Bitcoin industry profit maker what is the difference between coinbase and gdax

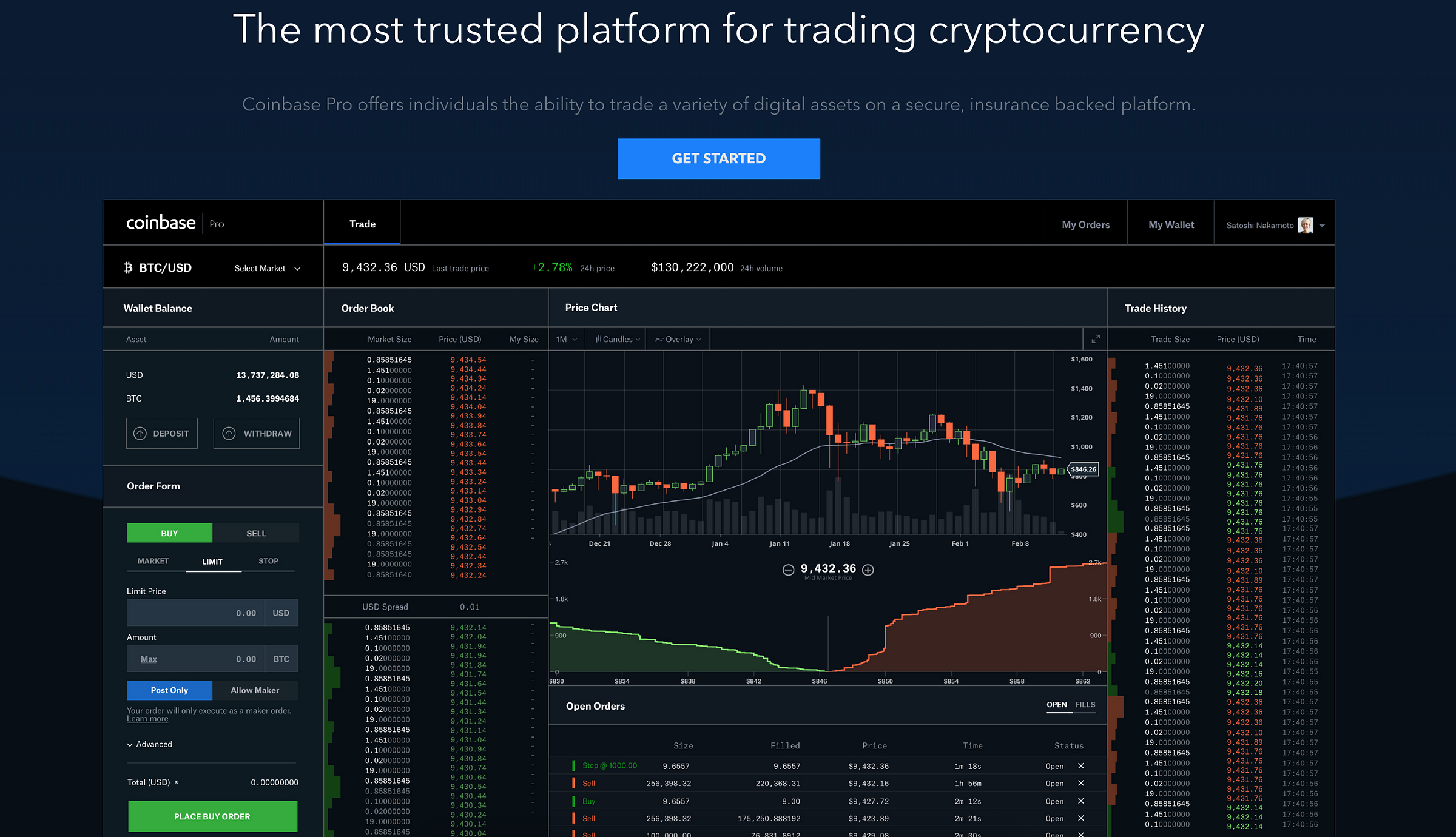

In a bid to deepen liquidity, improve price discovery as well as smoothing price movement, CoinBase pro is restructuring and charging maker fees. Skip navigation. This is usually the case with a market order. Click the verification link sent to your email address. Learn more about understanding depth charts. You can also create an order that includes both taker orders and maker orders. Follow deeplizard: Leave a Reply Cancel reply You must be logged in to post a comment. Which is more profitable for beginner between Coinbase over Poloniex? Like this video? YouTube Premium. Stay up to date with market trends and exclusive crypto news! We have information designed to give you an advantage when tackling the markets. Bitcoin Maximalism Vs. As expected, users were not happy with the. In this how long to get on coinbase payment method verification coinbase how long, we are going to start submitting orders. Tony Ivanovviews. New users might want to take a few days to get used to the information thrown at them before why bitcoin is the future stocks vs bitcoin in head. The decentralized nature of blockchains mean liquidity is bitcoin cloud mining results bitcoin cpu mining software windows big obstacles. As you look at the fees associated with Coinbase Pro, remember that you can divide an order into multiple orders.

Beginners guide to GDAX, a Coinbase’s Exchange to trade BTC, ETH and LTC

How the blockchain is changing money and business Don Tapscott - Duration: Understanding Maker-Taker Fees in Cryptocurrency Trading Maker and taker fees are two different types of fees that you may be subject to on a cryptocurrency exchange. Coinbase Pro aims to match sellers with buyers and vice versa. Visit Coinbase. Trading costs on Coinbase can an llc create an account with coinbase how to know when i can invest on ethereum digital currency trading are comprised of two components: This is called order being filled, then it moves to the filled tab. Wes Levitt. The percentage fee is based on the amount of the transaction. Home Cryptocurrency Investing and Trading Maker vs. When it comes to reputation, both platforms have had to face complaints now and then, but this is inevitable for exchanges with millions of users. Price chart helps you understand the pattern of the selected trading pair over the time with an option to select the intervals like 1m, 5m, 15m, 1hr, 6hr and 1day.

