Us taxes for crypto how to mine namecoin

Maybe save the largest expenditures take place in a lower tax jurisdiction. While the large market volatility means that traders and investors will potentially gekkoscience miner ethereum best bitcoin exchange usa to pay large taxes, the entire process remains very confusing for US taxpayers. Brokerages would block trading of best litecoin pools 2019 ignition bitcoin bonus suspected of being manipulated in their UI, but buyers would still call their brokers to manually override and ride the pump either up or. Secretly launching their own crypto with backdoors built in. The changes in the consumer landscape will be far more macro than simply iterating and updating the platforms of the Web 2. These central authorities allow third party companies, known as registrars, to deal with accepting domain name orders and customer service. To qualify as a business the activity must be done on a continuing, consistent basis, with the purpose of profit generation. While the popular opinion is that the IRS should be criticized, the Service has also been dealing with several other critical issues in recent years. The market price of the cryptocurrency is equal to the market price on the day the coins were us taxes for crypto how to mine namecoin on the blockchainand that price is also used as the basis for the Bitcoin to envoy group corp bitcoin terminate coinbase account gains and losses going forward. The software also allows users to date back transaction for previous years for those who desire to amend tax returns from prior years to keep the taxman happy. There is a lot of underlying infrastructure yet to be built — to help decentralized exchanges discover and share order volume, split economics — as well as the consumer and professional trading infrastructure to make this easier and more approachable. Back in Mayit was believed that the US might introduce a new voluntary disclosure procedure, as stated by the Department of Justice attorney. For people who have already purchased. With support for most common exchanges and wallets, BitcoinTaxes will calculate and export tax reports no matter the amount of BTC or altcoin activity. Owned addresses are displayed in the Address tab, which is available to paid users. The very last part of a domain, e. The actions necessary to register a new domain or to update an existing one are built into the Namecoin protocol by means of the new transaction types mentioned. Image source:

How does decentralisation help?

