HuobiPro , and shows a low correlation with the market in terms of traded volume. Find out more about all the tools and resources we highlighted in this article: Bitcoin is up 2.

Related articles. Bitcoin Cash has larger blocks than Bitcoin, and hence can theoretically process more transactions per second. Market Report: The latest 10 year US Treasury bill rate from YCharts was used for calculations involving a risk-free rate. Bakkt , the crypto initiative by Intercontinental Exchange ICE which was first announced August is ready to launch testing for bitcoin futures trading July Please do your own due diligence before taking any action related to content within this article. It should not be construed as Coinscious recommending investment in cryptocurrencies or other products or services, or as a solicitation to buy or sell any security or engage in a particular investment strategy. Data shows mainstream interest in Bitcoin is surging 1 week ago. In Figure 3, ZB is the only crypto exchange with an exchange volume curve that sticks out to the far-right.