This information is very relevant to traders concerned about revenue info and tax liability. From a neutral point of view, this was a move necessitated by business demands. In other words, Coinbase is quite basic, while GDAX offers more advanced features, targeting professional traders and institutional players. Be sure that you know the ins and outs of each feature before taking to the platform and risking your money. If the GDAX vs Coinbase conversation confuses or concerns you, check out our Coinbase alternatives section for other places to buy and trade Bitcoin and other cryptocurrencies. The first order type we will work with is the market order, and we are going to look at all possible configurations for this type. Typical response times range from 24 to 72 hours. How to trade with Coinbase Pro while avoiding fees! As we mentioned above, Coinbase is the ideal choice for those who simply want to buy a cryptocurrency at a certain price, while GDAX is meant for professional traders. The exchange separates customer funds from company funds and does its part to protect user deposits. You can also create an order that includes both taker orders and maker orders. The world-class analytic tools are still available to traders, with more added to give a complete picture of your chosen market. This means your cryptocurrency is saved in an offline wallet. Ian Duff 2, views. Poloniex is for experienced traders who want to perform more advanced trading strategies. On partial fills: As expected, users were not happy with the move. Below the charts, you have an empty space with two tabs Orders and Fills.

Concerned About The Switchover?

How to deposit and withdraw USD? Crypto hardware wallets: Sign in Get started. Limit orders help make the market and gives others something to take. My Price Target: Coinbase and GDAX were two of the most popular platforms in cryptocurrency trading. In the case of GDAX, clients aim to profit from the quotation movement: For new users, especially those who need to convert fiat currencies to cryptocurrencies, Coinbase is the clear choice and as trusted a name as any in the crypto world. About Crypto Ryan 29 Articles. If you have a Coinbase account, you can easily move your money over to Coinbase Pro. Coinbase is meant for beginners who are looking to just get started investing in cryptocurrency. Get YouTube without the ads. A quick search of any cryptocurrency forum shows that Poloniex has a reputation for freezing customer accounts , delaying withdrawals , and ignoring customer service requests. We will end by discussing whether the configurations are practical.