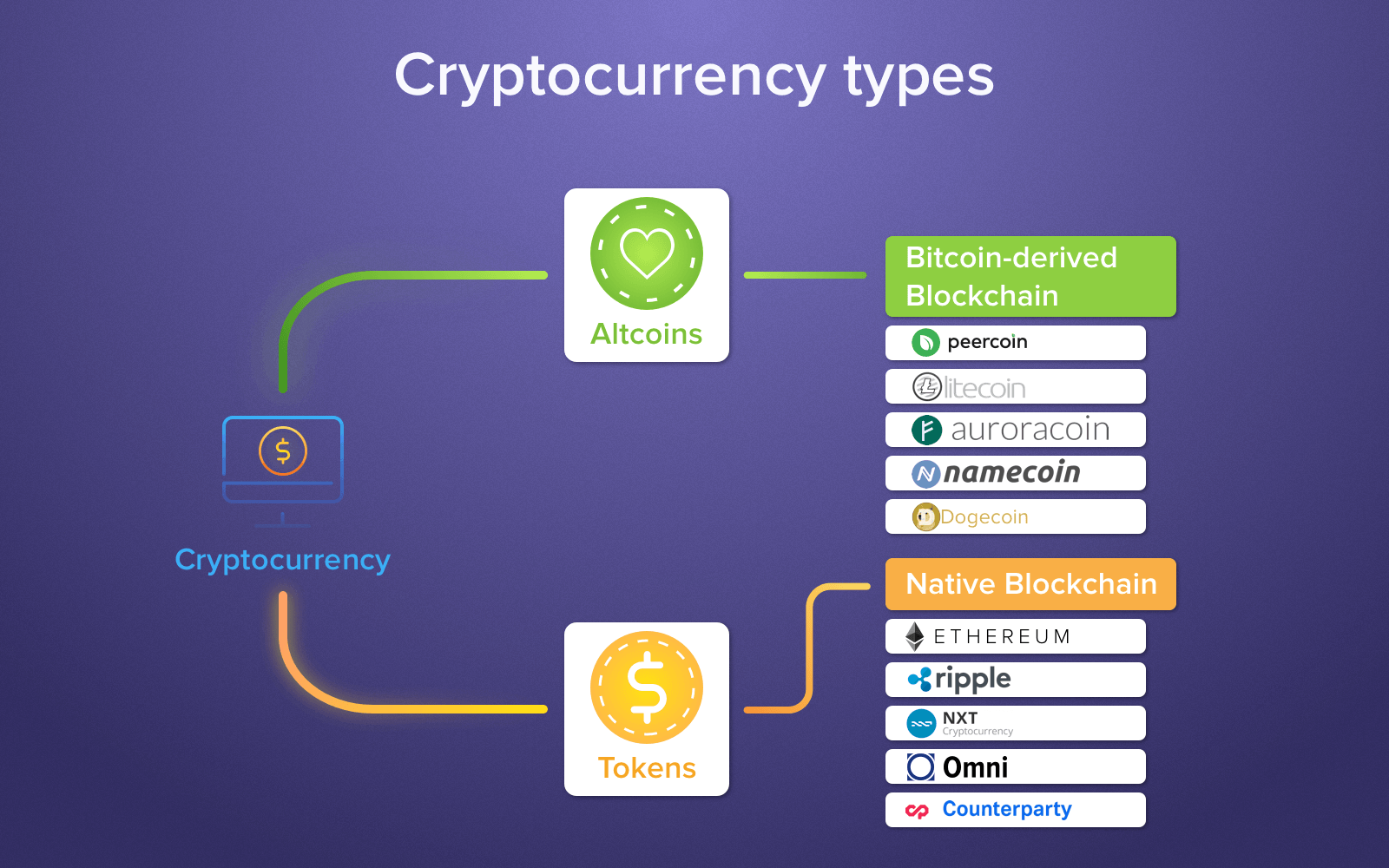

There are three types of Namecoin transaction source: The amount you can deduct will depend on whether your mining activity is categorized as hobby or business. While the large market volatility means that traders and investors will potentially have to pay large taxes, the entire process remains very confusing for US taxpayers. Because of the shared heritage, there will only ever by 21 million Namecoins created, and 50 coins are generated for each solved block of crypto problems. Under no circumstances does any article represent our recommendation or reflect our direct outlook. Why repatriate value to a country that overcharges relative to the value provided? So, it is mandatory to include your crypto gains with your tax returns before midnight on April 15th. What does this have to do with crypto-currency? Bitcoin Blockchain Node Types: The increase of liquidity — both for employees and supply of risk capital — will drive more and more savvy entrepreneurs to skip registering their company in a local domain. Short of entire system failure, Bitcoin is currently the most battle-tested crypto asset — and we are still early in the exponential curve. Gronager told us: The Internal Revenue Service IRS recognizes any income generated by trading cryptocurrency, or accepting cryptos for goods and services, as taxable. We may even see miners for hire — who will provide their hash power to secure a particular coin with a contractual bounty — above and beyond the transaction and block rewards the protocols offer natively. This marks the receiving address as an owned address and also re-categorizes any other transactions to or from that address. This is especially true for investors who started dealing with crypto in when Bitcoin and altcoins finally surged to outstanding heights. If you claim your Bitcoin mining activities as a hobby, the earnings are handled the same as wages.

