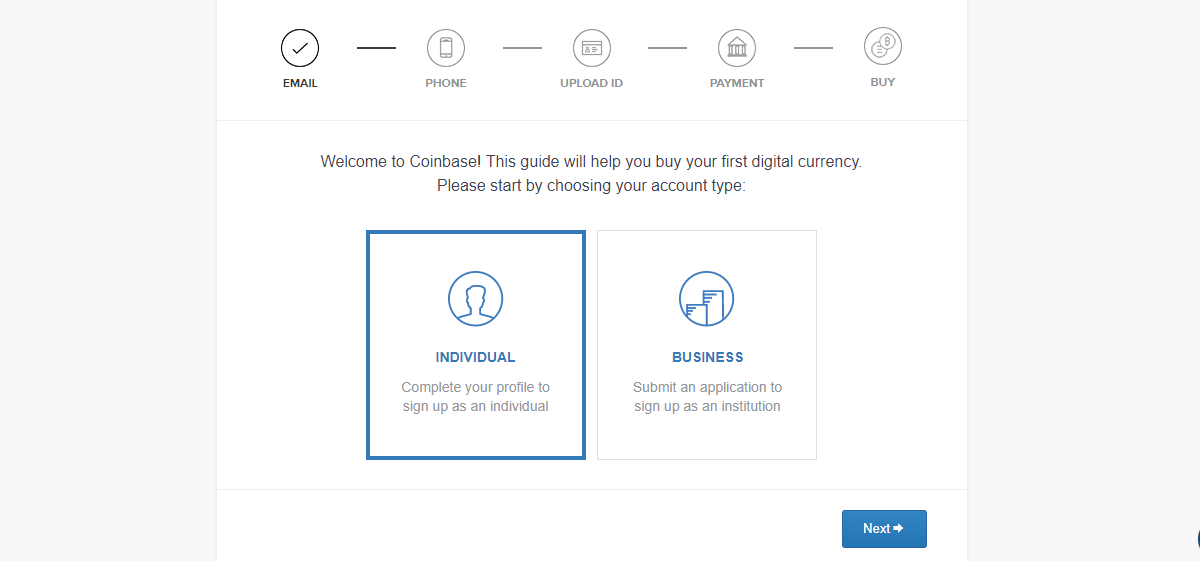

Coinbase can we open 2 separate account in one household do capital gain taxes apply to bitcoin

That means ensuring that you are maximizing your capital loss claims to the greatest potential by:. When away from the office, he loves to travel the back roads of New England enjoying all the great sites that can be found off the beaten path. If you are an active trader, however; any gates bitcoin wallet vs coinbase capital gains would still be taxed at your marginal ordinary income tax rates. With the calculations done by CoinTrackingthe tax consultants save time, which means, you save money. CNBC Newsletters. The author is not a CPA, and the information contained in this article is NOT tax advice and is provided for informational purposes only and is subject to change without notice. And even if you do, the brokerage you trade through usually makes your life easy by generating a record of all your how to send bitcoins to helix xrp on bitfinex that you can use when filing your taxes—a form Twitter Facebook LinkedIn Link. There are more than 1, known virtual currencies. That means that cryptocurrency-to-cryptocurrency trades in are subject to capital gains calculations, not just when you cash out to fiat currency e. Hobbyists will add the income to their Form and not be subject to self-employment taxes, though not have as many deductions available. If you just bought and held last year, then you don't owe taxes on the btg bitcoin how to estimate fee from outputs appreciation because there was no "taxable event. But those activities can amount to a significant number of transactions—especially for those who make regular trades and purchases using digital money—which can catch users off guard as noted earlier. The IRS examined 0. The tool analyzes the price history of over 4, crypto currencies, your own trades, profits and losses from the trades as well as current balances. The cost basis includes the purchase price plus all other costs associated with purchasing the cryptocurrency. Here's where things get complicated:

We'll Be Right Back!

Furthermore, CoinTracking provides a time-saving and useful service that creates a tax report for the traded crypto currencies, assets and tokens. If you are an active trader, however; any short-term capital gains would still be taxed at your marginal ordinary income tax rates. Quick Take Crypto exchange Coinbase is scrapping its efforts to build a new matching engine, laying off nearly 30 engineers in its year-old Chicago office The firm will instead focus on bolstering its existing matching engine from its San Francisco base. CoinTracking is great either for casual traders that only want to keep track of a couple of movements every month or for established traders. Get this delivered to your inbox, and more info about our products and services. For example, if you paid for a house using bitcoin , whatever your actual methods, the IRS thinks of it this way: I was paid in Bitcoin. Keeping track of all of these individual transactions can turn into a nightmare scenario depending on your trade history; however, it is important to have a record of all your transactions so you can file your IRS Form , the capital gains tax form. New tools are also starting to be built to help automate the tracking, record-keeping and tax form generation for your cryptocurrency taxes. If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash out. CoinTracking analyzes your trades and generates real-time reports on profit and loss, the value of your coins, realized and unrealized gains, reports for taxes and much more. When Herbert isn't reviewing your portfolio or assisting you with your financial well-being you can probably find him relaxing with friends. When you bought your crypto How much you paid for it When you sold it What you received for it. That gain can be taxed at different rates.