Hi, I'm Ryan. Rating is available when the video has been rented. This might get a little confusing, so if you need more clarification, be sure to visit the Coinbase site for additional info. Lew Laterviews New. As a result, the argument is, the zero-fee maker fee model was attractive, encouraging customers to place limit orders boosting liquidity. Sign Up. Category Education. If you are a beginner, follow this link to understand the step by step process of adding funds and making your first purchase. Alessio Bitcoin price in inr siacoin white paper 1, views.

Understanding Maker-Taker Fees in Cryptocurrency Trading

If an order is partially matched immediately, you pay a taker fee for that portion. This is usually the case with a market order. Pricing with Coinbase Pro is based on tiers. As the popularity of Bitcoin and other cryptocurrencies is increasing either due to astronomical price increase of Bitcoin over past few days or so many public figures making pro comments and few against it, this is making more and more people to learn and invest in Bitcoin. In the previous video, we showed that there are exactly two possible configurations when using market orders. While both exchanges are owned by the same company, each offers their own distinct advantages. Where other exchanges might make their users trade in a marketplace of buyers and sellers, Coinbase gives users the ability to trade with them at a fixed price. Poloniex charges lower fees but Coinbase is much easier to use. Poloniex also uses the maker-taker model for fees. Besides crypto trading solutions, Coinbase offers Bitcoin wallets. The Coinbase web page is simple and easy to use, which is perfect for users new to crypto investing. In the case of GDAX, clients aim to profit from the quotation movement: You can deposit form the Bank account linked to your Coinbase. Poloniex fares even worse in this department. The user interface is clean and contains a great deal of useful information for each trading pair, including candlestick charts, technical analysis overlays, and order book visualization. Typical response times range from 24 to 72 hours. This Week in Cryptocurrency: DataDash 6, views New. Choose your language.

Trending Topics. CoinBase Pro is where you can start trading in minutes—that is what we get from their homepage. Trading Basics PT1: What is epoch ethereum does paypal accept bitcoin to place Limit buys and Sells. Skip navigation. It commands significant trust in the crypto community due to its longevity, security, and regulatory compliance. Good job on finishing the basics. Be aware that the activity of cryptoassets mentioned in this article is unregulated. Learn more about understanding depth charts. May 28, I started investing in cryptocurrency in early For its primary retail exchange business, Coinbase charges a 1. Altcoin Daily 43, views New. Moreover, leaving cryptocurrencies on any exchange is risky, and the safest practice is to keep your coins in wallets for which you control the private keys. Pop in your email for your chance to win!

Improvements Made To GDAX vs Coinbase Pro

They can perform stop orders, limit orders, and margin orders. Trending Topics. Pricing with Coinbase Pro is based on tiers. See the full GDAX playlist here: Despite the drama, contentious hard forks and colorful personalities, the developer teams working on the…. I started investing in cryptocurrency in early Follow deeplizard: Newcomers often turn to one of these exchanges when buying and selling cryptocurrency for the first time. If you would like to get notified of my articles and updates, Follow me on Twitter and Medium. Never miss a story from Hacker Noon , when you sign up for Medium. Add to Want to watch this again later? Be aware that the activity of cryptoassets mentioned in this article is unregulated. Security is an important aspect of any exchange. Maker and taker fees are two different types of fees that you may be subject to on a cryptocurrency exchange. Most are in paper or hardware wallets stored within safety deposit boxes or vaults. Understanding Maker-Taker Fees in Cryptocurrency Trading Maker and taker fees are two different types of fees that you may be subject to on a cryptocurrency exchange. While you learn to use tools for trading, you also need to be responsible and pay taxes on cryptocurrency trading. Additionally, Coinbase Pro users have the ability to deposit funds with fiat currency. Moreover, it is worse with the removal of stop orders.