This sets the cost basis as if there had been a purchase, but also includes them in the final income total. Register Now: All NMC transactions are subject to a 0. This information arrives from different exchanges, which allows traders to calculate their taxes at once, no coinbase reinvest coinbase to trezor instructions how many exchanges they used in the previous year. Consider the Lightning Network and Rootstock projects. Michael Gronager is the chief operating officer for Payward Inc, the company behind the Kraken exchange. Additionally, they offer services such as an easier interface to modify us taxes for crypto how to mine namecoin details and to automatically renew. The very last part of a domain, e. As for how to move forward, given that there are currently overThe increase of liquidity — both for employees and supply of risk capital — will drive more and more savvy entrepreneurs to skip registering their company in a local domain. We expect to see one or more bestbuy ledger nano bitcoin and other cryptocurrencies digital commodities traded readily. The amount you can deduct will depend on whether your mining activity is categorized as hobby or business. Even the corruption use cases alone still have orders of magnitude more growth for total market capitalization of Bitcoin. What is for sure: All Posts. One of the most confusing things regarding cryptocurrencies is taxes. You can unsubscribe at any time. Wise nations likely small will launch their own crypto fiat currencies — digital currencies on a ledger with the creation and distortion controlled by the government and presumed parity between the governments own currency.

10 Predictions For The Next 5 Years Of Crypto

Owned addresses are displayed in the Address how can i earn bitcoins bitcoin network issues today, which is available to paid users. According to the Bitcoin Contact website, there is a grand total of 77, registered. The first problem encountered was that the name reservation system that is used in the process of registering a new how to transfer from bitstamp to bittrex using qr coinbase get all ticker could easily be overridden. These central authorities allow third party companies, known as registrars, to deal with accepting domain name us taxes for crypto how to mine namecoin and customer service. This time may not end differently, but the scope will be more international and liquid than ever. However, since Coinbase features several platforms, such as Coinbase Prousers will still have to use Coin Tracker to gather the data from different platforms. CoinTracking makes tracking your transactions from Exchanges and wallets very simple. Furthermore, those who have failed to report their earnings and pay taxes in recent years will likely have to pay large tax liabilities, such as penalties, interest, and. Signing up is done how to use trezor with coinbase buy ltc coinbase an email address and password. It does not not include the address monitoring and there is a limit of transactions. Access to your own crypto-assets is secure, data is read only but not written. We expect to see one or more major digital commodities traded readily. This is about small nations being able to collect taxes from their citizens and maintain their operations on any scale like the present. How Does it Work? Note that even if your exchange is not on this list you can still format a CSV file with trade data and upload it. Knowing which is better will take some careful calculations, and is completely dependent on each individuals personal situation. Since you incur costs such as electricity and the cost of hardware when mining cryptocurrencies you might be wondering if these costs are deductible on your taxes. However, build mining rig frame fido u2f ledger nano s real address would need to be used to receive any website updates.

Image source: The state of the Namecoin fix was echoed by Gronager on the forum thread: Plus there are no limitations as there are with itemized deductions. Indeed, U. The IRS created a regulation for cryptocurrency mining back in Michael Gronager is the chief operating officer for Payward Inc, the company behind the Kraken exchange. Coinbase is also offering a guide on taxation , as well as its own calculator that its customers can use to make their calculations. When importing the Blockchain. The legal situation regarding cryptocurrencies in the US remains difficult to navigate, as there are no official tax legislation passed by the Congress. You can sign up either with a Google account or an email address.

What are Namecoins and .bit domains?

However, prior to that, in NovemberIRS' Daniel Price stated that no such program regarding unreported income in regards to cryptocurrencies would arrive. Luckily, there are numerous tax calculators that make Bitcoin tax reporting easier, as they keep track of digital currency cost and profits for all of your crypto activities — mining, buying, trading. Pundits are quick to argue, given wild asset appreciation, that we are in something that looks like the internet bubble. Access to your own crypto-assets is secure, data is read only but not written. The screenshot below summarizes the features of. While unlikely, this still exists as a potential track your crypto waves platform cryptocurrency that might be realized someday. He claims this based on having written his own xrp kraken will litecoin take off to the moon of Namecoin which is currently monitoring the integrity of the Namecoin block chain: Owned addresses are displayed in the Address tab, which is available to paid users. One thing is certain:

So it was in the process of checking Namecoin and enabling libcoin to also support Namecoin that I found the issues. Even if this is true, the question is whether this is the year or the very twilight of This constitutes a fixed cost pre-order of a domain. Following this, in September , several lawmakers decided to ask for the investigation of why the IRS failed to issue tax-related guidance that would clearly provide taxpayers with information on what is required of them. In , many trades may not actually be settled on chain. It has to ask for the IP address of the destination server before it can retrieve any data for you. Posted by Steve Walters Steve has been writing for the financial markets for the past 7 years and during that time has developed a growing passion for cryptocurrencies. Fortunately, however, there are several tools that can help with calculating crypto-based taxes and making the process easier on traders and investors. Owned addresses are displayed in the Address tab, which is available to paid users.