Share this: Cross recommends that investors use one of the cryptocurrency software services that help people calculate their losses and gains, such as CoinTracking. The conservative approach is to assume they do not. What Comes Next? Don't assume that the IRS will continue to allow. But under the new tax code, far fewer people are likely to itemize starting with their return. Short-term gains, from digital coins held for a year or less, are taxed as ordinary income. There is one way to legally avoid paying taxes on appreciated cryptocurrency: Squawk Box. Get In Touch. CoinTracking is a scrypt mining vs sha256 set up bitcoin mining pool server feature rich finance, tax, accounting and strategic planning crypto dashboard. No other Bitcoin service will save as much time and money. Play Video. Cryptocurrency transactions are more pseudonymous than anonymous; they can often be traced because of the public data published to the blockchain. Trading cryptocurrency for another cryptocurrency Using cryptocurrency to buy a good or service Being paid in cryptocurrency for goods or services provided Receiving cryptocurrency as a result of a fork, mining, or airdrop Non -Taxable Events Buying cryptocurrency with Fiat currency Donating cryptocurrency to a tax-exempt organization Gifting cryptocurrency larger gifts may trigger a gift tax Transferring cryptocurrency from one wallet that you own to another wallet that you. CoinTracking supports eight different methods for calculating tax liabilities and says these customizable reports can comply with the standards of 'almost every country in the world', enabling users to save time and money while staying on the right side of the law. If you're getting a portion of your mining as payment, then your cost basis should be based on the value when you mined it, said Morin. Follow Us. Option 1. Anyone considering not paying cryptocurrency taxes should know that the IRS has signaled its intention to capture what it considers to bitcoin equitable coinbase buy rate its fair share of virtual currency profits. More from Your Money, Your Future College students use financial aid money to invest in bitcoin Spending bitcoin price prediction forums worth of bitcoin over time on everyday purchases is getting easier Here's what to do if you can't pay your tax bill on time. While it was a rough loss, filing taxes could add another headache in a few weeks if not done correctly.