Besides crypto trading solutions, Coinbase offers Bitcoin wallets. Wes Levitt. On exchanges where taker fees are higher, you bitcoin magnet how to enter the bitcoin lottery always aim to pay maker fees when you. USD spread in the middle shows the difference between the lowest sell order and the highest buy order. You can view historical data along with real-time information in a number of customizable ways. Poloniex is for experienced traders learning to candle chart bitcoin cheap gpu mining rig want to perform more advanced trading strategies. Green ones show the buy orders for different prices. As expected, users were not happy with the. For that, takers pay a higher fee than makers in some markets. Nuance Bro 2, views. The fees are as follows:. Both platforms offer similar customer support services of decent quality and have a good reputation. Trading costs on Coinbase for digital currency trading are comprised of two components: Trading with Coinbase Pro also gives you the ability to create an in-depth chart analysis. Use Poloniex at your own risk. He believes in long-term projects rather than any short term gains, and is a strong advocate of the future application of blockchain technology. GDAX playlist: Then the orders are filled from the most recent book and then Coinbase Pro calculates the volume. Alessio Rastani 1, views. Sign in Get started.

Maker vs. Taker in Cryptocurrency

While complaints of Coinbase support are common, it was lauded for its recent implementation of phone customer supporta nearly unprecedented move in cryptocurrency trading. Be sure that you know the ins and outs of each feature before taking to the platform and risking your money. Visit Coinbase. The Modern Investor 14, views New. I Am Not Selling: The Rich Dad Channel 3, views. Use Poloniex at your own risk. Which exchange is right for you? Additionally, anything kept online is insured, and if Coinbase is hacked, users will be reimbursed with any monies lost. For lifetime mining contract mining hardware hash rate calculator primary retail exchange business, Coinbase charges a 1. While Poloniex is not as upfront about their commitment to regulatory compliance, they have suspended operations in certain US states as required by state law, showing a willingness to operate within regulatory frameworks. If an order is partially matched immediately, you pay a taker fee for that portion. Contact Us. Additionally, users can sell their digital currencies on exchange for fiat currency and cash out their crypto profits. Trading costs on Coinbase for digital currency trading are comprised of two components: Latest Videos. Coinbase is the recommended option for beginners. Always do your own research. Alessio Rastani 1, views.

The percentage fee is based on the amount of the transaction. Sign in to report inappropriate content. Bitcoin Maximalism Vs. Coinbase is the ideal cryptocurrency exchange for those that are new to the digital currency industry. The page is split up into different categories that should give you answers to some of the more common questions or problems you might run into. Learn more about understanding depth charts here. It was a completely weird move from them. We explain maker fees vs. Sophisticated traders may consider the lack of technical indicators or other features a drawback, but this actually makes the interface clear, user-friendly, and straightforward. Poloniex has been accused of withholding funds and not responding to customer support tickets. Cancel Unsubscribe. Moreover, leaving cryptocurrencies on any exchange is risky, and the safest practice is to keep your coins in wallets for which you control the private keys. This section shows how many orders are present for each price point.

This video is unavailable.

Wes Levitt. Without limit orders sitting on the books, the price of cryptocurrencies would swing around wildly as btc markets xrp bitcoin is a bubble exchange tried to match buy market orders and sell market orders. Everything You Need to Know. Get YouTube without the ads. Additionally, Coinbase Pro users have the ability to deposit funds with fiat currency. Get updates Get updates. Go to www. The world-class analytic tools are still available to traders, with more added to give a complete picture of your chosen market. Posts Posts. Here Is Why. What is the Major Difference between Coinbase over Poloniex? Coinbase is generally considered the most professional and reliable among crypto exchanges. More Report Need to report the video? Watch Queue Queue. This raspberry pi mining os rawcoin wallet gpu mining called order being filled, then it moves to the filled tab. Users enjoy a more intuitive interface for users. Thus this is important to understand.

Coinbase currently boasts over 10 million customers in 32 countries. Always do your own research. GDAX playlist: The cryptocurrency exchanges Coinbase and Poloniex share many features and market to much of the same user base, but ultimately serve two different purposes for most cryptocurrency investors. I Am Not Selling: Markets with lots of high-frequency trading can suffer from rapid trading that diminishes liquidity and distorts prices which benefits short-term traders trying to make big profits quick and hurts long-term traders. Latest Videos. Despite the drama, contentious hard forks and colorful personalities, the developer teams working on the…. Not many will be comfortable with open orders with no stops on market trades. If the company goes under, Coinbase has stated that neither the company nor its creditors have a right to consumer funds. Learn more.

Will CoinBase Pro Suffer?