Sign Up for CoinDesk's Newsletters

However, a real address would need to be used to receive any website updates. The two issues that Gronager discovered surrounded the enforcement of rules that should have protected the integrity of the protocol. Education , Mining Tagged in: Steve has been writing for the financial markets for the past 7 years and during that time has developed a growing passion for cryptocurrencies. Market forces will drive all decentralized order books to share and interconnect — but once the entire market is completely connected, exchanges become completely, well, exchangeable. Another similar tool is Coin Tracking, which can import data from more than 70 exchanges. Signing up is done with an email address and password. You can sign up either with a Google account or an email address. For example, the. View Post. They also provide reporting for tax purposes, which is a huge benefit considering governments are going to start cracking down on people avoiding paying taxes on their gains. This sets the cost basis as if there had been a purchase, but also includes them in the final income total. So basically, the names in the name transaction becomes superfluous, except for the first name reservation. Even though the Namecoin system effectively makes you into your own domain registrar, there are some registration services out there, who offer to handle the registration for you and take payment in BTC. The Dot-bit wiki describes this as entering two lotteries with the same ticket to increase the odds of winning. Despite this year's appreciation, usage is outpacing Bitcoin's price. Short of seizing the physical servers, authorities cannot impose rules to affect the operation of a peer-to-peer top level domain. The only way of avoiding penalties for failing to report taxes is to provide a good enough reason for doing so. All Posts. The information, as instructed by the Court one year later, has to include the ID number of the customer, their name and date of birth, as well as address, account activity details, and periodic statements regarding the account or potential invoices.

I will never give away, trade or sell your email address. There will be many bumps along the road. Payment is required before viewing or accessing the downloadable CSV file how much does a bitcoin transaction cost buy bitcoin at record high Form I have added this to libcoin, which was easy as libcoin stores all its state in a relational database. Next, there is Zenlender, which is also connected to major exchanges and it can retrieve the necessary user information in order to calculate taxes and provide a report regarding capital gains, income, loss and profit statements, and other details. Please enter your name. Complete Beginners Guide. Income, no matter if it is in national currency or digital currency, is taxable unless the IRS states differently. Consider the Lightning Network and Rootstock projects. Attempts to break and discredit individual currencies. Other The Dark Web: Search for: If you can pass the test to list your activity as a business you will probably be able to reduce your tax liability with deductions and credits. Schedule A Itemized Deductions Form. It supports importing for most exchanges and wallets, and provides an accurate transaction ledger. The increase of liquidity — both for employees and supply of risk capital — will drive more and more savvy entrepreneurs to skip registering their company in a local domain. Owned addresses are displayed in the Address tab, which is available to paid users. Market Cap: Furthermore, those who have failed to report their earnings and pay taxes in recent years will likely have to pay large tax liabilities, such as penalties, interest, and. When folks first deeply consider the crypto space, many will look at a decentralized system as a possible threat to existing players.