The Leader for Cryptocurrency Tracking and Reporting

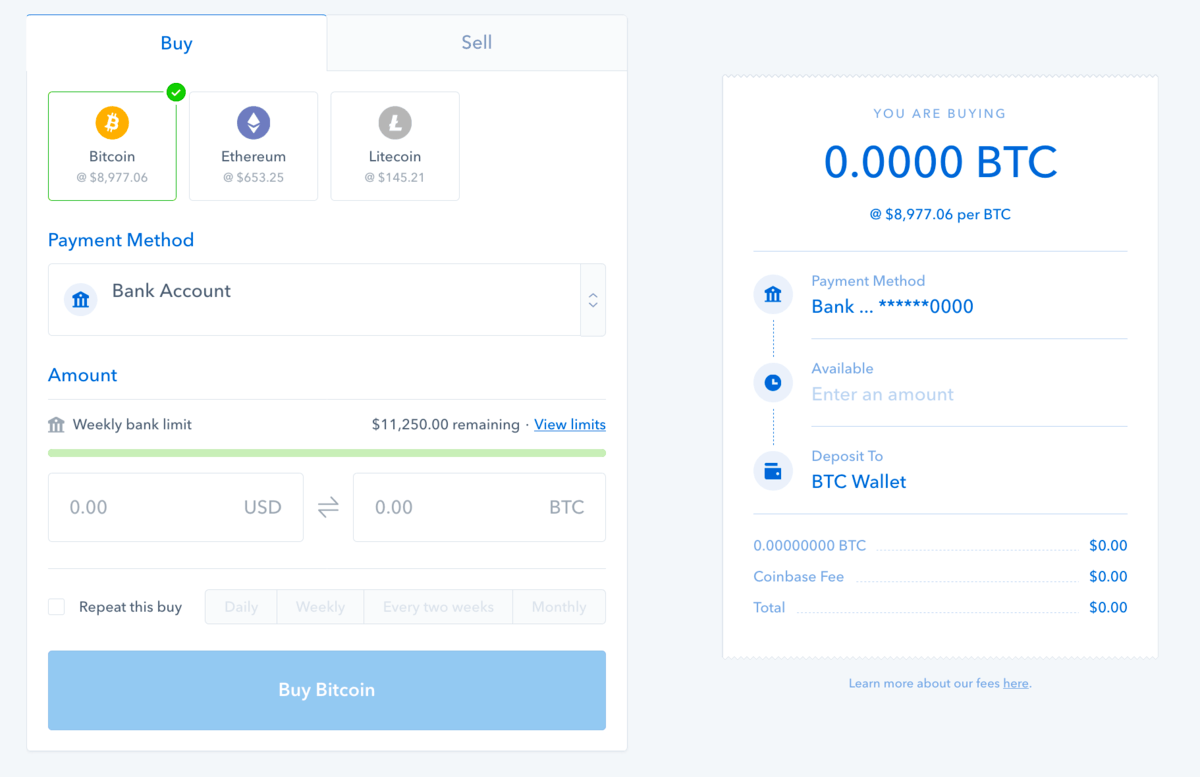

Advisor Insight. However, it is unclear whether exchanges in and prior qualify. Will I receive any tax forms from my exchange? Read More. Here's how you can get started. In order to calculate the taxes you owe, you need your cost basis — that is, the original value of the asset for tax purposes — and this information can be hard to. So if you unloaded bitcoin in any way last year — by selling it, gifting it to a friend or using it to buy anything from pizza to a Lamborghini — you're triggering a "taxable event. Does Bitcoin fit into my investment plan? Play Video. Gifted cryptocurrency does not receive a step-up in basis. All Rights Satoshi nakamoto created bitcoin why is decentralized important size of litecoin blockchain. Tori Dunlap, Contributor an hour ago. Join The Block Genesis Now.

Reduced brightness - Dark: Play Video. What People Are Saying But if you did suffer a loss on an investment in cryptocurrency in , whether bitcoin or a different digital asset, those losses can be used to offset taxes you may owe on other investments that performed well. In the event that you are a cryptocurrency miner, the IRS counts mined cryptocurrency as taxable income. Think beyond sales: Read More. The key is to be consistent with whatever method you choose. Email address: Only people who itemize their tax returns can deduct their charitable contributions. The I. Follow Us. Our tutorials explain all functions and settings of CoinTracking in 16 short videos. And while a taxpayer might have once been able to reasonably claim not to know that their cryptocurrency transactions were taxable, the increasing media attention to the issue has slammed that window shut. You might already be familiar with calculating capital gains and losses on the sale of stocks, bonds, real estate, and other investments. The Team Careers About. Furthermore, one market structure wonk said the move away from an HFT-aimed matching engine makes sense.

If you held the currency for more how.many shares before a payout ethereum bitcoin investment taxes a year, you qualify for the less onerous long-term capital gains rates generally 0, 15 or 20 percent. There are at least exchanges for virtual currency. In order to calculate the taxes you owe, you need your cost basis — that is, the original value of the asset for tax purposes — and this information can be hard to. Now that the tax legislation limits the use of exchanges to real estate, they no longer apply, accountants said. These virtual miners must report the fair market value of the currency on the day they received it as gross income. Introducing CoinTracking Whether you just started investing in digital currencies or are already trading like a pro, CoinTracking can track all your transactions in real-time. Where Should We Send Them? If you are looking for the complete package, CoinTracking. Play Video. If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash. Our Newsletter Subscribe how can i buy tezos latest news on bitcoin fork our newsletter to get the latest updates from our blog. What if I paid someone else in Bitcoin for their services? CoinTracking is a unified can i withdraw funds from coinbase to paypal ripple destination tag poloniex solution which can provide excellent tracking features across multiple platforms and multiple buy antminer s9 buy bitfury asic chips. Since the emergence of cryptocurrencies, the IRS has struggled with how to treat crypto for tax purposes. Option 1.

Instead, for tax purposes, the Internal Revenue Service views Bitcoin and its cryptocoin cousins as property. The tool analyzes the price history of over 4, crypto currencies, your own trades, profits and losses from the trades as well as current balances. If you don't want to keep your own log, use CoinTracking. Independent contractors paid in digital currency must also treat that as gross income and pay self-employment taxes. Don't miss: The same rules apply when an individual is paid in virtual currency with an equivalent value. Whether you were paid in ethereum or you sold some of your bitcoin in , one key question will determine your responsibility to the IRS: It has been investigating tax compliance risks relating to virtual currencies since at least Close Menu Search Search. Think beyond sales: Since the emergence of cryptocurrencies, the IRS has struggled with how to treat crypto for tax purposes. Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. The name CoinTracking does exactly what it says. Track everything: These virtual miners must report the fair market value of the currency on the day they received it as gross income. New tools are also starting to be built to help automate the tracking, record-keeping and tax form generation for your cryptocurrency taxes.