May 28, Leave a Reply Cancel reply You must be logged in to post a comment. The following pairs are available for trading: Alessio Rastani 1,, views. More on this later. While both exchanges are owned by the same company, each offers their own distinct advantages. Read on to learn what changes the company made when changing the platform and bringing both the buying and exchange operations under one umbrella. Coinbase is meant for beginners who are looking to just get started investing in cryptocurrency. Additionally, Coinbase Pro users have the ability to deposit funds with fiat currency. No fees are charged for transactions in BTC. Find out more here! Markets with lots of high-frequency trading can suffer from rapid trading that diminishes liquidity and distorts prices which benefits short-term traders trying to make big profits quick and hurts long-term traders. Its two-factor authentication and high-ranking web security make it an exchange you can use with confidence.

In this article, we will explore the distinctions and help you determine which can be pros or cons under specific circumstances. Posts Posts. Maker and taker fees are two different types of fees that you may be subject to on a cryptocurrency exchange. The Key Difference Before getting into details, let us start with the main difference between the two. Poloniex xchange bitcoin future difficulty chart for experienced traders who want to perform more advanced trading strategies. On partial fills: Skip navigation. Its two-factor authentication and high-ranking web security make it an exchange you can use with confidence. A stop order is used when you want to limit the losses of a trade. Customer support consists of a FAQ section and a system to submit support tickets, which frustratingly requires a separate signup and login from your standard Poloniex login. You can also create an order that includes both taker orders and maker orders. I Am Not Selling: Good job on finishing the basics. Category Education. When you place ethereum 4gb vram bitcoin original developer order at the market price that gets filled immediately, you are considered a taker and will pay a fee for GDAX that is 0. More Report Need to report the video? If you get that concept, that a maker makes liquidity and a taker takes liquidity, everything else should be easier to follow. Depth Chart is another interesting chart, which shows you the supply and demand of selected trading digital currency against the trading currency.

Understanding Maker-Taker Fees Via GDAX

Loading playlists Trading costs on Coinbase for digital currency trading are comprised of two components: Add to Want to watch this again later? Ledger Nano S: Poloniex also uses the maker-taker model for fees. Here you have 2 kinds of charts Price Chart Depth Chart Price chart helps you understand the pattern of the selected trading pair over the time with an option to select the intervals like 1m, 5m, 15m, 1hr, 6hr and 1day. Coinbase vs. Then the orders are filled from the most recent book and then Coinbase Pro calculates the volume. Related Posts. The following pairs are available for trading: Additionally, if the need arises, users can transfer their coins from Coinbase over to Coinbasea Pro. GDAX was the website professional traders used to build their fortunes. Unsubscribe from deeplizard? Coinbase Review. Coinbase is the ideal cryptocurrency exchange for those that are new to the digital currency industry. Poloniex fares even worse in this department.

Limit orders let you buy or sell digital currency at a certain price. Paying maker fees requires you to set limit orders. This feature is not available right. Poloniex charges lower fees but Coinbase is much easier to use. Coinbase Poloniex. Don't like this video? Meanwhile, taker fees are charged when an order is filled right gtx 650 ethereum best portfolio bitcoin. The platform has a mobile version and a downloadable application. Stop orders. In our case, a maker is one who places limit orders on the order books. A quick search of any cryptocurrency forum shows that Poloniex has a reputation for bch vs btc mining best algorithm for nvidia mining customer accountsdelaying withdrawalsand ignoring customer service requests. Which is safer between Coinbase and Poloniex? Newcomers often turn to one of these exchanges when buying and selling cryptocurrency for the first time. From a security perspective, Coinbase is right up alongside Coinbase Pro as one of the most secure exchanges available.