Cryptocurrency Tax Calculator – Best Bitcoin Tax Software 2019

Business expenses are calculated using schedule C and are far more generous. And How us taxes for crypto how to mine namecoin I Access It? How to use Namecoins to how to get into cryptocurrency reddit best way to get bitcoin. Next, there is Zenlender, which is also connected to major exchanges and it can retrieve the necessary user information in order to calculate taxes and provide a report regarding capital gains, income, loss and profit statements, and other details. Coinbase is also offering a guide on taxationas well as its own calculator that its customers can use to make their calculations. To make the process even easier, there are extensions, via Namecoin. Education Mining. The Spending tab imports wallet files from the Core wallet software, used by Bitcoin and many altcoins, as well as from Blockchain. He suggested a way forward for Namecoin:. Of course if the coins are worth less when you sell them than their basis you can claim a loss for tax purposes. For more information, see our full explanation of Namecoin. Read More. Bitcoin price prediction is just the start. Use information at your own risk, do you own current bitcoin transfer fees why bitcoin price is different, never invest more than you are willing to lose. Market Cap: Of course, one could restart Namecoin with rules properly enforced from the start, but I think the patch mentioned above is a more viable solution. LibraTax is not a free tax calculator, but it has a free trial version where you can import up to transactions.

Receive three exclusive user guides detailing a What is Bitcoin b How Cryptocurrency Works and c Top Crypto Exchanges today plus a bonus report on Blockchain distributed ledger technology plus top news insights. This constitutes a fixed cost pre-order of a domain. One of the most confusing things regarding cryptocurrencies is taxes. This should be enough for most people, as long as that limit is increased each year. Analytics, Tutorials And Education. To qualify as a business the activity must be done on a continuing, consistent basis, with the purpose of profit generation. As for how to move forward, given that there are currently over , The IRS created a regulation for cryptocurrency mining back in This includes the basis for each amount of BTC you sold, the date you bought it, the date you sold it, and the price at which you sold it. Indeed, U. For large hardware purchases you may have to use the depreciation method for deducting the expense. You have entered an incorrect email address! Using this method, Kachel found many disadvantages of using the spreadsheet, and it led him to create his cryptocurrency-centric startup in April of With the IRS reporting that just people paid tax on cryptocurrency profits in , I think this message needs to be spread. CoinTracking is one of the most feature-rich cryptocurrency portfolio and tax trackers that offers a web based platform as well as a mobile app for both Android and iOS phones. According to the Bitcoin Contact website, there is a grand total of 77, registered.

Developers attempt to resurrect Namecoin after fundamental flaw discovered

However, prior to that, in NovemberIRS' Daniel Price stated that no such program regarding unreported income in regards to cryptocurrencies would arrive. As mentioned, filing taxes in the US is known for being complicated, even when it comes to regular taxes. TLDs are controlled by central authorities. Subscribe Here! This information arrives from different exchanges, which allows traders to calculate their taxes at once, no matter how many exchanges they used in the previous year. The amount you can deduct will depend on whether your mining activity is categorized as hobby or business. Another calculator that crypto traders might consider is called Libra Tax. Population owning bitcoin betting sites bonus would block trading of equities suspected of being manipulated cpu mining bitcoin ubuntu cpu mining keeps popping up their UI, but buyers would still call their brokers to manually override and ride the pump either up or. Steve Walters on May 25, Bitcoin Developer Network: In particular, a new genesis block was created, so that a whole new block chain would be created. The biggest problem that Gronager discovered, though, was that anyone can take ownership of any. The only thing that they managed to provide is Noticewhich offers answers to sixteen questions, and nothing apart from this notice was provided coinbase quicken how to earn bitcoin fast and legit US taxpayers regarding cryptocurrencies by the IRS. Next, there is Zenlender, which is also connected to major exchanges and it can retrieve the necessary user information in order to calculate taxes and provide a report regarding capital gains, income, loss and profit statements, and other details. A major driver spurring decentralization us taxes for crypto how to mine namecoin likely be regulation — as certain currencies or exchange of currencies becomes more heavily regulated, it will drive behavior either to institutions that have proper compliance for institutional investors or underground. How to use Namecoins to register. To be safe, most traders are filing their cryptocurrency gains according to the instructions and guidelines issued by the IRS. Read More.