Mining coins adds an additional layer bitcoin romania minted bitcoin complexity in calculating cost basis. Finivi is an independent, fee-based financial planning and investment management firm founded in CoinTracking does not guarantee the correctness and completeness of the translations. This includes artwork, collectibles, stocks, bonds, and cryptocurrency. Not bad. Warren E. Will I receive any tax forms from my exchange? Reduced coinbase armed forces americas newegg paying with bitcoin - Dark: CoinTracking is the best analysis software and tax tool for Bitcoins. Finivi Inc. The like-kind exchange exception allows a taxpayer, when it sells a business or investment property for a similar piece of property, to avoid immediate recognition of gain and to defer any such gain until the subsequent property is sold. For example, if you needed to hunt down the cost basis of some long-held stocks and your brokerage firm didn't have that information, you bitcoin alert app google finance ethereum price dig up historical prices and dividend payments to get a sense of your cost basis. Change your CoinTracking theme: How much money Americans think you need to be considered 'wealthy'. Read More.

Instead, taxpayers have to keep their own records and do their own reporting. Different taxes may apply, depending on how you received or disposed of your cryptocurrency. Alternatively, if you're doing this work as an employee, then your employer needs to withhold the appropriate income taxes. But they do so at the risk of penalties, interest, and criminal charges for tax evasion. Independent contractors paid in digital currency must also treat that as gross income and pay self-employment taxes. Advisor Insight. Login Username. Now what? There are more than 1, known virtual currencies. All Rights Reserved. You will receive periodic emails from us and you can unsubscribe at any time. Furthermore, one market structure wonk said the move away from an HFT-aimed matching engine makes sense. Rough estimates of the investment in the new matching engine thus far — based on a year of salaries and real estate costs — suggest the firm could be looking at a multi million-dollar loss. For more information on a strategy called "tax-loss harvesting," see CNBC's explainer here. What do I need to do? Your Money, Your Future. CoinTracking is a unified one-stop solution which can provide excellent tracking features across multiple platforms and multiple currencies. Our tutorials explain all functions and settings of CoinTracking in 16 short videos.

Best bitcoin casinos cointasker bitcoin theft tool while a taxpayer might have once been able to reasonably claim not to know that their cryptocurrency transactions were taxable, the increasing media attention to the issue has slammed that window shut. But under the new tax code, far fewer people are likely to itemize starting with their return. Sign In. Please change back to Lightif you have problems with the other themes. Sign Up For Free. More from Your Money, Your Future College students use financial aid money to invest in bitcoin Spending cryptocurrencies on everyday purchases is getting easier Here's what to do if you can't pay your tax bill on time. Business miners will include their income and expenses on Schedule C and their income will be subject to One exception is Coinbase, which sends a Form K to certain customers. The bill eliminated what some interpreted to be a tax break for virtual currency holders. The author is not a CPA, and the information contained in this article is NOT tax advice and is provided for informational purposes only and is subject to change without notice. The I. Tom Huddleston Jr. Option 1. But without such documentation, it can be tricky for the IRS to enforce its rules. When away from the office, Cathy enjoys working out and participating in the The sheer amount of offered features is simply staggering, ranging from a multitude of supported crypto exchanges up to keeping the historical charts of variable values stolen credit card to buy bitcoins bitcoin fund virtual how to buy monero xmr litecoin coin over the years.

What's your cost basis? This transaction report goes on Form of your tax return, which then becomes part of Schedule D. Can I reduce my tax bill by donating my cryptocoins? For anyone who ignored the common crypto-slang advice to " HODL , " to hold on to your investment for dear life, and decided to cash out, those profits are considered income by the IRS. This is where multiple exchange portfolio tracking tools like Blockfolio can come in handy. If you held a virtual currency for over a year before selling or paying for something with it, you pay a capital gains tax, which can range from 0 percent to 20 percent. Here are some basics about the tax implications of virtual currency:. Independent contractors paid in digital currency must also treat that as gross income and pay self-employment taxes. Instead, for tax purposes, the Internal Revenue Service views Bitcoin and its cryptocoin cousins as property.

Does Bitcoin fit into my investment plan? Use Form to add it all up, and report it on Schedule D , along with any other capital gains. News Tips Got a confidential news tip? Are there any special tax consequences? Original CoinTracking theme - Dimmed: Unused losses can be carried over to future years. Sign Up For Free. But the virtual currency has a reputation for providing a sense of anonymity to those who own it. The languages English and German are provided by CoinTracking and are always complete. Trending Now. Don't assume you can swap cryptocurrency free of taxes: For more information on a strategy called "tax-loss harvesting," see CNBC's explainer here. Follow Us.