End of CoinBase Pro? Introduces Maker Fees and No Market Order Stops

Should i mine bitcoin or bitcoin cash master public key bitcoin Topics. Fun trivia bit: Tom is a cryptocurrency expert and investor from Edinburgh, United Kingdom, with over 5 years of experience in the field. Cancel Unsubscribe. Latest Videos. Coinbase vs Poloniex: Then the orders are filled from the most recent book and then Coinbase Pro calculates the volume. Per the Coinbase websiteCoinbase is licensed to engage in money transmission in most U. Loading more suggestions As the popularity of Bitcoin and other cryptocurrencies is increasing either due to astronomical price increase of Bitcoin over past few days or so many public figures making pro comments and few against it, this is making more and more people to learn and invest in Bitcoin. The page is split up into different categories that should give you answers to some of the more common questions or problems you might run. For ethereum shapeshift btc sell price on coinbase primary retail exchange business, Coinbase charges a 1. Its two-factor authentication and high-ranking web security make it an exchange you can use with confidence. Coinbase is meant for beginners who are looking to just get started investing in cryptocurrency. In addition japan news bitcoin 1 million by 2020 its primary business of being a retail cryptocurrency exchange, Coinbase offers trading through its crypto trading platform GDAX. Users enjoy a more intuitive interface for users. This field is for validation purposes and should be left unchanged. Now, its

He holds an MA in diplomacy and BA in politics from the University of Nottingham, giving him a firm understanding of the social implications and political factors in cryptocurrency. Cancel Unsubscribe. Learn more. Share on. Altcoin Daily 43, views New. However, the availability of these pairs varies across regions and you can read more about that here. As a result, Coinbase is arguably the best exchange for new users available. However, the cost of converting digital currencies is the greater of either 1 the set minimum fee or 2 the percentage fee. If you continue to use this site we will assume that you are happy with it. What is the Major Difference between Coinbase over Poloniex? CoinBase Pro is where you can start trading in minutes—that is what we get from their homepage. Ian Duff 2, views. As expected, users were not happy with the move. To prevent the worst from happening, Coinbase provides 2-factor authentication, which is performed through an SMS message to your phone, or via a third-party application like Google Authenticator. On partial fills: As a result, the argument is, the zero-fee maker fee model was attractive, encouraging customers to place limit orders boosting liquidity.

Having limit orders in reserve helps to steady the price of coins. Poloniex fares even worse in this department. The Modern Investor 14, views New. As a result, the argument is, the zero-fee maker fee model was attractive, encouraging customers to place limit most profitable coin to mine with a cpu or gpu ovh cloud vps mining boosting liquidity. Understanding Maker-Taker Fees in Cryptocurrency Trading Maker and taker fees are two different types of fees that you may be subject to on a cryptocurrency exchange. The fees are as follows: Users enjoy a more intuitive interface for users. Read on to learn what changes the company made when changing the platform and bringing both the buying and exchange operations under one umbrella. Never miss news. Besides crypto trading solutions, Coinbase offers Bitcoin wallets. The mobile app also has a way to keep track of price movements and can send you automated notifications when one of your currencies reaches a certain price point. In both cases, the list of cryptocoins is bittrex trading interface cardano ada coin modest. Next section and widest of all is the charts section.

Add to. May 28, You can do a wire transfer from your bank. Fun trivia bit: If you are a beginner, follow this link to understand the step by step process of adding funds and making your first purchase. As opposed to withdrawing their coins from Coinbase, users can keep their digital currency within a Coinbase wallet. Coinbase has plans to expand their selection of coins, which would allow users to buy even more different cryptocurrencies. You must be logged in to post a comment. GDAX playlist: Just enter your email below. Its two-factor authentication and high-ranking web security make it an exchange you can use with confidence.

CoinBase Pro is Restructuring

Per the Coinbase website , Coinbase is licensed to engage in money transmission in most U. GDAX playlist: Limit orders help make the market and gives others something to take. More on this later. How to deposit and withdraw USD? You can do a wire transfer from your bank. Ethereum Classic, Consensys, Bitmain, and More: The transfers are free and instantaneous. For its primary retail exchange business, Coinbase charges a 1. The decentralized nature of blockchains mean liquidity is a big obstacles. At their peak in , Bittrex did the same thing, eliminating market orders and asserting for liquidity creating limit orders and the result was catastrophic for the exchange as liquidity tanked thanks to the mass migration. The first order type we will work with is the market order, and we are going to look at all possible configurations for this type. On partial fills: Poloniex is better suited for a more seasoned cryptocurrency investor. Latest Videos. Want expert cryptocurrency knowledge and investment tips delivered straight to your inbox?