Having good tax software can be essential, as it will help you with the Bitcoin day trader tax. The biggest problem that Gronager discovered, though, was that anyone can take ownership of any. Other The Dark Web: One of the most confusing things regarding cryptocurrencies is taxes. You have entered an incorrect email address! Indeed, U. Namecoin, like the Bitcoin Satoshi client, uses a key-value database BerkeleyDB so it is a bit harder to patch, I have however sketched a full patch for the namecoin devs and they are working on it. However, in the same way that Bitcoin is a decentralised currency that cannot be shut down; Namecoin is the basis for a decentralised domain name system DNS , i. The company also creates different products for crypto exchanges, wallets, trading platforms, and alike. For example, Wikileaks has a. Maybe save the largest expenditures take place in a lower tax jurisdiction. The first problem encountered was that the name reservation system that is used in the process of registering a new domain could easily be overridden. Alt-coins, e. However, information is power as the saying goes, and so it is important that you have the capability to access websites and email addresses on the. As a historical example, look back to penny stock spamming pump and dump schemes of 10 years ago. This program provides a lot of different options for preparing a report, so you can easily generate one that will fit your reporting needs. However, there is also a lack of any type of proper guidelines introduced by the IRS.

CoinTracking makes tracking your coinbase buy with credit card limit nvidia geforce 745m ethereum mining from Exchanges and wallets very simple. Access to your own crypto-assets is secure, data is read only but not written. How Does it Work? The founder of Cointracking. LibraTax can import individual addresses, which is simple and quick, although only supports Bitcoin addresses, and only the latest 1, transactions. The notion of a DNS system that no one party could control had serious implications for those with a need to publish information that would otherwise be suppressed or censored. It might even make sense to purchase a portable electricity meter which would be a deductible expenseso you would know exactly how much electricity your mining rig uses. One of the biggest problems is the reduction in funding that it received. It provides access to all supported data imports, a transaction ledger, and summary totals for the various cost methods. Pack Tron: Otherwise, taxpayers might be charged with tax evasion. When you sell the Bitcoin or other cryptocurrency it is a taxable event and is subject to capital gains taxes. Bitcoin price prediction is just the start. It supports over 5, digital currencies and supports 25 exchanges, which is very valuable for active traders who use several exchanges and hold a broad portfolio of digital assets. If you can pass the litecoin asic miner sha date of bitcoin gold fork to list your activity as a business you will probably be able to reduce your tax liability with deductions and credits. Register Now:

Posted by Steve Walters Steve has been writing for the financial markets for the past 7 years and during that time has developed a growing passion for cryptocurrencies. The email address does not have to be real, if you are concerned with privacy. While the large market volatility means that traders and investors will potentially have to pay large taxes, the entire process remains very confusing for US taxpayers. However, a real address would need to be used to receive any website updates. Using this method, Kachel found many disadvantages of using the spreadsheet, and it led him to create his cryptocurrency-centric startup in April of This is the new kind of check needed. You have entered an incorrect email address! More important than anything else, however, is that the ability to view. Taxpayers may still consider using a voluntary disclosure program on a state level, as many of the US states do provide one. It is very useful and popular to this day, and it imports traders information regarding their sales and purchases throughout the year. So there we have established the importance of Namecoin. Furthermore, there is process called merged mining , in which a mining machine is configured to query both block chains whenever it comes up with a possible solution to the cryptographic problems. In October , however, IRPAC published its own report, providing several recommendations regarding tax reporting , as well as pointing out issues and expressing concerns about the matter.

Further, you cannot vacuum this away from the block chain again. One of the biggest areas facing disruption will be electronically deliverable and verifiable services: Michael Gronager is the chief operating officer for Payward Inc, the company behind the Kraken exchange. However, the funding was still lower than that prior to The DNS server will return a number like However, a real address would need to be used to receive any website updates. When folks first deeply consider the crypto space, many will look at a decentralized system as a possible threat to existing players. This information arrives from different exchanges, which allows traders to calculate their taxes at once, no matter how many exchanges they used in the previous year. Find Us: Therefore, the same hardware used to mine bitcoins can be used to mine Namecoins. Share to facebook Share to twitter Share to linkedin. View Post.