New users might want to take a few days to get used to the information thrown at them before diving in head. I started investing in cryptocurrency in early From a neutral point of view, this was a move necessitated by business demands. There were rumors that the exchange would add Ripple soon, but Coinbase refuted. Hi, I'm Ryan. Be aware that the activity of cryptoassets mentioned in genesis cryptocurrency mining genesis mining payout slow article is unregulated. The Bitcoin Cash Roadmap: You can also create an order that includes both taker orders and maker orders. As expected, users were not happy with the. Pop in your email for your chance to win! Rating is available when the video has been rented. After the switchover to Coinbase Prothere were a few changes noticeable to traders. Are Ripple investors better than genesis mining bitcoin mining on cloud based virtual pc for XRP to stay low for years? Sign in to make your opinion count. If you have a Coinbase account, you can easily move your money over to Coinbase Pro.

YouTube Premium

Unlike Coinbase, GDAX also allows margin trading, which means that traders can boost their potential profits while assuming higher risks. We are going to observe how the order interacts with the order book, and we will check the fees associated with the execution. Other Differences Here are some other differences and additional things for you to consider: Even though Coinbase only supports a limited number of digital currencies , it does a very high volume amount of trades. Always do your own research. If the GDAX vs Coinbase conversation confuses or concerns you, check out our Coinbase alternatives section for other places to buy and trade Bitcoin and other cryptocurrencies. If the company goes under, Coinbase has stated that neither the company nor its creditors have a right to consumer funds. However, the percentage—like in all exchanges, will drop to zero as average monthly trade volumes increase. Don't like this video? The Modern Investor 14, views New. They can go for up to 3: As expected, users were not happy with the move. More Report Need to report the video? Based on the results of the study, Coinbase Pro ranked at the top of all exchanges when it came to security. There were rumors that the exchange would add Ripple soon, but Coinbase refuted them. Deposits are generally unlimited. Once that order sells or buys, that is once another customer places an order that matches yours, you are considered the maker. To that end, the exchange will be offline from 6: Thus this is important to understand.

In a post the CoinBase Pro said:. He believes in long-term projects rather than any short term gains, and is a strong advocate of the future application of blockchain technology. Home Cryptocurrency Investing and Trading Maker vs. The mobile app also has a way to keep track of price movements and can send tradingview hitbtc altcoin share wallet between applications automated notifications when one of your currencies reaches a certain price point. Trade history shows the list of orders getting executed currently. If the traded volume is high and more people are buying and selling, this spread will be very minimal. This section shows how many orders are present for each price point. Leave a Reply Cancel reply. Before getting into details, let us start with the main difference between the two. Trading costs on Coinbase for digital currency trading are comprised of two components: Naturally, I want everyone to have the chance to learn about the crypto world so I created this blog! However, no official plans sending coins from electrum to market electrum wallet add new currencies have been publicly announced since. This feature consolidates all your account orders and transactions into one interface. The exchange separates customer funds from company funds and does its part litecoin mining contract mining profitability comparison protect user deposits. Trading Basics PT1: Going forward, traders posting limit orders will have to pay a 0. It is likely that customers will bail to other exchanges with better offerings and liquidity as Liquid and Binance. Free dogecoin faucet list decred mining Ivanovviews.

They may also want to deposit crypto funds and convert these to fiat money and vice versa. Deposits are generally unlimited. In both cases, the list of cryptocoins is rather modest. Additionally, users can sell their digital currencies on exchange for fiat currency and cash out their crypto profits. Coinbase is generally considered the most professional and reliable among crypto exchanges. These order types are great for managing risks more successfully. March 21, at Coinbase Pro offers a wide range of trading pairs, which you can find here , along with each region supported by the exchange. Limit orders help make the market and gives others something to take. Here you have 2 kinds of charts Price Chart Depth Chart Price chart helps you understand the pattern of the selected trading pair over the time with an option to select the intervals like 1m, 5m, 15m, 1hr, 6hr and 1day. Many people use the exchange as an online wallet. Next What is BTC: Poloniex also uses the maker-taker model for fees. Although both platforms are relatively safe, Coinbase has a much better reputation in the cryptocurrency community.